Weekly Market Insight – October 31, 2022

Cornerstone Financial Advisory

OCTOBER 31, 2022

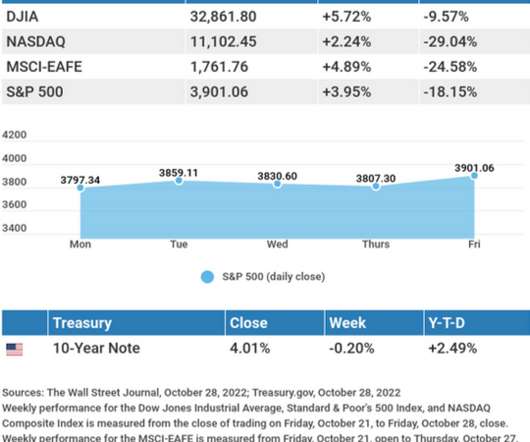

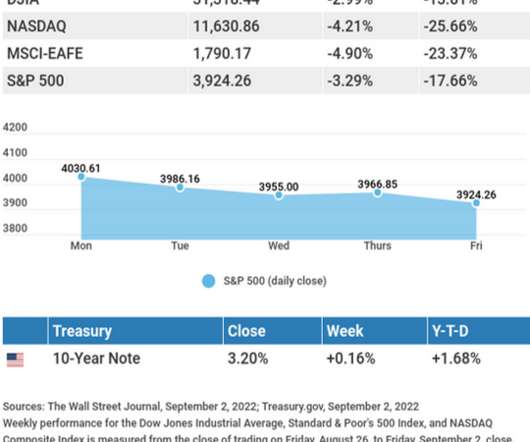

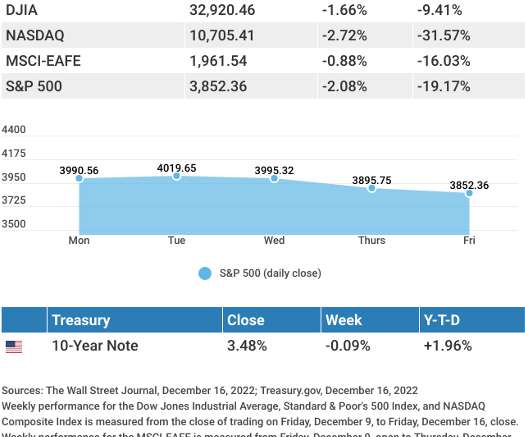

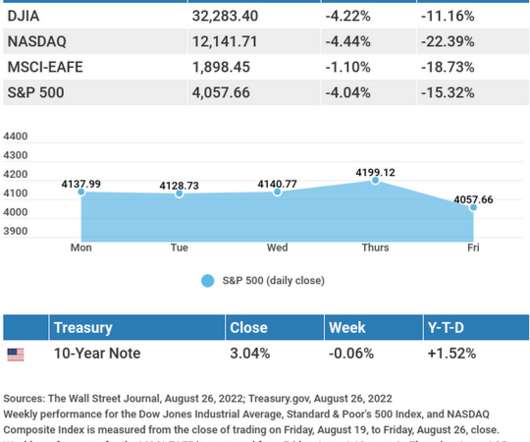

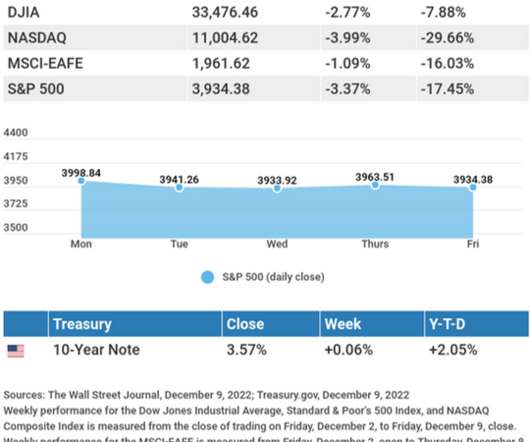

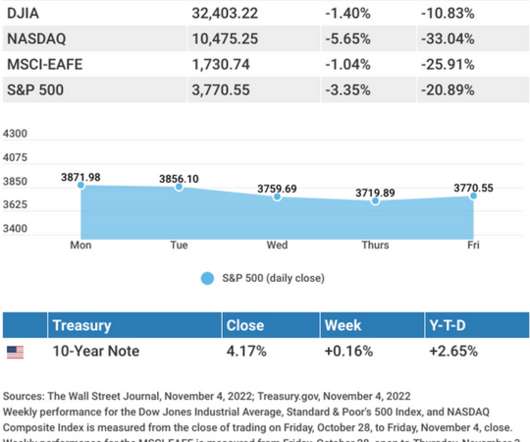

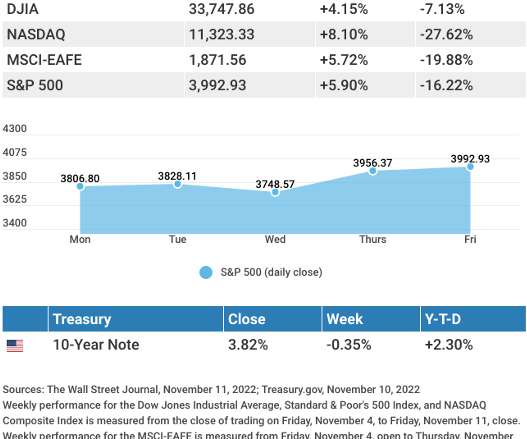

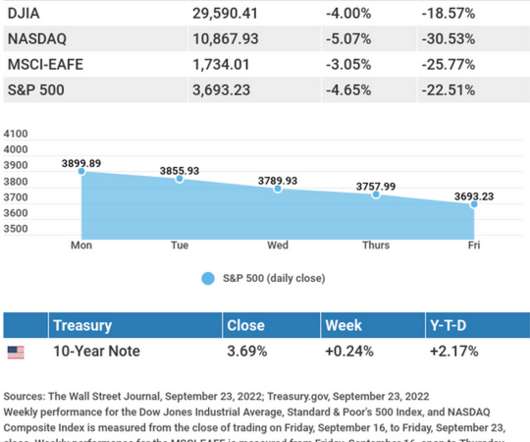

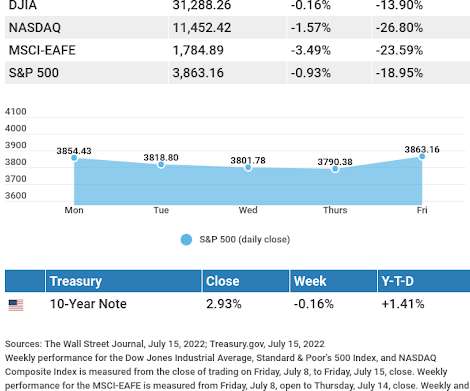

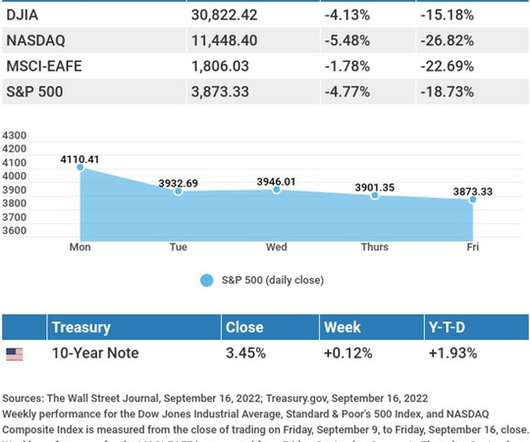

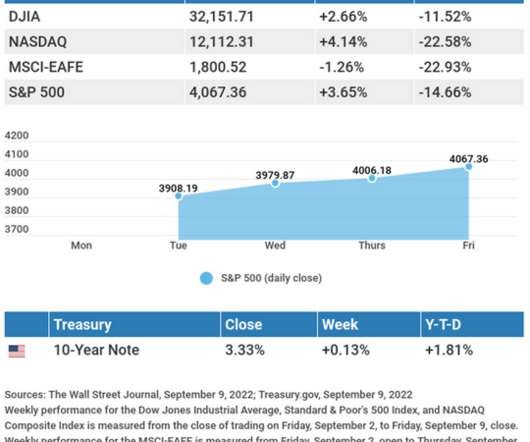

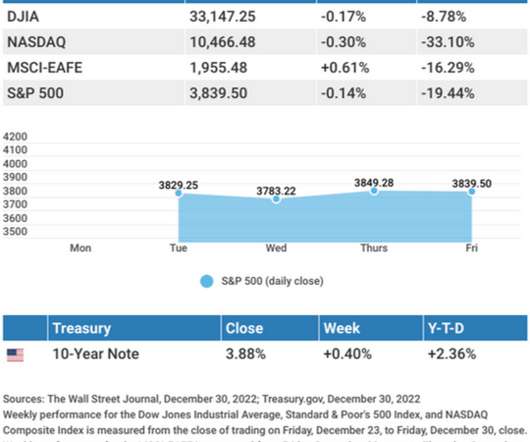

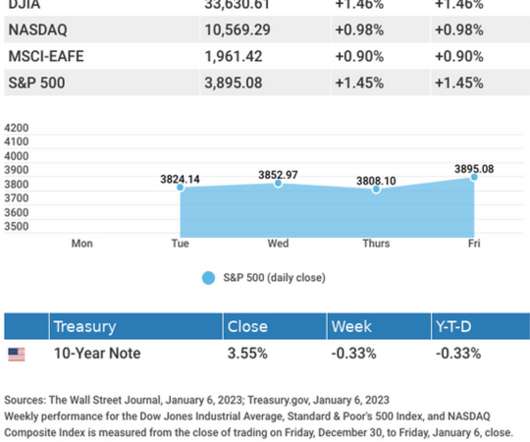

Stocks overcame poor earnings results from some of America’s largest companies to post gains last week as investors cheered positive earnings surprises, easing inflation and a rebound in economic growth. Economic Growth Exceeds Expectations. This Week: Key Economic Data. The Wall Street Journal, October 28, 2022.

Let's personalize your content