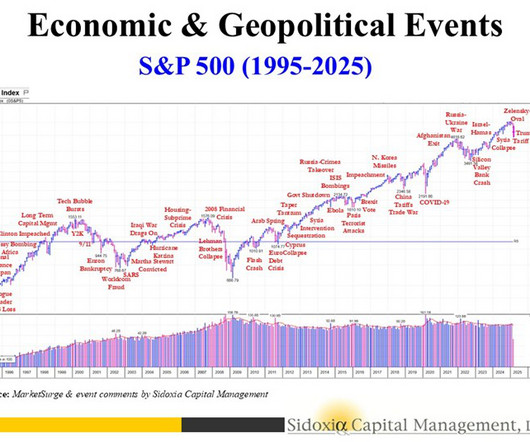

Ten Economic Questions for 2025

Calculated Risk

DECEMBER 22, 2024

Here is a review of the Ten Economic Questions for 2024. There were many promises made during the campaign that obviously will not happen (deport 20 million people, no taxes on tips, overtime or Social Security benefits, 200% tariffs, and on and on). We can assume the 2017 Tax Cuts and Jobs Act (TCJA) will be extended.

Let's personalize your content