The Advisory | June 2015

Brown Advisory

JUNE 3, 2015

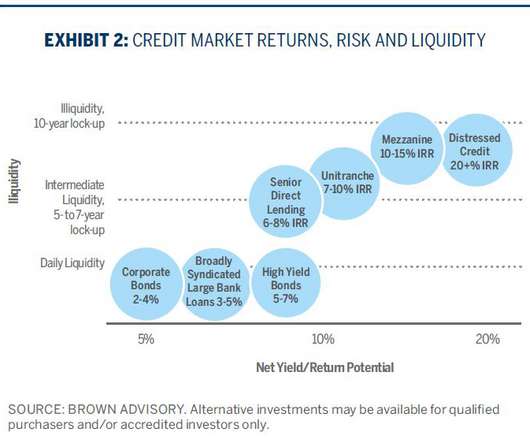

The Advisory | June 2015. Wed, 06/03/2015 - 10:14. In many clients’ portfolios we have eliminated our overweight position in U.S. equity market: A comparatively quick interest rate increase counteracts the benefit from stronger economic growth, impairing profitability and valuations. Shifting Gears. Impact on U.S.

Let's personalize your content