At the Money: Austan Goolsbee, Chicago Fed President on Tariffs, Inflation and Monetary Policy

The Big Picture

MARCH 6, 2025

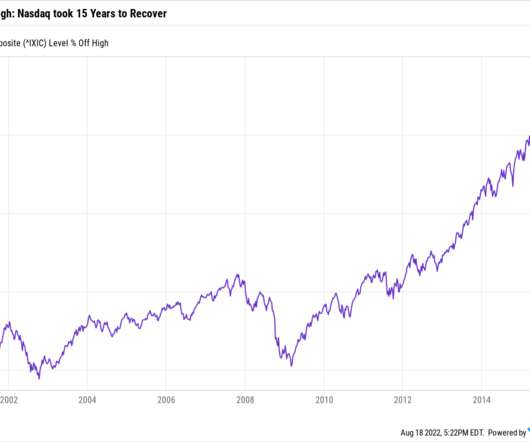

And the reason it’s that is because part of buying a house is a financial asset. You’ve said you’ve turned 180 degrees on the inflation target questions since your initial thoughts in 2012. Okay, so in 2012 th there had been vague targets. The stock market. It’s owner equivalent rent.

Let's personalize your content