A Spectacularly Underappreciated 15 Years

The Big Picture

APRIL 28, 2025

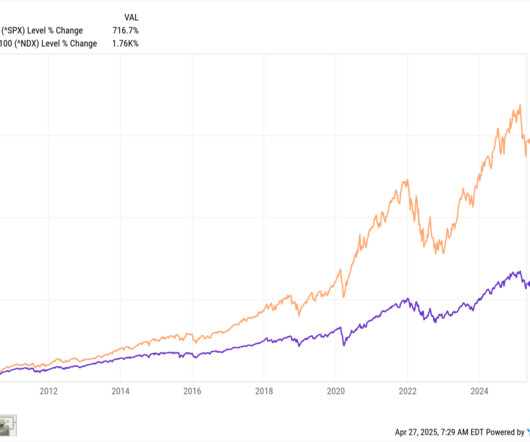

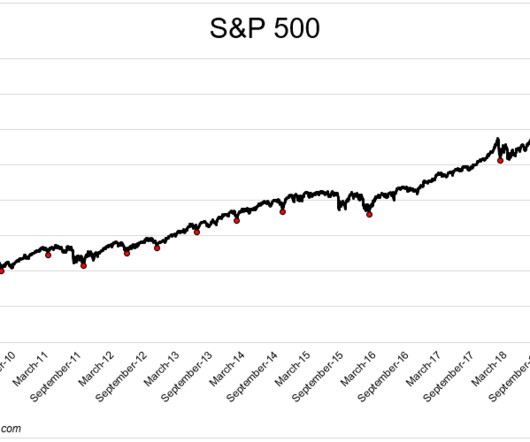

Chart above is from March 2009, but that’s cheating) Compare this to the average 15-year return periods over the past century, which generated ~8.7%. In October 2009, I called the move off the lows The Most Hated Rally in Wall Street History. Financial Repression was the rallying cry for underperforming managers.

Let's personalize your content