The Essence of Risk Management

The Irrelevant Investor

MARCH 23, 2020

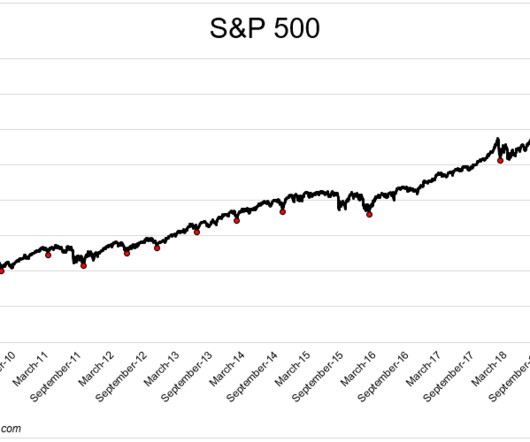

In a bull market, protecting one's downside gets punished, and after being burned enough times, people tend to lighten up on risk management, or abandon it altogether. In a bull market the more risk you take, the more you're rewarded, and the more you're rewarded, the more you forget about risk.

Let's personalize your content