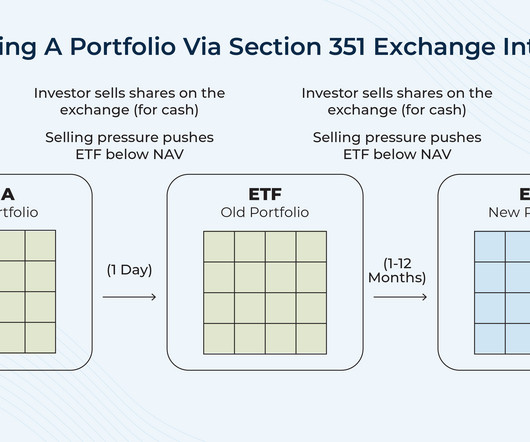

Using Section 351 Exchanges To Tax-Efficiently Reallocate Portfolios With Embedded Gains

Nerd's Eye View

MARCH 12, 2025

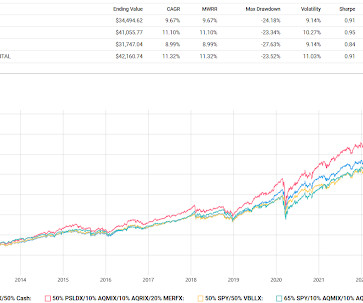

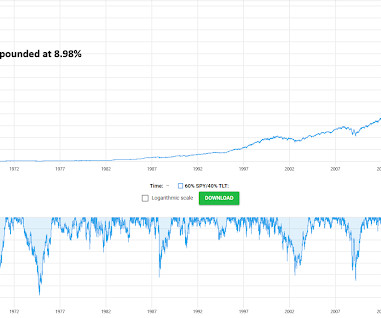

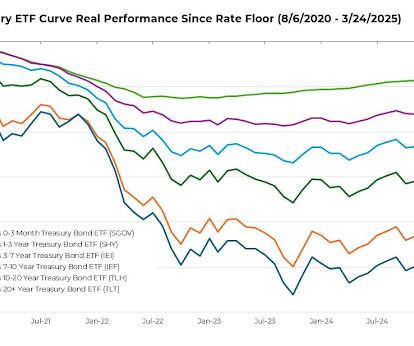

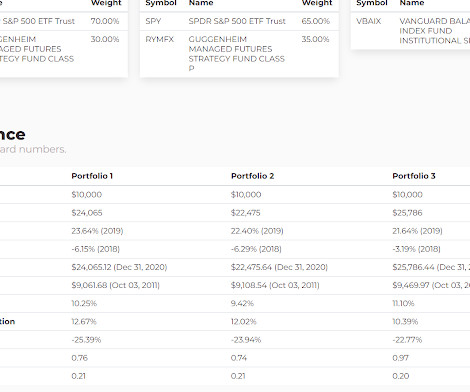

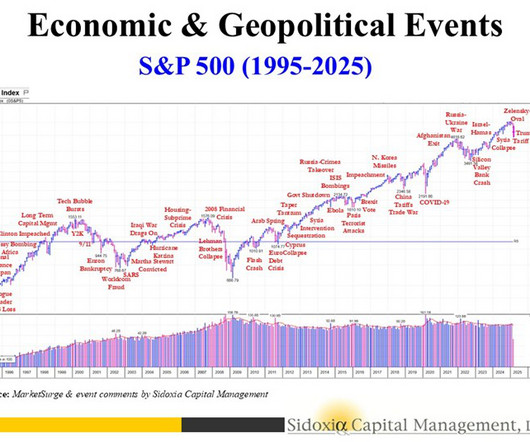

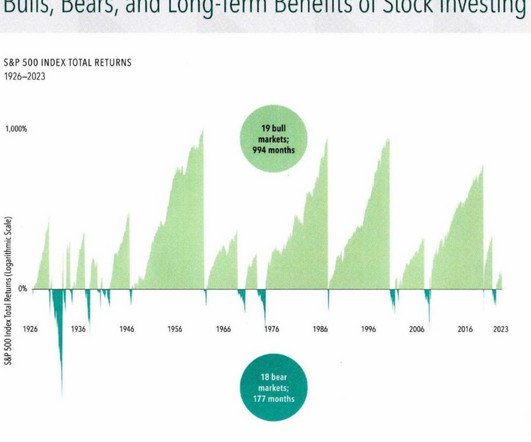

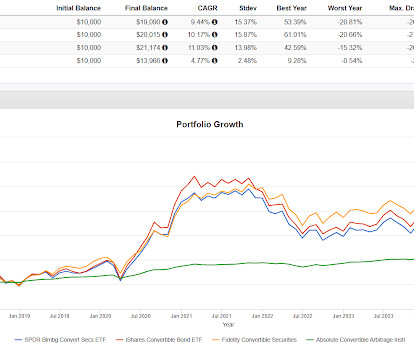

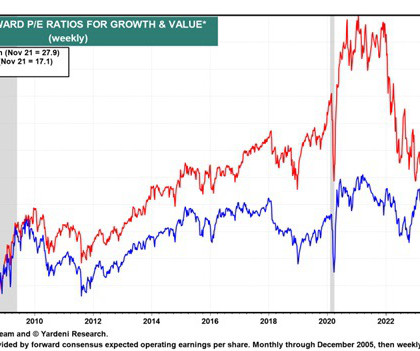

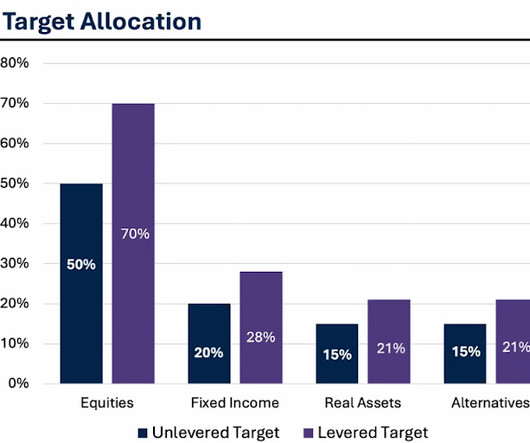

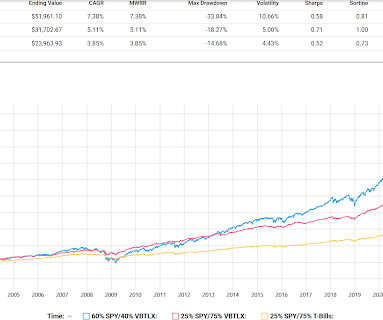

Following the long run-up in the US equity markets since the bottom of the 2008–2009 financial crisis, many investors with taxable investment accounts have likely found themselves with high embedded gains in their portfolios. If the exchange meets the requirements of Section 351, it is tax-deferred for investors.

Let's personalize your content