Build a Resilient Investment Strategy With The All Weather Portfolio

Validea

JUNE 2, 2025

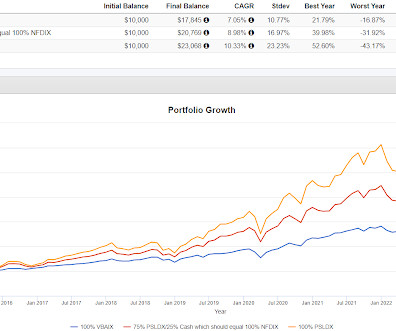

At Validea, we’ve built our version of the All Weather Portfolio based on the core principles of asset class diversification that underpin Dalio’s original concept. All Weather Portfolio: Asset Class Behavior Across Economic Regimes Asset Class Performs Well In Why It’s Included U.S. 2008 -0.4% -21.0%

Let's personalize your content