Things Change

The Better Letter

JANUARY 10, 2025

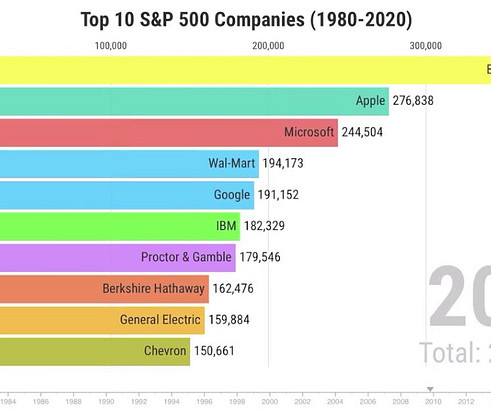

GE jumped over Exxon to the top spot as the oil company (which had bought Mobil in 1998 in what was then the biggest merger ever) stayed at number two. Chevron, which had been known as Standard Oil of California, returned to the top ten at number eight. The broader economy matters. percent per annum, including dividends.

Let's personalize your content