Markets attempt a bounce on encouraging earnings

Nationwide Financial

OCTOBER 24, 2022

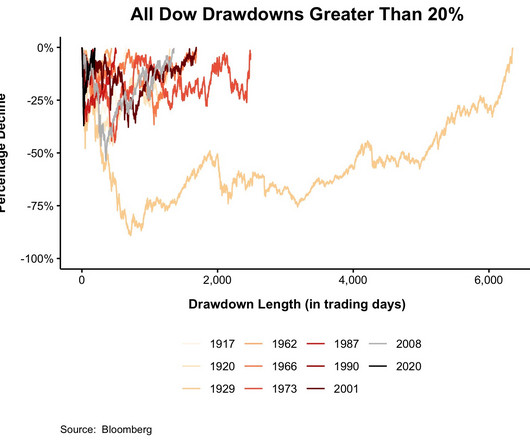

This is similar to the market behavior near the bottoms in 2002, 2009, 2011, and 2020, reflecting the willingness of institutional investors to dip their toe back in the water. Despite historic levels of investor pessimism, the S&P 500® Index has shown 2% gains in six sessions in the past month in an effort to bounce.

Let's personalize your content