Weekly Market Insight – July 18, 2022

Cornerstone Financial Advisory

JULY 18, 2022

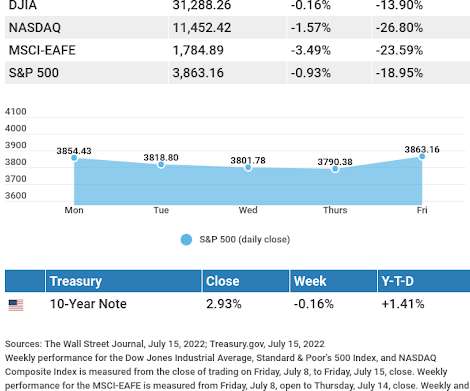

dollar continued to climb, reflecting global economic weakness. dollar to six other major currencies) reached a fresh high, while the euro fell to parity with the dollar and to its lowest level since 2002. This Week: Key Economic Data. Index of Leading Economic Indicators. . Friday: Verizon Communications, Inc. (VZ),

Let's personalize your content