Taxpayer Granted Time to Make Alternate Valuation Election

Wealth Management

JUNE 18, 2025

IRS allows estate to make late alternate valuation date election due to reliance on tax professional.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

JUNE 18, 2025

IRS allows estate to make late alternate valuation date election due to reliance on tax professional.

Wealth Management

JULY 18, 2025

Resonant Capital Merges with Tax, Accounting Firm QBCo $2.2B Resonant Capital Merges with Tax, Accounting Firm QBCo $2.2B Resonant Capital Merges with Tax, Accounting Firm QBCo Wisconsin-based Resonant Capital and QBCo will share clients across wealth and tax in an increasingly popular service model.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

How to Streamline Payment Applications & Lien Waivers Through Innovative Construction Technology

Your Accounting Expertise Will Only Get You So Far: What Really Matters

Wealth Management

JULY 18, 2025

Resonant Capital Merges with Tax, Accounting Firm QBCo $2.2B Resonant Capital Merges with Tax, Accounting Firm QBCo Brennan’s experience is indicative of many young advisors working in the RIA space. Related: Innovative CPA Group Launches RIA To Capture Client Wealth Management Demand “It’s a relationship business,” he said.

Darrow Wealth Management

APRIL 23, 2025

For individuals with stock-based compensation, an 83(b) election has the potential to greatly reduce taxes on stock options or restricted stock. Section 83(b) of the tax code gives individuals the ability to accelerate the taxation of their unvested equity grant. What is an 83(b) election?

Diamond Consultants

DECEMBER 16, 2024

By Allie Brunwasser & Jason Diamond Its no secret that the wealth management industry has a major impending crisis: A shortage of quality next gen advisor talent. Option 2: Sell the business to a strategic buyer A quality wealth management business is like the holy grail: everyone wants it. But is that fair?

Darrow Wealth Management

JUNE 24, 2025

Tax implications Interested sellers should always consult a tax professional before accepting a tender offer. There are many tax considerations and nuances which can impact the outcome. But in general, the tax consequences are as follows. Speak with your tax advisor and the company to find out more.

Darrow Wealth Management

JANUARY 16, 2025

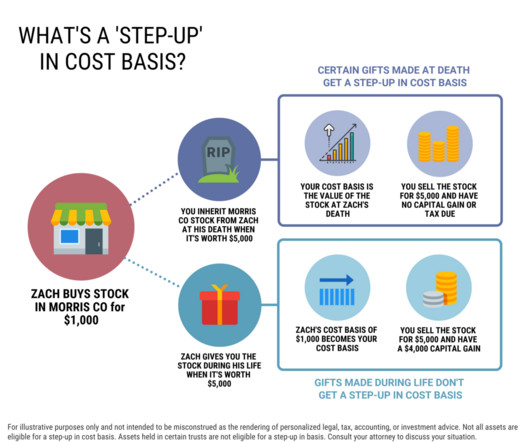

A step-up in basis is a tax advantage for individuals who inherit stocks or other assets, like a home. Understanding step-up in basis at death If youve received an inheritance you may have questions about the tax treatment of certain assets. This increases the tax basis, which determines capital gains or losses when the asset is sold.

The Big Picture

JANUARY 21, 2025

I’d left the journal and I was working at Citi Groupers, director of financial education for the wealth management business. I think it’s very hard to say stocks are objectively cheap because all of these valuation metrics have, have become unreliable over the decades as the nature of the stock market has changed.

The Big Picture

APRIL 29, 2025

We learned everything, you know, across from accounting to auditing to, to tax and valuation. I ended up in what was called the valuation services group, where we valued real estate and businesses either for transactions or for m and a activity. You know, in those days these companies hired, you know, crops of undergrads.

Wealth Management

JUNE 9, 2025

trillion and 121 million participant accounts along part of the $37 trillion overall in retirement assets, the pressure is causing many record keepers to dig deep and, for many, reinvent themselves or face exiting the market before their valuations drop even further just as it did for active asset managers years ago.

The Big Picture

APRIL 8, 2025

She was CIO at Merrill Lynch Asset Management, and now CIO at both Morgan Stanley Wealth Management and runs their asset allocation models and their outsourced chief investment officer models. She, she absolutely has a unique background and a unique perch on, on wealth management and what’s going on in the world.

The Big Picture

MARCH 25, 2025

Valuations tended to crash and burn very, very cheap valuations tended to do well. He goes, well, our, our clients, the, the Riol Wealth Managements of the world could, could use this and it would be amazing for their business. The, the tax side of it was a game changer. Right, right. Very, very high.

The Big Picture

APRIL 7, 2025

CNN ) How Has Private Credit Affected Valuations Across Debt Markets? Washington Post ) Be sure to check out our Masters in Business this week with Lisa Shalett , Chief Investment Officer and head of Global Investment Office for Morgan Stanley Wealth Management , with more than $100 billion in assets under management.

Wealth Management

APRIL 9, 2025

Court of Appeals for the Second Circuit upholds QTIP trust valuation for estate tax, rejecting deduction for settlement payment to widows estate. In Kalikow v. Commissioner, the U.S.

Wealth Management

MAY 21, 2024

A cornerstone in strategic planning to optimize clients’ financial legacies.

Nerd's Eye View

MAY 16, 2023

Jim is the Co-Founder and CEO of Dew Wealth Management, an independent RIA based in Scottsdale, AZ, that provides virtual-family-office-style financial planning on a monthly retainer basis for 150 small-business owner entrepreneurs. Welcome back to the 333rd episode of the Financial Advisor Success Podcast !

Wealth Management

JANUARY 30, 2024

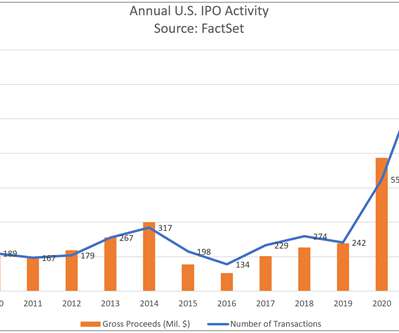

Developments from 1999 through 2019.

Abnormal Returns

MAY 8, 2023

(financial-planning.com) The biz What variables matter when it comes to RIA valuation. citywire.com) Dynasty Financial Partners has formed Dynasty Investment Bank to provide services related to mergers and acquisitions in wealth management. sciencedaily.com) How tax-adjusting a portfolio works in practice.

Wealth Management

JANUARY 30, 2024

Developments from 2020 to 2023.

Wealth Management

MARCH 27, 2024

It may cause trouble down the line If your client is audited.

Wealth Management

MARCH 1, 2023

Commissioner provides insights on how to weigh evidence on valuation discounts.

Darrow Wealth Management

JULY 30, 2024

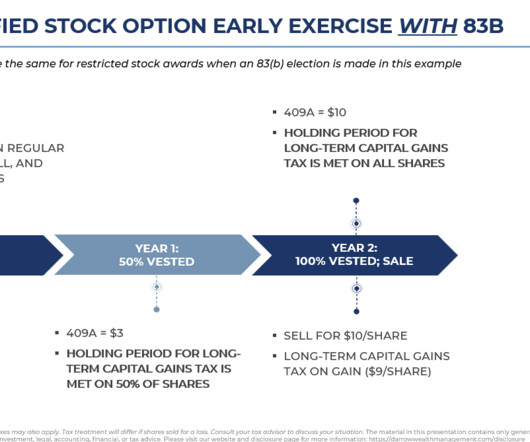

For founders, employees, and executives with stock-based compensation, an 83(b) election can be a powerful tax planning tool. When you make an 83(b) election, you’re opting to pay tax on unvested shares now, instead of when the stock vests. In tax lingo, this is known as substantial risk of forfeiture.

Wealth Management

APRIL 20, 2023

How does the court weigh evidence on valuation discounts?

Darrow Wealth Management

DECEMBER 5, 2022

Donating appreciated stock to charity can be a great way to give back and reduce your tax bill. Taxpayers who itemize get a tax deduction for the market value of the stock. If you want to make a gift for the 2022 tax year – act now. These two steps don’t need to happen in the same tax year. Give wisely.

Darrow Wealth Management

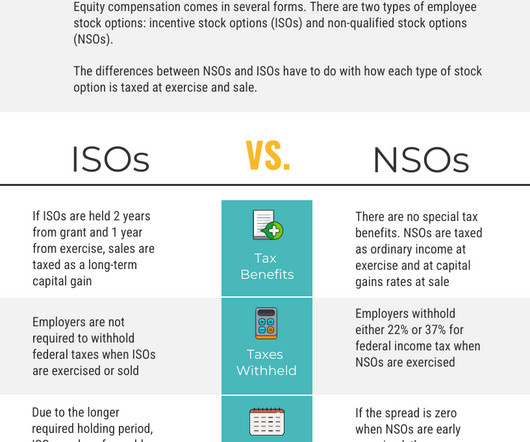

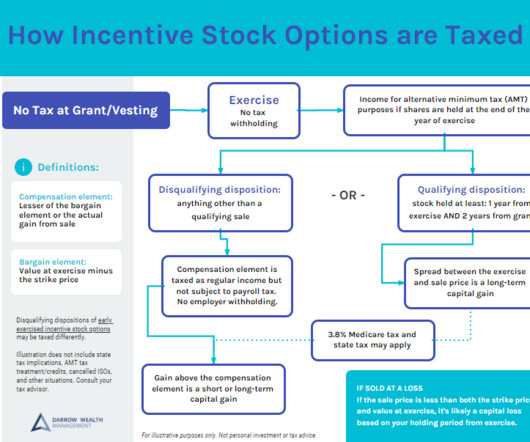

OCTOBER 21, 2024

When unexercised ISOs are cashed out at closing, it’s considered a cancellation of stock options for tax purposes, not a disqualifying disposition. This is important, as the former will be subject to payroll tax. Should the deal not go through, you may be left with a large tax bill and no liquidity to pay it.

Darrow Wealth Management

JULY 30, 2024

For founders, employees, and executives with stock-based compensation, an 83(b) election can be a powerful tax planning tool. When you make an 83(b) election, you’re opting to pay tax on unvested shares now, instead of when the stock vests. In tax lingo, this is known as substantial risk of forfeiture.

Darrow Wealth Management

OCTOBER 31, 2022

Due to tax implications, liquidity issues, and periods of heightened market volatility, exercising options before an anticipated initial public offering may not be worth the risk. One of the top risks for people with incentive stock options (ISOs) is not having cash to pay the taxes due from the exercise. Instacart isn’t alone.

Darrow Wealth Management

SEPTEMBER 7, 2023

Pros and cons of exercising stock options in a pre-IPO window If you are new to the tax implications and basics about exercising stock options, please read this article first. Unfortunately, for those tax savings to materialize, the post-IPO stock price at sale must be considerably more than the pre-IPO valuation at exercise.

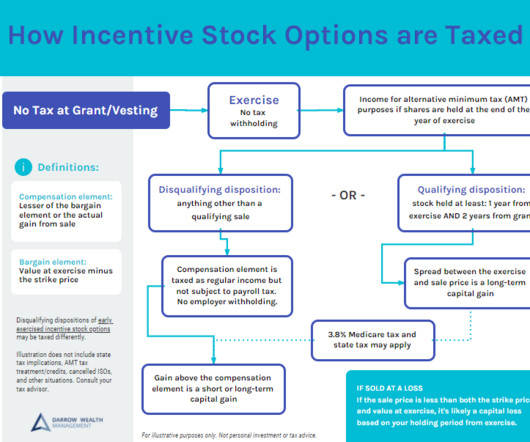

Darrow Wealth Management

NOVEMBER 14, 2024

Tax implications of exercising and selling stock options If you have stock options as a large part of your income, taxes are especially important. How stock options are taxed depends on the type of options you have and your sale and exercise strategy. However, that doesn’t mean you won’t need to pay taxes!

Darrow Wealth Management

AUGUST 28, 2023

Make your business more sellable later by getting advice now Business brokers often recommend getting a valuation done years before expecting to sell the company. Your business advisory team may consist of: a business broker or M&A advisor, accounting and tax advisors, and transaction/M&A attorney.

Darrow Wealth Management

MARCH 24, 2024

6 tax strategies for incentive stock options and AMT Triggering the alternative minimum tax isn’t the end of the world, but you don’t want to do it by accident. Exercise ISOs early in the year to manage or avoid AMT To get long-term capital gains tax treatment, you need to hold ISOs through the end of the year of exercise.

Darrow Wealth Management

FEBRUARY 20, 2023

Here are key provisions to gather: What type of equity is being offered and how many shares Strike or purchase price for the equity Current 409a valuation Vesting schedule Warning! Then there are the tax implications. This can also help with longer term tax planning optimization. A lot of things need to go right.

Darrow Wealth Management

JULY 25, 2022

Particularly for employees of companies that IPO’d last year, valuations have fallen significantly. If the company was trading at an inflated price due to market conditions at the time, then it’s going to be much harder to justify that valuation when exuberance wanes. Single stocks vs the market. Strategies to diversify.

Darrow Wealth Management

MARCH 31, 2023

But that doesn’t mean the actual assets are just split down the middle, and some assets are much more favorable from a tax perspective than others. Money and divorce This article solely focuses on some of the general financial planning aspects of divorce and is not personal legal, tax, accounting, or financial advice.

Darrow Wealth Management

FEBRUARY 24, 2025

In the right situations, early exercising stock options can reduce tax with an 83(b) election, and in the case of incentive stock options, potentially avoid the alternative minimum tax (AMT). Employees with stock options often focus on one thing: taxes. In the typical scenario, there are no tax implications at grant or vesting.

Darrow Wealth Management

MARCH 24, 2024

6 tax strategies for incentive stock options and AMT Triggering the alternative minimum tax isn’t the end of the world, but you don’t want to do it by accident. Exercise ISOs early in the year to manage or avoid AMT To get long-term capital gains tax treatment, you need to hold ISOs through the end of the year of exercise.

Darrow Wealth Management

JUNE 2, 2022

Quite simply, a down round is when a company raises money at a lower valuation per share relative to earlier financing rounds. A simple example: a startup raises a Series B at a $30M post-money valuation and a Series C at a $20M post-money valuation. With rates rising, unrealistic valuations are getting cut.

eMoney Advisor

DECEMBER 20, 2022

They raise valuation issues because they may not be subject to commonly-accepted valuation methodologies and may not be subject to consistent accounting treatment or traditional reporting requirements. It is not meant to be, and should not be taken as financial, legal, tax or other professional advice.

Park Place Financial

NOVEMBER 29, 2022

For instance, a trust can decrease your tax liability and protect you from some legal trouble, such as lawsuits. Internal Revenue Service (IRS) provides actuarial tables , which dictate the assets that estate tax rules value and are defined by interest rates. In other words, when rates go up, the table valuations follow suit.

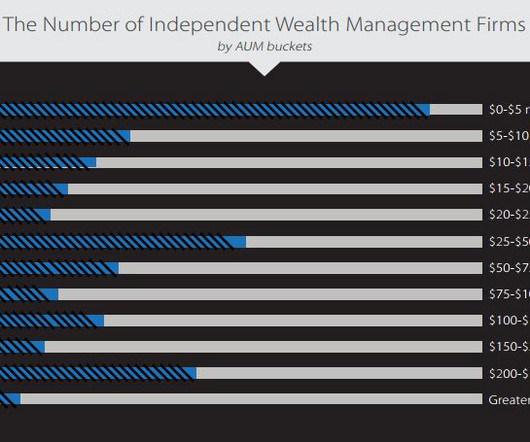

The Irrelevant Investor

JULY 24, 2017

People's view of gold is driven by who is in the White House, how much taxes you pay, whether you're employed or on government assistance, etc. There are 13,000 wealth management firms in the United States, according to RIA Database , so when the robo-advisors see charts like the one below, they must lick their chops.

Trade Brains

FEBRUARY 2, 2024

The company was founded in 2008 and was previously known as IIFL Wealth Management Limited. 360 ONE is a wealth management firm based in Mumbai, India. Most of the company’s revenue in FY23 came from wealth management (72.71%), with the remainder from asset management (27.29%). .) ₹ 3,459.63

Fortune Financial

AUGUST 31, 2022

These bonds may also come with tax incentives, making them more attractive than traditional bonds. This type of tax incentive is typically applied to municipal bonds in the United States market. The information contained herein is based on current tax laws, which may change in the future.

International College of Financial Planning

NOVEMBER 10, 2021

In this course program, you’d be trained in concepts such as capital budgeting, risk management, and option valuation to name a few. You will also be trained in theories of finance and capital structure and help organizations manage their assets and monetize them.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content