Retirement Visions Joins Redhawk Wealth Advisors

Wealth Management

JANUARY 8, 2024

The 10-person Retirement Visions team left Securities America to harness technology, compliance and administrative support by Redhawk Wealth Ventures.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

JANUARY 8, 2024

The 10-person Retirement Visions team left Securities America to harness technology, compliance and administrative support by Redhawk Wealth Ventures.

Wealth Management

SEPTEMBER 22, 2023

NFP grew its wealth and retirement business in Utah, R&R left Avantax for Commonwealth, tru Independence launched its 4th firm of 2023 and Johnson Financial, LPL and Kestra all made announcements this week.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

How To Overcome Change Fatigue In Finance With Neuroscience-Backed Strategies

Protect What Matters: Rethinking Finance Ops In A Digital World

Your Accounting Expertise Will Only Get You So Far: What Really Matters

Abnormal Returns

JUNE 9, 2025

podcasts.apple.com) Dan Haylett talks with Brendan Frazier about the art of spending money in retirement. riabiz.com) Wealth advisors are on notice: inheritors are likely to fire you. Podcasts Jess Bost and Mark Newfield talk with Phil Pearlman about the connection between health and executive function.

Wealth Management

DECEMBER 18, 2023

Cerulli data shows what would entice wealth advisors to manage defined contribution retirement plans.

Abnormal Returns

NOVEMBER 18, 2024

Podcasts Daniel Crosby talks with Christina Lynn about Motivational Interviewing in order to enhance the work of wealth advisors. advisorperspectives.com) 7 areas where advisers may be falling short with retired clients. podcasts.apple.com) Bogumil Baranowski talks with Justin Castelli about living an authentic life.

Nerd's Eye View

FEBRUARY 25, 2025

In this episode, we talk in-depth about why Jennifer’s firm has taken an approach to grant equity rather than require buy-ins (and intends for every employee to either have equity, or at least a path to equity if they’re still new), how Jennifer’s firm sets individual performance targets for its client-facing wealth advisors to earn (..)

Tobias Financial

JUNE 15, 2025

Retirement planning is deeply personal, and for single individuals, it comes with both unique opportunities and important considerations. Whether by choice or circumstance, retiring solo means you’re in full control of your financial decisions, but you also face distinct planning challenges that require thoughtful strategy.

Abnormal Returns

JULY 10, 2023

Podcasts Meb Faber talks with Blake Street is a Founding Partner and CIO of Warren Street Wealth Advisors. larrykotlikoff.substack.com) The biz Goldman Sachs ($GS) has snagged another custodian client, NewEdge Wealth. larrykotlikoff.substack.com) A real-life example of balancing differing wants in retirement. wsj.com)

Nerd's Eye View

JULY 10, 2023

As owners of financial planning firms approach retirement, some may decide to sell to an external buyer, while others may plan for an internal succession. Jason then pivoted to offering financial planning services for those nearing or entering retirement, which required the firm to retrain its staff on the ins and outs of retirement planning.

Abnormal Returns

AUGUST 5, 2024

Podcasts Michael Kitces talks divorce planning with Michelle Klisanich who is a Wealth Advisor for Financially Wise Divorce. kitces.com) Matt Zeigler talks with Wade Pfau about managing sequence of returns risk in retirement. youtube.com) Ted Seides talks with Jeff Assaf who is the founder and CIO of ICG Advisors.

Advisor Perspectives

SEPTEMBER 24, 2023

For many wealth advisors, workplace retirement plans are either a burden or an afterthought, according to John Kutz, National Retirement Plan Strategist at Franklin Templeton. He and his team explore why embracing these plans can benefit their practice, and their clients.

WiserAdvisor

OCTOBER 4, 2022

Retirement planning can be a bit complex. Given the complexity and magnitude of things necessary for a comfortable retirement, starting planning from a young age is also essential. At the age of 30, your daily expenses can significantly differ from what you would need in retirement. Ten retirement expenses to keep in mind: 1.

Nerd's Eye View

AUGUST 6, 2024

Welcome to the 397th episode of the Financial Advisor Success Podcast ! Jaime is the Managing Principal of Benedetti, Gucer, and Associates and BEAM Wealth Advisors, hybrid advisory firms based in Atlanta, Georgia, and Covington, Louisiana that oversee a total of $1.2 My guest on today's podcast is Jaime Benedetti.

WiserAdvisor

AUGUST 31, 2023

Financial advisors play a crucial role in assisting you before your retire. They can provide ongoing support so you can continue investing after retirement, monitor market fluctuations, and make necessary adjustments to your retirement portfolio. Here are 5 benefits of hiring a financial advisor after you retire: 1.

Advisor Perspectives

OCTOBER 2, 2024

Explore the significant opportunities for wealth advisors in managing 401(k) plans. Our Mike Dullaghan explains how these plans can help both advisors and clients with financial growth and retirement planning.

Tobias Financial

APRIL 1, 2025

We are excited to welcome Francheska Ruiz, CFP and Chad Williamson, CFP to our team as Wealth Advisors. With nearly 10 years of experience working with high-net-worth individuals in the fee-only Registered Investment Advisor space, Chad is dedicated to helping clients navigate complex financial decisions.

Advisor Perspectives

MAY 11, 2024

Legislation is driving a renewed focus on workers without workplace savings plans, creating opportunities for both wealth advisors and retirement specialists. Our Retirement Strategist Mike Dullaghan discusses the trends.

Carson Wealth

JANUARY 22, 2025

It was a heartwarming day, and even our Associate Wealth Advisor, Zach Vande Weerd, managed to get a photo with his wife, Hannah, and their adorable dog, Chief. Later in the month, on October 29th, we partnered with Alecia Barnette, Senior Vice President of Sales, for a Long-Term Care Seminar.

Carson Wealth

DECEMBER 8, 2023

Many states also exempt retirement income, which may include Social Security. However, retirement income is generally included for income related monthly adjustment amount (IRMAA) computations to determine if supplemental payments are due for Medicare Part B and Medicare Part D premiums.

Diamond Consultants

DECEMBER 16, 2024

Namely, even when senior advisors have a rockstar inheriting advisor in place, these Gen 2 advisors seldom have the capital at hand to facilitate the purchase of the book in a timely and orderly fashion. After all, shouldnt the retiring advisors be compensated fairly for their lifes work? But is that fair?

Darrow Wealth Management

FEBRUARY 13, 2025

The ability to advise on standard financial planning matters such as retirement planning should be table stakes (if not, red flag). But even comprehensive wealth advisors have blind spots or can only go an inch deep on certain subjects. Working with an independent firm can reduce the risk of receiving biased advice.

Zoe Financial

DECEMBER 28, 2024

For instance, I will contribute an additional $10,000 to my retirement fund this year or I will pay off my $15,000 credit card balance by December 2025. Allocate funds for savings, retirement, and an emergency fund while leaving room for meaningful indulgences. An advisor can help you stay accountable and adapt to lifes changes.

Tobias Financial

APRIL 11, 2024

We are thrilled to announce that our Wealth Advisors, Edzai Chimedza, CFP® and Franklin Gay , CFP®, EA will be leading two Financial Planning Seminars at Nova Southeastern University. These seminars, scheduled for Friday, April 12th and Friday, May 3rd at 11 a.m., will cater specifically to the students of the dental school.

Harness Wealth

APRIL 15, 2025

Table of Contents How Net Worth Is Changing in America The New Wealth Benchmarks How Net Worth Changes with Age Why Net Worth Is More Important Than Income Whats on the Average American Balance Sheet? Find Your Wealth Advisor at Harness How Net Worth Is Changing in America From 2016 to 2022, the median U.S.

Pacifica Wealth

JULY 31, 2023

Robert was recently featured in MarketWatch , where he discussed how to overcome the hurdles of Average Retirement and embrace a full life filled with more meaning, fulfillment and adventure. With longer life expectancies, retirement can last as long as 40 years. Then retire full-time,” Pagliarini said. See what you like.

Tobias Financial

MARCH 11, 2025

In times of economic uncertainty, market fluctuations can create anxiety for investors as they wonder what these changes mean for their savings, retirement accounts, and overall financial strategy. Our Wealth Advisor, Franklin Gay, CFP, EA was interviewed by CBS News, where he offered his perspective on the situation.

Tobias Financial

OCTOBER 12, 2023

Despite the positive statistics, disparities in income, workplace discrimination, and lower inheritance rates persist, impacting long-term wealth accumulation. Additionally, financial habits such as lower contributions to retirement plans and reliance on tangible assets pose unique challenges.

Tobias Financial

JANUARY 20, 2023

Our Wealth Advisor, Franklin “Franko” Gay , is passionate about helping others achieve their personal goals by utilizing strategic financial and tax planning in their day-to-day lives. In summary, shoring up your financials in the decade or less before retirement can be a daunting task when you feel you have a shortfall in assets.

WiserAdvisor

SEPTEMBER 13, 2022

The average retirement age in America is 63. However, it may still be advised to start planning your retirement as soon as you can. Retirement planning is a long process. It can take several years to understand your future needs and accumulate enough savings to prepare for a financially secure retirement.

Darrow Wealth Management

OCTOBER 28, 2024

Are you planning to retire? Going from running a company to suddenly retired can be a difficult transition for some people. After the transaction is complete, consider ways to protect and grow the wealth you’ve built. Will you retire after selling the business? This is the best way to stress-test a retirement plan.

Nerd's Eye View

JANUARY 10, 2023

Welcome back to the 315th episode of the Financial Advisor Success Podcast ! Lisa is a Partner and Wealth Advisor for CI Brightworth, an RIA under the CI Financial umbrella with offices in Atlanta, Georgia, and Charlotte, North Carolina, that oversees nearly $5 billion in assets under management * for over 1,500 client households.

Steve Sanduski

APRIL 8, 2025

Guests: Bill Keen, Founder and CEO, and Matt Wilson, Chief Investment Officer and President, of Keen Wealth Advisors , a billion-dollar-plus RIA in Overland Park, Kansas. In a nutshell: Bill Keen named his book Keen on Retirement: Engineering the Second Half of Your Life.

FMG

MAY 19, 2025

Add keywords your audience might use, like Financial Advisor | Retirement Planning or “Wealth Management | Tax Planning.” Include Keywords for Discoverability People search Instagram like they do Google, so include keywords like retirement planning, wealth advisor, or student loan help to boost discoverability.

WiserAdvisor

SEPTEMBER 14, 2022

The average retirement age in America is 63. However, it may still be advised to start planning your retirement as soon as you can. Retirement planning is a long process. It can take several years to understand your future needs and accumulate enough savings to prepare for a financially secure retirement.

FMG

OCTOBER 14, 2022

Financial Freedom Wealth Management Group. Based out of Newport, Oregon the Financial Freedom Wealth Management website focuses on retirement planning services. Special attention to design makes information easy to absorb. .” – Julia Carlson, Financial Freedom Wealth Management Group. Peabody Wealth Advisors.

Carson Wealth

APRIL 9, 2025

Advocating for Financial Professionals in Iowa Zach Vande Weerd, Associate Wealth Advisor, represented our firm at the Iowa CPA Day at the Iowa State Capitol. Whether you’re looking to fine-tune your investment strategy, plan for retirement, or discuss financial goals, our team is here to help.

Random Roger's Retirement Planning

MAY 10, 2023

When you get close to retirement, you know what will matter? What will matter is whether you have enough to retire to the lifestyle you want plus maybe having some sort of margin for error in your accumulated savings. That's the difference between a great season/successful retirement outcome and a poor result.

Random Roger's Retirement Planning

MAY 18, 2023

Bloomberg did a survey and found that Generation-X does not feel like it will be "financially prepared for retirement." Anyone closer to the younger edge of Gen-X could probably benefit by cutting expenses now, the impact of that could compound over the next 20+ years as they approach a normal retirement age.

Darrow Wealth Management

JUNE 14, 2023

There are many different types of sudden wealth events, for example: Receiving an inheritance Stock options or equity compensation Sale of a business Winning the lottery Asset division in a divorce Proceeds from a lawsuit Professional athletes (signing bonus, performance, sponsorships, etc.)

Darrow Wealth Management

AUGUST 28, 2023

With many sellers relying on the sale to fund their retirement and lifelong financial goals, getting it right from the start is critical. Here are tips from sell-side business advisors on what to do (and not do) when selling a business. Be sure to involve your wealth advisor in discussions around deal terms too.

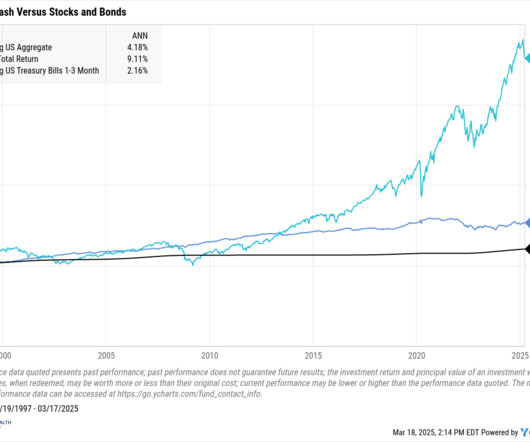

Darrow Wealth Management

MARCH 17, 2025

That’s often the difference between having enough money to retire, and not. Schedule a consultation with a wealth advisor to discuss investing extra cash The post Are You Holding Too Much Cash? appeared first on Darrow Wealth Management. For long-term investors, only stocks have reliably outpaced inflation.

International College of Financial Planning

JUNE 5, 2025

These days, wealth is younger, faster, and more digital than ever – layered with complexities we didn’t even dream of back then. As someone who’s spent years guiding families and now teaches at ICOFP, I can confidently say, “the role of a wealth advisor has completely transformed.” It’s not just a certification.

Tobias Financial

SEPTEMBER 16, 2022

Moreover, she will explore the topics of technology, working through Covid and baby boomer retirements from the millennial perspective. . To join the virtual event, visit: [link] .

Indigo Marketing Agency

APRIL 28, 2023

If you work for a very large firm with high name recognition, I would use the firm name in your headline, such as Wealth Advisor at XYZ Wealth Management Group. I would leave your name out of the headline if your firm name has your own name in it since that keyword is already accounted for in your name.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content