Top Senate Taxwriters Seek Input on Digital Asset Tax Rules

Wealth Management

AUGUST 16, 2023

The call for feedback touches on policies that, if changed, would likely impact the flow of crypto gifts to nonprofits.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

AUGUST 16, 2023

The call for feedback touches on policies that, if changed, would likely impact the flow of crypto gifts to nonprofits.

Cordant Wealth Partners

NOVEMBER 18, 2024

We also get you up to speed on the tax benefits of using a DAF. If you've heard of a DAF and are curious about incorporating it into your giving and tax planning strategy, this article is for you. Key Takeaways: Contributions to a donor-advised fund reduce your tax bill in the year your contribution is made.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Protect What Matters: Rethinking Finance Ops In A Digital World

Your Accounting Expertise Will Only Get You So Far: What Really Matters

Carson Wealth

NOVEMBER 3, 2022

And while the holidays are traditionally a time to reflect on our blessings and help those less fortunate than ourselves, there’s another factor influencing the timing of these donations — and that’s the goal of minimizing a tax bill. Three Tax-Advantaged Donation Strategies to Consider. Create a donor-advised fund (DAF).

Brown Advisory

MAY 4, 2020

Beyond Investing: Strategic Advice for Nonprofits ajackson Mon, 05/04/2020 - 14:54 Running a nonprofit is a tall order. And in parallel with their program work, nonprofit leaders must also build the financial and organizational infrastructure to sustain those programs.

Brown Advisory

SEPTEMBER 4, 2019

Beyond Investing: Strategic Advice for Nonprofits. Running a nonprofit is a tall order. And in parallel with their program work, nonprofit leaders must also build the financial and organizational infrastructure to sustain those programs. Wed, 09/04/2019 - 14:54. client: NATIONAL HEALTH ADVOCACY ORGANIZATION.

Walkner Condon Financial Advisors

FEBRUARY 15, 2024

The nonprofit sector has a path forward, but it needs the help of individuals, institutions, and government to get there. Whichever way you look at it, 2024 will bring uncertainty for a vast swath of the nonprofit sector, making planning and charitable spending more conservative and less dependable. A Look at 2024’s Hunt for Revenue.

Envision Wealth Planning

JULY 12, 2023

True forgiveness is the public student loan forgiveness program, which requires working for a qualified nonprofit, making 120 on-time payments, and only then is your loan forgiven. Typically, those who work in a nonprofit environment make less money than those who work in for-profit firms.

Carson Wealth

MARCH 21, 2025

Theyre established to benefit charitable organizations, including educational or cultural institutions, community organizations, service organizations such as hospitals, and other nonprofits. Donations to endowment funds are tax-deductible, giving them a place in your overall financial management and tax plan.

MainStreet Financial Planning

MAY 10, 2023

A few weeks ago, I had the pleasure of attending a gala fundraiser for one of my favorite nonprofit organizations, Junior Achievement. You may not be aware, but I worked for this same nonprofit for about 5 years before joining MainStreet. Here is a great way to value those items if you are eligible to take a tax deduction.

Carson Wealth

MAY 7, 2025

Positioning Philanthropy as a Cornerstone of Legacy There are many reasons for giving during your lifetime, including supporting causes you care about, making a positive impact on the world, and accessing certain tax advantages. There are overall limits on charitable donation tax deductions, however.

Harness Wealth

APRIL 26, 2022

No-one loves paying taxes. Did you know you can buy crypto through an IRA and receive the same tax benefits? Just like with other assets, if you buy crypto through an IRA, the tax will be paid at your income tax rate at retirement. You can see the crypto advisor tax webinar replay here. Manage your timing.

Carson Wealth

MAY 30, 2025

Although sophisticated tech solutions have been slower to reach the nonprofit world than some other sectors, their arrival was inevitable. Transparency is critical in the nonprofit world: Charities with greater transparency have been shown to attract 53% more contributions. Plus transparency can help nonprofits operate better.

Million Dollar Round Table (MDRT)

NOVEMBER 15, 2022

Ideally, the calendar is marked for significant dates, such as tax payment deadlines. Hopefully, they are charitable, though, and have a favorite nonprofit. Buy clients a calendar. You should be able to get them imprinted with your name and business contact information. When they use the calendar, they’ll see your name. Send candy.

eMoney Advisor

JANUARY 12, 2023

Volunteer Income Tax Assistance (VITA) or Tax Counseling for the Elderly (TCE). Website: irs.gov/individuals/irs-tax-volunteers. Volunteers say: “I have had a wonderful experience doing VITA—preparing income taxes for mid- and low-income members of my community. Best for: All financial professionals.

Brown Advisory

APRIL 28, 2020

The CARES Act Supplement: New Relief Funds Authorized eberkwits Tue, 04/28/2020 - 08:44 On April 23rd, Congress approved a second emergency package to expand funding for small businesses, nonprofits, hospitals and money for COVID-19 testing. Business and nonprofits with up to 10,000 employees or up to $2.5

Brown Advisory

APRIL 28, 2020

On April 23rd, Congress approved a second emergency package to expand funding for small businesses, nonprofits, hospitals and money for COVID-19 testing. The measure replenishes the Paycheck Protection Program (PPP) and Economic Injury Disaster Loan (EIDL) program for nonprofits and small businesses. Documentation Preparedness.

Brown Advisory

APRIL 16, 2018

The Other 95% achen Mon, 04/16/2018 - 13:23 The traditional goal for a nonprofit’s investment portfolio was to earn a 5% return or so that could be used to fund the nonprofit’s programs. Today, we help nonprofits make an impact with the other 95% of their portfolio.

Brown Advisory

APRIL 16, 2018

The traditional goal for a nonprofit’s investment portfolio was to earn a 5% return or so that could be used to fund the nonprofit’s programs. Today, we help nonprofits make an impact with the other 95% of their portfolio. When a nonprofit wants a mission-aligned investment strategy, we use the same process.

Brown Advisory

APRIL 3, 2020

Despite the challenges we are all facing, we are inspired by the work that our nonprofit clients are doing and seek to be a partner, resource and friend during this period, offering relevant information and perspectives when possible that can aid our clients in pursuing their missions. Charitable Deductions.

Walkner Condon Financial Advisors

APRIL 27, 2023

Related Reading: What to do With Your Previous Job’s 401(k) Plan If you work for a university, public school, or a 501(c)(3) tax-exempt organization (more commonly referred to as a charitable organization or nonprofit), you may have participated in a 403(b) plan. This is where unwelcome tax surprises can occur.

The Big Picture

MARCH 4, 2025

So taxes and bonds for sure. So kind of an, you know, easy transition taxes and bonds to, to corporate bonds. Barry Ritholtz : And, and just for the youngsters listening, 25 or so years ago, high rated municipal tax free bonds were yielding five, 6% maybe more, maybe Melissa Smith : More.

Walkner Condon Financial Advisors

APRIL 13, 2022

If you work for a university, public school, or a 501(c)(3) tax-exempt organization (more commonly referred to as a charitable organization or nonprofit), you may have participated in a 403(b) plan. It is a defined-contribution plan that offers an opportunity for an employee to save and invest for retirement in a tax-deferred manner.

James Hendries

NOVEMBER 26, 2022

billion to nonprofits and community organizations on #GivingTuesday in 2021, a 6% increase from 2020. Ideally, at the beginning of every year – with your financial professional – you would map out a plan to maximize the tax benefits of your giving. And according to GivingTuesday.org, the giving in the U.S. alone totaled $2.7

Clever Girl Finance

DECEMBER 16, 2023

Figure out how much money you make in after-tax income. More accurately, 70% of your take-home pay, or net income after taxes, not pre-tax income. 401(k)s offer the opportunity to save for retirement before taxes. Keep in mind that these accounts are tax-deferred, not tax-free.

James Hendries

SEPTEMBER 13, 2022

Employees can pick either their 401(k) Roth or pre-tax retirement savings account to receive their employer’s match. all employer matching dollars must deposit into the employee’s pre-tax retirement savings account. Create tax credits of up to $1,000 per employee for small businesses that offer a retirement savings plan.

Brown Advisory

MARCH 27, 2020

There are a number of temporary income tax provisions in the CARES Act that will be of interest to our private clients. PROVISIONS AFFECTING INDIVIDUALS AND FAMILIES Recovery Rebate for Individual Taxpayers – Tax Credit. Student Loan Repayment Deferral for Department of Education & Exclusion from Income Tax.

Brown Advisory

MARCH 27, 2020

There are a number of temporary income tax provisions in the CARES Act that will be of interest to our private clients. Recovery Rebate for Individual Taxpayers – Tax Credit. Eligibility for the one-time payment will be calculated using taxpayer’s income/filing status as reported on their 2019 income tax return.

Good Financial Cents

DECEMBER 12, 2022

They offer a variety of features, including portfolio rebalancing, tax-loss harvesting, and automatic deposits. These premium services include tax-loss harvesting and advanced analytics tools. .” Investment Management: M1 Finance offers investment management services to help you grow your money. Hows does M1 Finance make money?

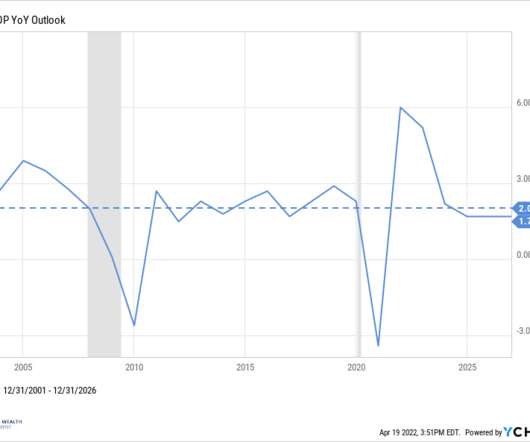

Darrow Wealth Management

APRIL 20, 2022

The Personal Consumption Expenditures (PCE) measures the change in the prices of goods and services consumed by all households and nonprofit institutions serving households. Given the strength of household balance sheets and that the Fed is raising rates from zero, prepare for inflation to stick around. Taming inflation won’t be easy.

WiserAdvisor

FEBRUARY 2, 2023

Mass layoffs impact not only for-profit corporations but also nonprofit organizations. Plan your future finances Significant life events such as a wedding, a house purchase, planning to have a baby, adopting pets, and other similar things can be financially taxing. This can help reduce your expenses and preserve cash.

Brown Advisory

SEPTEMBER 12, 2016

SIBs are not backed by tax revenue or the creditworthiness of the issuer. Social Finance, a global nonprofit that pioneered the SIB concept, sold the first social impact bond in 2010 to fund programs aimed at reducing convict recidivism. The return hinges on the outcome of a government-backed social program.

Brown Advisory

SEPTEMBER 12, 2016

SIBs are not backed by tax revenue or the creditworthiness of the issuer. Social Finance, a global nonprofit that pioneered the SIB concept, sold the first social impact bond in 2010 to fund programs aimed at reducing convict recidivism. The return hinges on the outcome of a government-backed social program.

Brown Advisory

MARCH 28, 2019

The “5% rule” was instituted in 1981 by the IRS; this rule requires private foundations to distribute at least 5% of portfolio assets each year, and over time this rule has been voluntarily adopted by nonprofits of all types. No portfolio rebalancing costs, including taxes, if applicable, are deducted from the hypothetical portfolio value.

Brown Advisory

MARCH 28, 2019

The “5% rule” was instituted in 1981 by the IRS; this rule requires private foundations to distribute at least 5% of portfolio assets each year, and over time this rule has been voluntarily adopted by nonprofits of all types. No portfolio rebalancing costs, including taxes, if applicable, are deducted from the hypothetical portfolio value.

The Big Picture

MAY 20, 2025

We want to donate half of our profits to nonprofit organizations. It’s been helpful for the after-tax return of the shareholders. That’s when you launched where you launched. And from the very beginning you said something kind of unusual about the firm. Tell us where that idea came from. So we’ve done that.

Brown Advisory

MARCH 28, 2017

Values-based investing can be complex, and transitioning an entire portfolio can often involve meaningful tax and transaction expenses. For example, we recently helped a family foundation structure a program-related loan to to help a nonprofit bridge a cash flow gap. Take "baby steps" before a "giant leap."

Brown Advisory

MARCH 28, 2017

Values-based investing can be complex, and transitioning an entire portfolio can often involve meaningful tax and transaction expenses. For example, we recently helped a family foundation structure a program-related loan to to help a nonprofit bridge a cash flow gap. Take "baby steps" before a "giant leap."

Clever Girl Finance

JANUARY 26, 2024

There, you can learn about better budgeting , mortgages, taxes, and more related to homeownership. Expert tip: A credit counselor can help with more than debt management For anyone struggling with debt and unsure how to move forward, seeing a certified nonprofit credit counselor is a great place to begin.

The Big Picture

APRIL 29, 2025

We learned everything, you know, across from accounting to auditing to, to tax and valuation. You know, in those days these companies hired, you know, crops of undergrads. They, they trained them together. And it was a, a terrific company, a great learning experience. And, and you know, she’s been a great inspiration to me.

Brown Advisory

MARCH 28, 2017

SIBs are not backed by tax revenue or the creditworthiness of the issuer. Social Finance, a global nonprofit that pioneered the SIB concept, sold the first social impact bond in 2010 to fund programs aimed at reducing convict recidivism. Given the structure of SIBs, investors should view these differently than conventional bonds.

Brown Advisory

MARCH 28, 2017

SIBs are not backed by tax revenue or the creditworthiness of the issuer. Social Finance, a global nonprofit that pioneered the SIB concept, sold the first social impact bond in 2010 to fund programs aimed at reducing convict recidivism. Given the structure of SIBs, investors should view these differently than conventional bonds.

WiserAdvisor

FEBRUARY 2, 2023

Mass layoffs impact not only for-profit corporations but also nonprofit organizations. Plan your future finances Significant life events such as a wedding, a house purchase, planning to have a baby, adopting pets, and other similar things can be financially taxing. This can help reduce your expenses and preserve cash.

Harness Wealth

FEBRUARY 4, 2025

However, unlike stocks and bonds, alternative investments, or alts as theyre commonly known, have unique tax treatments and complex reporting requirements that investors should carefully consider before investing. Well also go into some potential strategies to optimize tax efficiency. How Are Alternative Investments Taxed?

Carson Wealth

DECEMBER 5, 2024

million nonprofit organizations registered in the U.S. The Tax Impact of Charitable Giving The personal financial and income tax impact from charitable giving can affect the size of the gift and the timing of giving. Donations can also be deferred until death to manage estate taxes or create a charitable legacy.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content