Impact of New $15M 'Permanent' Estate/Gift Tax Exemption

Wealth Management

JULY 7, 2025

Explore how the new $15 million federal estate tax exemption affects lifetime transfer planning and strategies for high-net-worth clients.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

JULY 7, 2025

Explore how the new $15 million federal estate tax exemption affects lifetime transfer planning and strategies for high-net-worth clients.

Wealth Management

JULY 14, 2025

New law increases transfer tax exemptions, raises SALT deduction cap, preserves TCJA rates, expands QSBS benefits and continues QBI deduction.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

How to Streamline Payment Applications & Lien Waivers Through Innovative Construction Technology

Your Accounting Expertise Will Only Get You So Far: What Really Matters

Wealth Management

JULY 18, 2025

The 20% deduction for qualified business income, including REIT dividends, has been made permanent in the new tax law, reducing effective tax rates for investors.

Wealth Management

JULY 17, 2025

based accounting firm, is taking a page from large registered investment advisors by bringing together taxes and wealth management. Minopoli, who is also a partner in the new RIA, had previously been the chief investment officer of a team managing a $30 billion portfolio for the Knights of Columbus Asset Advisors.

Speaker: Rita Keller - President of Keller Advisors, LLC

You've worked diligently and have built a glowing reputation grounded in your excellent skills in tax, accounting, and auditing. You're known as the “go-to” person when a client is faced with tax and financial decisions. You have a very successful firm -- but that’s not enough. For others, it will be a significant challenge.

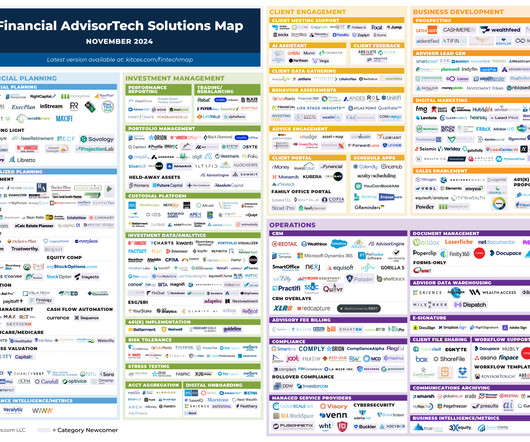

Nerd's Eye View

JANUARY 21, 2025

Daniel is the CEO of WMGNA, a hybrid advisory firm based in Farmington, Connecticut, that oversees approximately $270 million in assets under management for 200 client households.

Wealth Management

JUNE 10, 2025

Podcasts & Videos CE Webinars Research Newsletters Subscribe Subscribe News Related Topics RIA IBD Wirehouse RPA Insights & Analysis Regulation & Compliance Career Moves Recent in News See all Wealth Management EDGE 2025 Industry News & Trends Scenes From Day 1 of Wealth Management EDGE 2025 Scenes From Day 1 of Wealth Management EDGE (..)

Wealth Management

MAY 21, 2025

Tax Court case in which a taxpayer's charitable deduction was allowed despite an unqualified appraisal. A summary of a recent U.S.

Wealth Management

AUGUST 13, 2025

While opinions on OBBBA may vary, the legislation includes several corporate tax provisions that could be valuable for manufacturers, capital-intensive businesses, and others positioned to benefit. Below, we’ve highlighted 10 key takeaways, plus a bit of commentary. Related: Big Beautiful Bill: What Estate-Planning Steps Make Sense Now?

Nerd's Eye View

MARCH 12, 2025

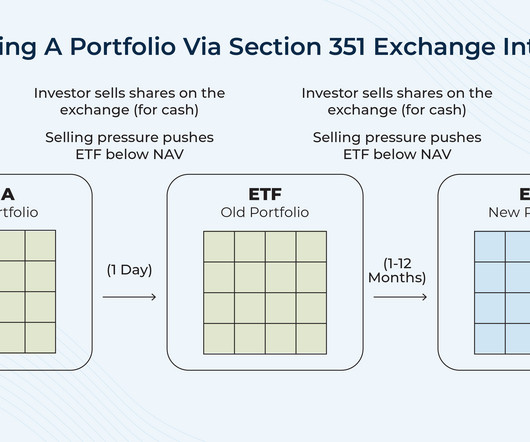

While the gains signal portfolio growth, they also create challenges for ongoing management. Once a portfolio becomes 'locked up', i.e., unable to be managed without triggering capital gains, investors' options become limited. If the exchange meets the requirements of Section 351, it is tax-deferred for investors.

Wealth Management

AUGUST 6, 2025

Asset managers and family wealth advisors have traveled a long way from their early experiments with ChatGPT. Financial advisors handle highly sensitive data regularly and already operate in a highly regulated sector, so they’re primed to approach AI with risk management in mind.

The Big Picture

DECEMBER 4, 2024

Would you like to diversify but also defer paying big capital gains taxes? Full transcript below. ~~~ About this week’s guest: Meb Faber is co-Founder and CIO at Cambria Investment Management, as well as research firm Idea Farm. The fund runs 15 ETFs and manages nearly 3 billion in assets. None of these solutions are optimal.

Nerd's Eye View

JULY 4, 2025

Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that Congress has passed highly anticipated tax legislation, making 'permanent' (i.e.,

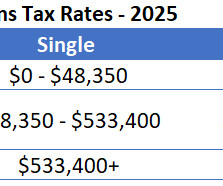

Darrow Wealth Management

NOVEMBER 2, 2024

The IRA and Roth IRA contribution limits are unchanged but income eligibility for tax-deductible IRA contributions and Roth IRA contributions have changed. The 2025 income tax brackets and long-term capital gains tax rates are also updated. The 2025 income tax brackets and long-term capital gains tax rates are also updated.

The Big Picture

MAY 29, 2025

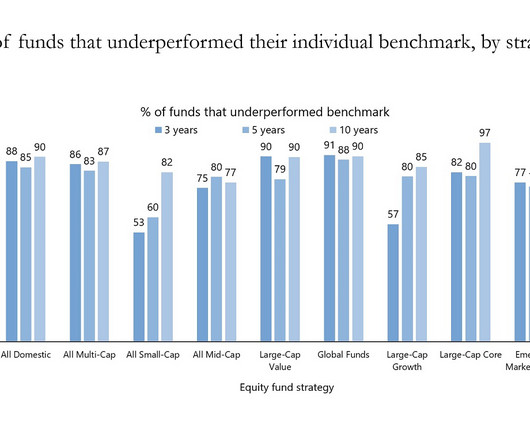

RWM works with clients by constructing a long-term financial plan, marrying it to an appropriate level of risk in a broadly diversified portfolio built around a core index, and then applying the best technology we can find to generate net after-tax returns with modest risk and volatility.

Nerd's Eye View

NOVEMBER 19, 2024

Anjali is the Founder of FIT Advisors, an RIA based in Torrance, California (but works virtually with clients nationwide) and oversees $65 million in assets under management for 45 client households. Read More.

Nerd's Eye View

NOVEMBER 25, 2024

Over the past decade, a growing number of advisors have expanded into offering comprehensive financial planning services, reflecting a shift that not only helps them stand out from (increasingly commoditized) portfolio management offerings but also supports clients' broader financial goals.

Wealth Management

JULY 18, 2025

Resonant Capital Merges with Tax, Accounting Firm QBCo $2.2B In 2023, he launched his own firm, Park Hill Financial Planning and Investment Management. “I Resonant Capital Merges with Tax, Accounting Firm QBCo Brennan’s experience is indicative of many young advisors working in the RIA space. Related: $2.2B

Wealth Management

JULY 8, 2025

The move nearly doubles the number of institutional, no transaction fee (INTF) funds available through Schwab’s platform to approximately 2,000 from 58 asset managers. Related: Morningstar: Fee War Among Asset Managers Plateaus Previously, the program included about 1,200 funds from 25 managers.

Nerd's Eye View

NOVEMBER 4, 2024

This month's edition kicks off with the news that Holistiplan has announced the rollout of a new estate plan document extraction tool to stand alongside its highly popular tax return scanning tool – which highlights how advances in AI technology have allowed tools like Holistiplan to go beyond tax returns and scan nearly any kind of document (..)

Wealth Management

JULY 30, 2025

Anthony Venette , Manager, Valuation Services , Withum July 30, 2025 5 Min Read The passage of recent tax legislation has brought welcome clarity to estate planners and private investors alike. However, due to the inclusion of the direct interest, it may use up more of a partner’s gift/estate tax exemption than desired.

Darrow Wealth Management

MARCH 13, 2025

So if you have a large portion of your wealth tied to a single stock, here are six options to manage it. Morgan Private Bank) 6 ways to manage a concentrated stock position In no particular order, here are some strategies to reduce the risk of concentrated stock holdings. Outright Sales: Selling stock through market or limit orders.

Wealth Management

AUGUST 5, 2025

Brian Marchiel August 5, 2025 4 Min Read Donny DBM/iStock/Getty Images Plus The unified managed account has undergone a quiet but powerful evolution over the past two decades as managed accounts continue their journey to client centricity. Working toward the UMH has become a top goal for many firms.

Wealth Management

JUNE 26, 2025

Mason, who ran Rubicon Wealth Management, a registered investment advisor in Gladwyne, Pa., Attorney’s Office said he failed to report the fraud proceeds on his personal income tax returns, which generated a tax loss of about $3 million. Today’s sentencing shows how seriously the courts take federal tax crimes.”

Nerd's Eye View

JUNE 27, 2025

Which could ultimately lead to a virtuous cycle of attracting more new clients as well as talented advisors who seek to work at growing firms.

Nerd's Eye View

JULY 18, 2025

Also in industry news this week: A recent survey finds that next-generation employees at broker-dealers are looking for improvements in branding and social media promotion from their firms as they look to build their own practices and take the reins from a rapidly graying advisor population RIA M&A volume hit a record in the first half of 2025 (..)

Carson Wealth

FEBRUARY 4, 2025

Understanding Tax Compliance and Risk Management Ultra-high-net-worth individuals face unique tax challenges, including high rates and ever-changing complex tax codes. If managed improperly or inefficiently, tax issues could significantly erode your familys wealth and even lead to legal complications.

Wealth Management

JULY 9, 2025

The list provides a picture of the places with the most growth potential compared to the competition in the wealth management profession. As you might expect, states with higher net worth households, such as New York, Connecticut and Massachusetts, are oversaturated. Click through to see where the biggest opportunities are.

Nerd's Eye View

AUGUST 11, 2025

By contrast, larger teams provide advisors with this leverage, but their additional seats often fail to translate into productivity gains because they introduce two key inefficiencies relating to coordinating across too many members: the "Management Tax" and the "Shared-Clients Tax".

Wealth Management

JULY 2, 2025

As a result, financial advisors should start honing the services Gen X members will likely benefit from the most, including retirement planning, estate and tax planning and mortgage refinancing. trillion annually over the next decade as part of the great wealth transfer, a new report finds. trillion annually.

Wealth Management

AUGUST 13, 2025

Zephyr's Ryan Nauman and Prosperity Capital Advisor's Dave Alison discuss the importance of adopting a holistic approach to wealth management, emphasizing the integration of financial planning, asset management, tax management, protection planning, and legacy planning to provide long-term benefits for clients.

Wealth Management

AUGUST 8, 2025

For Jordan Raniszeski, co-founder and senior managing partner of Carnegie Private Wealth, it meant balancing efficiency with humanity, testing everything from AI meeting assistants to client portals, and building a culture that embraces innovation without becoming tech-dependent. In this role, Ms.

Nerd's Eye View

JANUARY 6, 2025

From there, the latest highlights also feature a number of other interesting advisor technology announcements, including: SEI has acquired LifeYield, which is designed to facilitate tax-efficient management of multiple accounts across an entire household, to bundle into its RIA custodial platform and investment management technology – underscoring (..)

Wealth Management

AUGUST 1, 2025

based wealth management firm with $1.2 The deal includes Family Wealth Tax Advisory, an affiliated tax practice that will be integrated into Mercer’s tax planning services. “We and Lewis Wealth Management, a Denver-based RIA with about $75 million in AUM. Raymond James Practice Mercer Advisors Lands $1.2B

The Big Picture

JULY 23, 2025

Full transcript below. ~~~ About this week’s guest: Joey Fishman is a Senior Advisor at Ritholtz Wealth Management (RWM), where he assists clients with managing their stock, options, and equity compensation. If you thread the needle appropriately or correctly, you avail yourself to long-term capital gains tax treatment.

Nerd's Eye View

JULY 11, 2025

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that, amidst the growing number of RIAs it supervises, the Securities and Exchange Commission (SEC) is moving ahead with a potential plan to raise the $100 million regulatory assets under management threshold for SEC registration, (..)

Wealth Management

JUNE 26, 2025

Former Merrill Lynch advisor Michael Henley reveals how his tax-centric approach and strategic vision helped Brandywine Oak Private Wealth double AUM to $1.5 billion since breaking away in 2018.

Wealth Management

JULY 23, 2025

Explore effective estate planning and charitable giving strategies for financial advisors to navigate complex tax policies and help clients maximize wealth.

Harness Wealth

APRIL 17, 2025

Tax season can be overwhelming, but understanding how to leverage deductions and credits can significantly impact your bottom line. While both mechanisms help reduce what you owe, they operate in fundamentally different ways that affect your final tax bill. And tax law is not static. of your AGI. of your AGI.

Wealth Management

JULY 31, 2025

These options can be integrated alongside ETFs, mutual funds, SMAs and direct indexing within a single tax-managed custodial account. The platform also aligns alternative fund activity with tax-loss harvesting, tax transition and tax-aware rebalancing. They are now broadly available.

Nerd's Eye View

JUNE 23, 2025

These included trust, communication quality, and a general discomfort managing finances alone. Firms can spotlight the concrete financial services they provide – such as tax strategies, retirement planning, or investment management – in clear, client-friendly language.

Harness Wealth

JULY 31, 2025

The IRS updates for 2025 are more than routine adjustments—they mark a turning point for tax professionals navigating an increasingly complex regulatory environment. With major shifts in tax brackets, standard deductions, and digital asset reporting, firms will need to rethink how they serve clients across income levels and asset classes.

Harness Wealth

APRIL 17, 2025

Tax deductions can save you thousands annually by reducing your taxable income through legitimate business expenses. Understanding these deductions is more critical than ever as tax laws evolve, presenting new opportunities for savings. Understanding this distinction is crucial for maximizing your tax benefits effectively.

Harness Wealth

APRIL 4, 2025

This weeks Tax Advisor Weekly covers key updates for financial professionals. We begin with guidance on navigating property tax considerations during business mergers and expansions. In this blog post, well cover key business events that impact property tax and business licenses, along with what you need to consider for each.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content