Wealth Management EDGE Podcast: Retirement, Annuities and Regulation Unveiled

Wealth Management

OCTOBER 5, 2023

Protecting the average retiree in a confusing landscape of investment planning vs. financial planning.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

OCTOBER 5, 2023

Protecting the average retiree in a confusing landscape of investment planning vs. financial planning.

Nerd's Eye View

MAY 2, 2025

a ski chalet), assessing whether it will lead to greater overall wellbeing, or, alternatively, more stress, is more challenging Enjoy the 'light' reading! a ski chalet), assessing whether it will lead to greater overall wellbeing, or, alternatively, more stress, is more challenging Enjoy the 'light' reading!

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Nerd's Eye View

DECEMBER 13, 2024

Also in industry news this week: While the SEC has had the power to restrict mandatory arbitration clauses in RIA client agreements for more than a decade, an advisory committee meeting this week suggests support for such a measure isn't unanimous CFP Board saw a record number of exam-takers during 2024, reflecting recognition of the professional and (..)

Nerd's Eye View

MAY 17, 2024

Also in industry news this week: The SEC this week announced a proposed rule that would require RIAs to collect and verify their clients' personal information in an effort to prevent illicit activity, though many firms likely are taking many of these steps already Why larger RIAs and those that have been acquired tend to have worse client and staff (..)

Abnormal Returns

FEBRUARY 12, 2024

Podcasts Brendan Frazier talks with Sten Morgan, the founder of Legacy Investment Planning, about better communicating with clients. investmentnews.com) Lifetime income Americans need more help managing retirement income. thinkadvisor.com) Five steps to create a paycheck in retirement. thinkadvisor.com)

Nerd's Eye View

NOVEMBER 3, 2023

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that the Department of Labor this week released its long-awaited "retirement security rule", its latest effort to curb conflicts of interest around retirement savings recommendations.

Nerd's Eye View

AUGUST 25, 2023

Also in industry news this week: The SEC settled its first charges related to its new marketing rule with a firm that advertised 2,700% annual returns A survey suggests that older Americans prefer the term "longevity" to "aging", perhaps informing the way advisors discuss related issues with their clients From there, we have several articles on retirement (..)

WiserAdvisor

JUNE 4, 2025

Apart from new laws and changes in regulations, it is also important to pay attention to emerging investment trendsevery year. The financial planning industry is constantly undergoing change. This article will discuss some of the most pivotal financial planning industry trends to watch out for this year.

Dear Mr. Market

DECEMBER 31, 2024

Because when it comes to financial planning, you’re ready to write it downand studies show that writing down your goals makes you 42% more likely to achieve them. Heres your top 10 financial planning checklist for the new year. Maximize Retirement Contributions Contribute as much as possible to your 401(k), IRA, or Roth IRA.

Wealth Management

JUNE 11, 2025

Whether clients support the policies with cash gifts or split-dollar, the discussion of options will necessarily involve a combination of insurance planning, tax planning, income and gift tax-oriented wealth transfer planning and investment planning. Charles L. Ratner Charles L. See more from Charles L.

Nerd's Eye View

JANUARY 13, 2023

From there, we have several articles on retirement planning: The latest rules for 2023 Required Minimum Distributions from inherited retirement accounts. Why relying on Treasury Inflation-Protected Securities (TIPS) to support the bulk of retirement income needs could be risky.

Nerd's Eye View

AUGUST 30, 2024

Nonetheless, given that adding services requires an investment on the part of the firm (often in the form of increased staffing to offer high-touch services and add needed expertise), firms appear to be analyzing the costs and benefits of offering these services in-house versus adding value to clients by referring them to trusted professionals in these (..)

Nerd's Eye View

AUGUST 2, 2024

Enjoy the current installment of “Weekend Reading For Financial Planners” - this week’s edition kicks off with the news that a Federal district court in Texas has put a stay on the effective date of the Department of Labor’s (DoL’s) new Retirement Security Rule (aka “Fiduciary Rule 2.0”),

Yardley Wealth Management

SEPTEMBER 10, 2024

The post Investing for Retirement: Strategies for Long-Term Success appeared first on Yardley Wealth Management, LLC. Investing for Retirement: Strategies for Long-Term Success Introduction Investing for retirement is a journey that demands careful planning, patience, and discipline.

Nerd's Eye View

NOVEMBER 4, 2022

From there, we have several articles on investment planning: While I Bonds have received significant attention during the past year, TIPS could be an attractive alternative for many client situations.

Nerd's Eye View

AUGUST 2, 2024

Enjoy the current installment of “Weekend Reading For Financial Planners” - this week’s edition kicks off with the news that a Federal district court in Texas has put a stay on the effective date of the Department of Labor’s (DoL’s) new Retirement Security Rule (aka “Fiduciary Rule 2.0”),

Nerd's Eye View

DECEMBER 25, 2023

Each week in Weekend Reading For Financial Planners, we seek to bring you synopses and commentaries on 12 articles covering news for financial advisors including topics covering technical planning, practice management, advisor marketing, career development, and more.

Talon Wealth

OCTOBER 26, 2023

Retirement planning can be intimidating, especially if you need help figuring out where to start. Determine When to Start Saving When it comes to saving for retirement, earlier is almost always better. Create a Budget Creating a budget allows you to track your expenses and ensure you’re saving enough for retirement.

Integrity Financial Planning

OCTOBER 9, 2023

When talking about retirement financial planning, we often take investment strategy at face value. But what does an investment strategy really consist of? An investment strategy is utilized to help your wealth not only retain its value against inflation but hopefully grow as well.

Yardley Wealth Management

FEBRUARY 4, 2025

From maximizing deductions to managing capital gains, we’ll cover everything you need to know about smart tax planning. In this comprehensive guide, we’ll explore proven strategies to help you minimize tax liability while staying compliant with current regulations.

WiserAdvisor

AUGUST 31, 2023

Financial advisors play a crucial role in assisting you before your retire. They can assess your financial situation, long-term goals, risk tolerance, and investment preferences to create personalized strategies. Here are 5 benefits of hiring a financial advisor after you retire: 1.

NAIFA Advisor Today

JANUARY 28, 2025

As a Retirement Income Certified Professional and a Life and Annuities Certified Professional, John advises clients on retirement planning, investment planning, and risk management. Zack is also skilled in presenting, emceeing, event planning, program management, and social media.

Tobias Financial

OCTOBER 12, 2023

Additionally, financial habits such as lower contributions to retirement plans and reliance on tangible assets pose unique challenges. According to Catalina, empowering the Latino community financially requires knowledge, advocacy, and strategic planning.

Clever Girl Finance

MARCH 19, 2024

No one cares more about your financial well-being than you, so having a personal financial plan is important. Knowing how to make a financial plan will allow you to save money, afford the things you want, and achieve long-term goals like saving for college and retirement. Table of contents What is a financial plan?

Your Richest Life

APRIL 15, 2024

Do you have a plan in place for your retirement? For many people, the extent of their retirement planning includes signing up for the plan at work – which is often more of a starting point than a comprehensive retirement plan. Some 457 plans can allow for Roth contributions and in-plan rollovers.

eMoney Advisor

FEBRUARY 9, 2023

If you are looking for opportunities to grow your business, expanding your services to clients at all stages of the financial planning lifecycle creates new opportunities for you to reach those households in search of professional advice. People in this stage may have just graduated from college and recently joined the working world.

WiserAdvisor

MAY 29, 2025

Its a great way to invest in strong performers while maintaining balance in your portfolio. Retirement accounts : Opening an Individual Retirement Account (IRA) is one of the smartest long-term moves you can make. IRAs offer tax advantages and encourage consistent, long-term investing.

Darrow Wealth Management

AUGUST 30, 2022

Jump-starting (or catching up on) retirement savings by investing the money in a brokerage account. Developing an asset allocation and investment plan that suits you , which may be different than who left you the inheritance. Inherited IRA or retirement account. Shoring up college funds. What not to do?

oXYGen Financial

MARCH 24, 2024

[CDATA[ When it comes to managing your finances, it's not just about saving and investing wisely. Tax planning is a crucial aspect of personal finance that often gets overlooked and plays a pivotal role in your overall financial health and wealth accumulation.

Advisor Perspectives

JUNE 8, 2024

New data from Goldman Sachs reports that younger generations of investors are using more personal investment plans to prepare for retirement.

Darrow Wealth Management

OCTOBER 28, 2024

Deciding how to allocate and invest the proceeds after the sale of your company is a big decision that requires careful planning. If you are expecting a sudden windfall , develop a plan to allocate the proceeds and reinvest in your future. Are you planning to retire? Create a formal financial plan.

Nationwide Financial

DECEMBER 7, 2022

For people nearing retirement, these challenges can be even more daunting. A market downturn at the start of retirement, hitting portfolio values when retirees begin to take account withdrawals, can be unsettling, even for seasoned investors. Many near-retirees see their highest portfolio values just before retirement.

Million Dollar Round Table (MDRT)

JULY 21, 2022

This is the time to do comprehensive financial planning: retirement planning, investment planning, tax planning and estate planning. Discuss more advanced estate planning, charitable planning and special family issues.

Talon Wealth

AUGUST 26, 2023

We all know retirement is an important milestone that requires careful planning. Of course, one of the most important aspects of retirement planning is managing retirement taxes. Taxes can significantly impact the amount of money you’ll have for retirement. This can be a mistake.

Talon Wealth

OCTOBER 26, 2023

We all know retirement is an important milestone that requires careful planning. Of course, one of the most important aspects of retirement planning is managing retirement taxes. Taxes can significantly impact the amount of money you’ll have for retirement. This can be a mistake.

Carson Wealth

OCTOBER 6, 2022

I have two friends, both in education, who literally threw away their 403(b) enrollment forms because they didn’t understand what the tax-sheltered retirement plan was. 1. Employer match on 401(k) plans. There’s not a lot of mystery surrounding the 401(k) retirement and savings investment plan.

WiserAdvisor

DECEMBER 15, 2023

According to a survey, a significant majority of Americans, approximately 80%, share the common notion that the point of working hard in your adult life is so you can enjoy a nice retirement. After years of dedicated labor and hard work, the prospect of a peaceful retirement appeals to everyone.

WiserAdvisor

AUGUST 26, 2022

Are you good with numbers, accounting, and financial planning? If yes, then DIY financial planning might be a good option for you. On the other hand, if you tend to struggle with budgeting or find financial planning overwhelming, then professional money management could be a better solution. What is DIY financial planning?

Gen Y Planning

JUNE 1, 2022

Bonds also generate income, making them a flexible part of your long-term cash flow plan. While bonds are an essential component of investing, it’s important to note that inflation and bonds typically don’t get along, which isn’t good news for today’s investors. Think about this in conjunction with investing in a 529 Plan.

Yardley Wealth Management

OCTOBER 7, 2020

The post Is COVID-19 affecting your Retirement Planning? Is COVID-19 affecting your Retirement Planning? Retirement Planning Financial Planning Risk. Over their lifetimes, most people have heard warnings and advice from retirement advisors about various aspects of their plans.

Indigo Marketing Agency

JANUARY 17, 2024

You’ve worked hard to build your legacy, and now that you’re approaching retirement, you want a smooth transition for both you and your clients. You’re not alone: a recent Investment Planning Counsel study found that only 11% of financial advisors had a formal plan in place even though they were nearing retirement.

International College of Financial Planning

DECEMBER 29, 2024

In today’s increasingly complex financial landscape, professional financial planning education has become more crucial than ever. The CFP certification stands as the gold standard in financial planning, offering professionals a comprehensive pathway to excellence in this dynamic field.

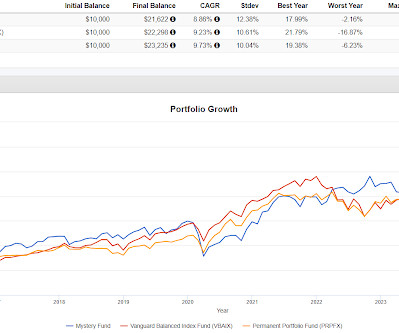

Random Roger's Retirement Planning

FEBRUARY 9, 2025

The point is to understand that a portfolio that is valid for a long term investment plan will have periods where it lags in a frustrating manner. In real life, the Mystery Fund isn't suitable as a one portfolio solution despite being in the ballpark. The result is close but the fund isn't valid for that purpose.

WiserAdvisor

JANUARY 16, 2024

Preparing for retirement is a significant life transition that demands a clear understanding of your financial situation. This data can serve as a baseline for tailoring your retirement plan, taking into account factors such as inflation, your current age, and your desired retirement age.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content