Weekend Reading For Financial Planners (June 14–15)

Nerd's Eye View

JUNE 13, 2025

Other key findings from the survey included a gap between long-term investment return expectations of investors and advisors (12.6%

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Nerd's Eye View

JUNE 13, 2025

Other key findings from the survey included a gap between long-term investment return expectations of investors and advisors (12.6%

Nerd's Eye View

MAY 16, 2025

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that Republicans in the House of Representatives this week released their long-awaited tax plan to address the impending sunset of many measures in the 2017 Tax Cuts and Jobs Act.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Protect What Matters: Rethinking Finance Ops In A Digital World

Your Accounting Expertise Will Only Get You So Far: What Really Matters

Nerd's Eye View

JUNE 27, 2025

Which could ultimately lead to a virtuous cycle of attracting more new clients as well as talented advisors who seek to work at growing firms.

Nerd's Eye View

JANUARY 24, 2025

Nonetheless, given the scale and brand awareness of the wirehouses, and as their own use of fee-based models increases (as opposed to primarily relying on commissions from selling products), competition for clients (and advisors) will likely remain stiff going forward, even amidst the favorable trends for RIAs Also in industry news this week: A recent (..)

Wealth Management

JUNE 11, 2025

Ratner June 11, 2025 2 Min Read A client whose estate will remain non-taxable after 2025 has a policy in an irrevocable life insurance trust (ILIT) that was presumably purchased for estate tax liquidity. I just thought it appropriate to acknowledge the challenge.

Nerd's Eye View

JUNE 12, 2025

Tax planning often fits the 'kind environment' model: The rules are relatively stable, outcomes repeat annually, and feedback is immediate (e.g., a tax bill or refund). Kind environments have clear rules, quick feedback, and consistent patterns, making them easier to navigate and learn from.

Yardley Wealth Management

FEBRUARY 4, 2025

The post Tax Strategies for High-Income Earners 2025 appeared first on Yardley Wealth Management, LLC. Tax Strategies for High-Income Earners in 2025. In this comprehensive guide, we’ll explore proven strategies to help you minimize tax liability while staying compliant with current regulations.

Abnormal Returns

MAY 21, 2023

bilello.blog) Strategy Why so many Americans think their house is the best investment. awealthofcommonsense.com) Every investment plan needs some room for error. nytimes.com) Taxes Tax filing companies are lining up against the IRS offering a free filing option.

WiserAdvisor

JUNE 13, 2025

In this article, we’ll walk through some of the most common investment mistakes retirees make. By spreading your investments across different asset classes like stocks, bonds, real estate, and alternatives, you reduce the impact of any one market struggling. A good estate plan ensures your assets go where you want them to.

Nerd's Eye View

SEPTEMBER 8, 2023

Read More.

Nerd's Eye View

NOVEMBER 4, 2022

From there, we have several articles on investment planning: While I Bonds have received significant attention during the past year, TIPS could be an attractive alternative for many client situations. ” to pass by the end of the year, while passage of other proposed tax measures appears to be less likely.

Dear Mr. Market

DECEMBER 31, 2024

Review Investment Allocations Markets evolve, and so should your portfolio. Remember: investing isnt about timing the market, its about time in the market. Optimize Tax Strategies Its not what you makeits what you keep. For 2025, the IRS has increased contribution limitsdont miss out. Consolidation might be a smart move too.

Nerd's Eye View

DECEMBER 25, 2023

We start with several articles on retirement planning: Data showing where American retirees currently stand, from their average net worth to how they spend each hour of the day How, according to a recent study, delaying Social Security benefits typically leads to greater lifetime wealth than claiming benefits early in order to reduce portfolio withdrawals (..)

Yardley Wealth Management

SEPTEMBER 10, 2024

The post Investing for Retirement: Strategies for Long-Term Success appeared first on Yardley Wealth Management, LLC. Investing for Retirement: Strategies for Long-Term Success Introduction Investing for retirement is a journey that demands careful planning, patience, and discipline. What lifestyle do you envision?

Carson Wealth

OCTOBER 26, 2022

As the tax year draws to a close, many high-income investors will look to reposition their portfolios to intentionally generate losses as a way to offset gains — an investment strategy known as tax loss harvesting. A net neutral tax position. What Is Tax Loss Harvesting? How Tax Loss Harvesting Works.

Brown Advisory

OCTOBER 16, 2017

Investment Planning Options achen Mon, 10/16/2017 - 10:24 The decision to sell or hold a concentrated position may sound simple, but these situations are often more complex than they appear. They require the investor to reconcile investment dynamics, tax considerations and a variety of subjective, emotional factors.

Brown Advisory

OCTOBER 16, 2017

Investment Planning Options. They require the investor to reconcile investment dynamics, tax considerations and a variety of subjective, emotional factors. Similarly, investors should be cautious about a heavy weighting in a single investment. Taxes: What are the tax consequences if the position is sold?

Trade Brains

JUNE 30, 2025

The 20 th century has seen a rise in numerous investment options, among these the gilt mutual funds (MFs) have emerged as one of the most reliable investment plans. Gilt funds primarily invest in government securities, which are issued by the Reserve Bank of India (RBI). Does Gilt MFs fit in your Portfolio?

Nerd's Eye View

JUNE 7, 2024

Also in industry news this week: Backers announced the new Texas Stock Exchange, which seeks to provide companies with a lower-cost alternative to the NYSE and Nasdaq, which, if successful, could create a more competitive landscape and potentially better execution and reduced trading costs for financial advisors and their clients The American College (..)

Yardley Wealth Management

FEBRUARY 15, 2022

The post Part 2: Tax-Wise Investment Techniques appeared first on Yardley Wealth Management, LLC. Part 2: Tax-Wise Investment Techniques In our last piece, we introduced some of the tools of the tax-planning trade. In other words, your tax-planning techniques matter at least as much as the tools.

Yardley Wealth Management

FEBRUARY 15, 2022

The post Part 2: Tax-Wise Investment Techniques appeared first on Yardley Wealth Management, LLC. Part 2: Tax-Wise Investment Techniques. In our last piece, we introduced some of the tools of the tax-planning trade. In other words, your tax-planning techniques matter at least as much as the tools.

Trade Brains

JULY 3, 2025

Mutual funds are one of the most popular ways for people to make investments and generate wealth over time. One of the common questions that arise with persons earning a salary is “How much of my salary should I invest in mutual funds?” You can also invest in ELSS funds in case you also want to save for taxes.

WiserAdvisor

JUNE 4, 2025

Apart from new laws and changes in regulations, it is also important to pay attention to emerging investment trendsevery year. The financial planning industry is constantly undergoing change. For example, a clients investment choices should align closely with their tax strategy, too.

Workable Wealth

APRIL 29, 2020

Taxes play an important role in your financial life. Taxes are actually involved in nearly every financial decision you make, chief among them being investing. Taxes are to investing as textbooks are to education—you can’t have one without the other. But what happens if your investments lose money?

International College of Financial Planning

JULY 2, 2025

Rising incomes, complex tax rules, countless investment options, and growing aspirations have made personal finance decisions more challenging than ever. Here’s the pathway under the current education structure: Investment Planning Specialist – Focuses on asset classes, portfolio strategies, and wealth accumulation.

Good Financial Cents

SEPTEMBER 2, 2022

Most people are well aware that investing is the key to building long-term wealth, yet that doesn’t mean that getting started is easy. In fact, all new investors face a huge learning curve when it comes to figuring out how to invest and where to invest their extra money. So, how do you start investing exactly?

WiserAdvisor

MAY 29, 2025

Consistent habits, disciplined investing, and patience form the bedrock of wealth creation, keeping financial security in mind. A long-term perspective allows you to ride out market volatility, avoid impulsive decisions, and benefit from the natural growth of your investments over time.

Workable Wealth

NOVEMBER 25, 2020

When you actively contribute to your workplace retirement account, invest in a separate portfolio , and funnel money into your savings account, it can be difficult to open – let alone manage – another account. Contributions are pre-tax, investments grow tax-free, and distributions are taxed as ordinary income.

oXYGen Financial

MARCH 24, 2024

[CDATA[ When it comes to managing your finances, it's not just about saving and investing wisely. Tax planning is a crucial aspect of personal finance that often gets overlooked and plays a pivotal role in your overall financial health and wealth accumulation.

Good Financial Cents

AUGUST 11, 2022

I once had a client ask me, “Jeff, if you had a million dollars, how would you invest it?”. The reality is, there are a ton of different strategies I would personally use to invest $1 million dollars, and to help this seed money grow into even more cash over time. Ad Robo-Advisors move with the market to ensure your investments.

Darrow Wealth Management

AUGUST 30, 2022

Inheriting money or taxable investment accounts has some big benefits. This is a major advantage as assets can be sold/diversified right away without tax implications. Jump-starting (or catching up on) retirement savings by investing the money in a brokerage account. Make a plan to reinvest the money in a brokerage account.

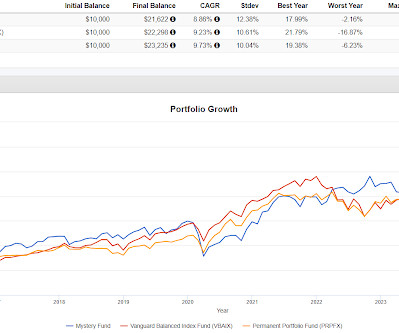

Random Roger's Retirement Planning

FEBRUARY 9, 2025

The point is to understand that a portfolio that is valid for a long term investment plan will have periods where it lags in a frustrating manner. They are not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation.

Darrow Wealth Management

OCTOBER 28, 2024

Deciding how to allocate and invest the proceeds after the sale of your company is a big decision that requires careful planning. If you are expecting a sudden windfall , develop a plan to allocate the proceeds and reinvest in your future. Are you planning to retire? Put the plan into action.

Gen Y Planning

JUNE 1, 2022

Does investing in I-bonds make sense as part of your strategy? Bonds also generate income, making them a flexible part of your long-term cash flow plan. While bonds are an essential component of investing, it’s important to note that inflation and bonds typically don’t get along, which isn’t good news for today’s investors.

Talon Wealth

OCTOBER 26, 2023

Even if you can’t contribute a significant amount each month, any savings will help strengthen your financial future, put you on track for a comfortable retirement, and take advantage of specific tax incentives. Many employers offer matching contributions for 401(k)s and other investment plans.

Brown Advisory

APRIL 13, 2022

Expats: Tax Compliance mhannan Wed, 04/13/2022 - 06:37 We help U.S.-connected assess their current financial situation, understand their long-term goals and objectives, and build a robust and flexible investment plan for the future – all while considering the intricacies (and importantly, the interaction) of the U.S.

Talon Wealth

AUGUST 26, 2023

Of course, one of the most important aspects of retirement planning is managing retirement taxes. Taxes can significantly impact the amount of money you’ll have for retirement. As such, you must be aware of any tax implications arising from your investments during your working years.

Talon Wealth

OCTOBER 26, 2023

Of course, one of the most important aspects of retirement planning is managing retirement taxes. Taxes can significantly impact the amount of money you’ll have for retirement. As such, you must be aware of any tax implications arising from your investments during your working years.

Truemind Capital

FEBRUARY 2, 2021

HR is asking to submit investment proofs by the end of the month. This reminded him of the last time when he didn’t submit any investment proof, a significant portion of his salary was deducted in lieu of taxes. He asked his colleagues what they are doing for saving taxes. Rohit took a sigh of relief.

WiserAdvisor

MARCH 30, 2023

With the several investment strategies available to us, choosing one that suits your unique investment objectives can be confusing. A goal-based investing approach is one such strategy. Consider consulting with a professional financial advisor who can help you understand whether a goal-based investing approach is right for you.

Nationwide Financial

OCTOBER 18, 2022

Talking to your clients about their children or grandchildren’s college plans as well as their own financial goals can help when deciding what type of 529 plan in which to invest. Plans also vary by state, so location will come into play when choosing between plans. 529 Education Savings Plan.

Million Dollar Round Table (MDRT)

JULY 21, 2022

Help her focus on immediate needs, pay bills, monitor cash flow and review her investment portfolio. This is the time to do comprehensive financial planning: retirement planning, investment planning, tax planning and estate planning.

International College of Financial Planning

MARCH 13, 2023

Mutual funds have become a popular investment for individuals looking to grow their wealth and achieve their financial goals. Benefits of Investing in Mutual Funds in India Diversification: Investing in mutual funds offers diversification, reducing risk.

International College of Financial Planning

JULY 31, 2023

Investing is essential to achieving our financial goals, whether saving for retirement, funding our children’s education, or building wealth for the future. However, eliminating the complex world of investments can be challenging, and many individuals fall prey to common investment mistakes that can hinder their financial success.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content