Considering Medicare Costs in Retirement Planning: What Financial Professionals Need to Know

NAIFA Advisor Today

JUNE 13, 2025

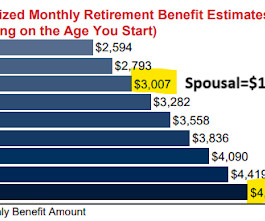

For many Americans, reaching Medicare eligibility marks a noticeable decrease in healthcare spending. For financial advisors helping clients prepare for retirement, understanding and planning for the costs associated with Medicare is critical. Of course, that doesn’t mean that Medicare is free.

Let's personalize your content