Weekend Reading For Financial Planners (November 30–December 1)

Nerd's Eye View

NOVEMBER 29, 2024

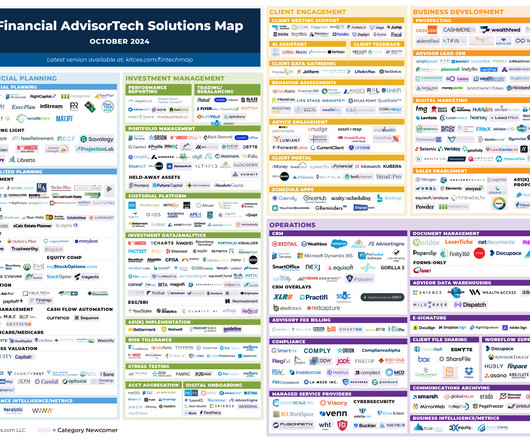

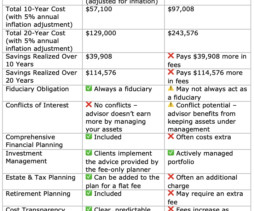

Which could prove to be a boon for the financial advice industry as more consumers are willing to entrust their assets to an advisor (while at the same time possibly making it tougher for some advisors to differentiate themselves primarily by how they put their clients' interests first?).

Let's personalize your content