You’re not good at this.

The Reformed Broker

SEPTEMBER 23, 2022

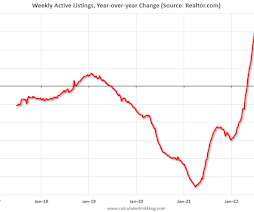

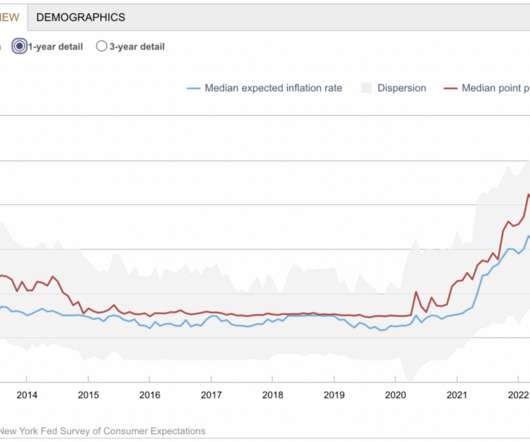

A recession so contrived and man-made that every economist, politician, business owner, college student, CEO, rapper and professional athlete has been able to see it coming in real-time for months and months… Take a picture, you may never see anything so obviously about to happen ever again. A child could have foreseen it. At a certain point, a person who is charge of price stability should probably look in the mirr.

Let's personalize your content