User Agreements: The Hidden Risks in Third-Party Integrations

Wealth Management

AUGUST 30, 2024

Advisors need to be diligent when it comes to their third-party technology and terms of service.

Wealth Management

AUGUST 30, 2024

Advisors need to be diligent when it comes to their third-party technology and terms of service.

Abnormal Returns

AUGUST 25, 2024

Top clicks this week 15 sure-fire ways to lose money in the markets. (awealthofcommonsense.com) Successful investors have a long time horizon. (awealthofcommonsense.com) Stop paying attention to stuff that doesn't matter. (behaviouralinvestment.com) What do you get when you buy a share of Berkshire Hathaway ($BRK.B)? (sherwood.news) It's not your imagination, market moves are getting faster.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Nerd's Eye View

AUGUST 28, 2024

Historically, advisors haven't had many avenues to manage clients' 401(k) plan accounts, since unlike traditional custodial investment accounts, advisors generally lack discretionary trading authority in employer-sponsored retirement plans. Which wasn't necessarily a big issue back when most clients hired advisors after they had already retired and were able to roll over their employer plans into an IRA managed by the advisor; but as advisors have increasingly taken on working-age clients (and t

Calculated Risk

AUGUST 27, 2024

CR Note: On vacation. I will return on Thursday, Sept 5th (If I don't get lost!) In December 2006, my friend Doris "Tanta" Dungey started writing for Calculated Risk. From December 2006, until she passed away from ovarian cancer on Nov 30, 2008, Tanta was my co-blogger. Tanta worked as a mortgage banker for 20 years, and we started chatting in early 2005 about the housing bubble and the changes in lending practices.

Advertisement

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

Wealth Management

AUGUST 30, 2024

Advisory firms grew 5.7% last year, according to a new study by The Ensemble Practice. It’s a wakeup call for firms to make marketing a vital function.

Abnormal Returns

AUGUST 28, 2024

Podcasts Peter Lazaroff on why you don't have to pick stocks to be successful. (peterlazaroff.com) Barry Ritholtz talks with Prof. Aswath Damodaran about the lifecycle of companies. (ritholtz.com) Khe Hy talks with Rachel Feintzeig about the ins and outs of taking a sabbatical. (youtube.com) Retirement How to plan for retirement. (humbledollar.com) The case against downsizing in retirement.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Calculated Risk

AUGUST 24, 2024

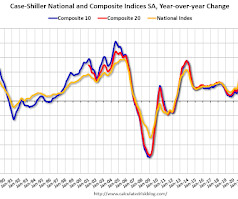

I'll be out of contact from August 20th until Sept 4th. I'll be back for the August employment report. The key indicators this week include the second estimate of Q2 GDP, Personal Income and Outlays for July, and Case-Shiller house prices for June. -- Monday, August 26th -- 8:30 AM ET: Chicago Fed National Activity Index for July. This is a composite index of other data. 8:30 AM: Durable Goods Orders for July from the Census Bureau. 10:30 AM: Dallas Fed Survey of Manufacturing Activity for Augus

Wealth Management

AUGUST 27, 2024

Once the deal closes later this year, the combined RIA will have $32 billion in assets under management.

Abnormal Returns

AUGUST 26, 2024

Strategy Why pessimism sells on Wall Street. (optimisticallie.com) You can't just lock in money market rates. (obliviousinvestor.com) Finance Building a better global market index. (ft.com) The big index fund managers have a problem on their hands. (humbledollar.com) Ukraine How Ukraine successfully invaded Kursk. (ig.ft.com) How Ukraine defeated Russia in the Black Sea.

Nerd's Eye View

AUGUST 30, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that a recent benchmarking study suggests that a number of RIAs are looking to move 'upmarket' and work with wealthier clients by expanding their service menu to include family office services, investment banking, and/or trust services.

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

The Big Picture

AUGUST 28, 2024

Why Fees Really Matter with Eric Balchunas , Bloomberg Intelligence (Nov 8, 2023) Fees matter more than you think. Over the long term, the difference between a few basis points can turn into real, big money. On this episode, Bloomberg Intelligence ETF analyst Eric Balchunas joins us to discuss how fees can significantly impact your portfolio. ~~~ About this week’s guest: Eric Balchunas is been an ETF Analyst for Bloomberg Intelligence.

Wealth Management

AUGUST 28, 2024

After more than 20 years in the wealthtech business, Orion's president of advisor technology says he's taking a break from the industry. He’ll stay on as an advisor to Orion’s CEO for the rest of this year.

Abnormal Returns

AUGUST 25, 2024

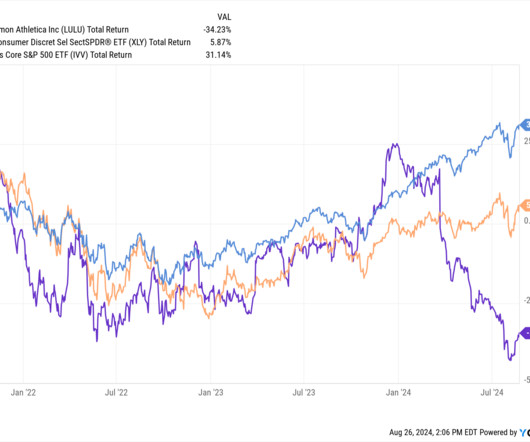

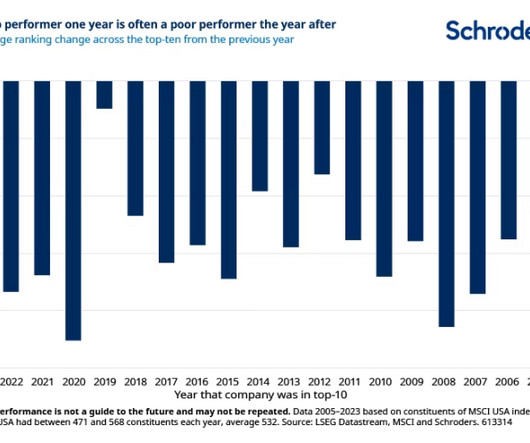

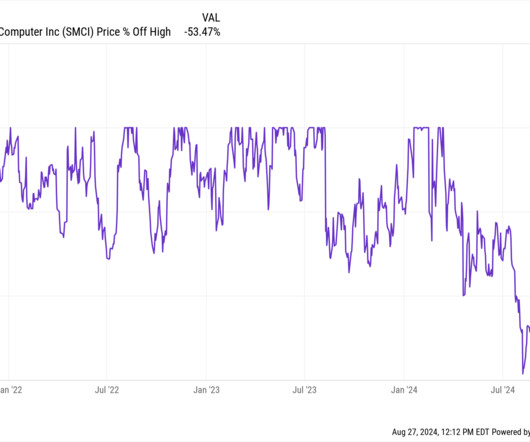

Strategy Another star manager, another disaster for investors. (awealthofcommonsense.com) Just because something is an index fund doesn't mean its a good investment. (wsj.com) Most market arguments are because of differing time frames. (tker.co) Why you likely don't need to focus on dividend paying stocks. (humbledollar.com) Companies Complexity is killing Starbucks ($SBUX).

Nerd's Eye View

AUGUST 26, 2024

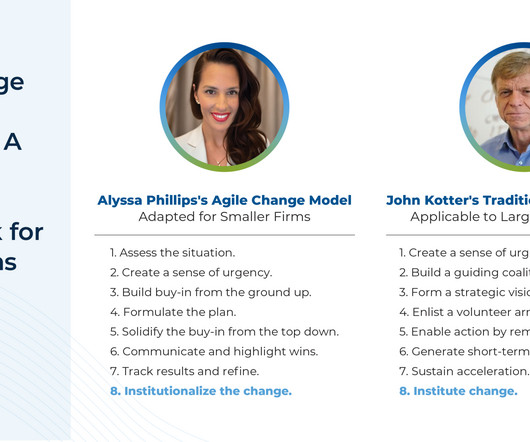

For most of its history, the financial advice industry has been very slow to change. Over the last 50 years, even the most substantial changes to occur – such as the movement away from commissions and towards fee-based compensation, and the shift from an investment-centric approach to more holistic financial planning – have taken place over decades and, in many cases, are still ongoing.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

The Big Picture

AUGUST 24, 2024

The weekend is here! Pour yourself a mug of coffee, grab a seat outside, and get ready for our longer-form weekend reads: • How Costco Hacked the American Shopping Psyche : More than 100 million people visit the retailer for their groceries — and gas and TVs and gold bars and pet coffins — but saving money may not be the only motive. ( New York Times ) • Politics and your portfolio: How the election could impact your money : Politics don’t matter for your portfolio if you’re one of many people

Wealth Management

AUGUST 27, 2024

The recent outperformance in low-volatility ETFs marks a reversal of factor performance trends.

Abnormal Returns

AUGUST 27, 2024

Quant stuff Just how much financial analysis can AI already do? (sparklinecapital.com) A look at three different backtesting methodologies. (papers.ssrn.com) Index funds On the performance of stocks kicked out of major indices. (researchaffiliates.com) Why do index funds change benchmarks? (morningstar.com) Private equity A look at the dispersion in private fund returns.

A Wealth of Common Sense

AUGUST 27, 2024

The firehose of information we’re afforded these days is a double-edged sword. There is an abundance of news, analysis, charts and opinions but it can all be overwhelming if you don’t have an effective filter in place. When it comes to finance I have some filters to help understand which types of sources and people to safely ignore. These are the types of financial voices and data I immediately ignore: Pricing.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Nationwide Financial

AUGUST 28, 2024

Amid the market volatility that dominated headlines in the financial press, many investors may have missed some good news for the ongoing bull market for stocks—the continued strength and resilience of company earnings. With some of the volatility calming down more recently, it’s a good time to review several key themes that emerged during the Q2 earnings season.

Wealth Management

AUGUST 30, 2024

After a sluggish first six months of 2023, publicly-traded REIT total returns are up more than 10% in the third quarter and by double-digits year-to-date.

Abnormal Returns

AUGUST 28, 2024

Markets The Fed's balance sheet continues to shrink. (sherwood.news) Money is flowing into the iShares 20+ Year Treasury Bond ETF ($TLT). (ft.com) The rise of Nvidia ($NVDA) is simply unprecedented. (sherwood.news) Companies Is any media companies actually investable? (hollywoodreporter.com) Will Japanese customers abide a takeover of 7-Eleven? (washingtonpost.com) Lego is still crushing it.

A Wealth of Common Sense

AUGUST 25, 2024

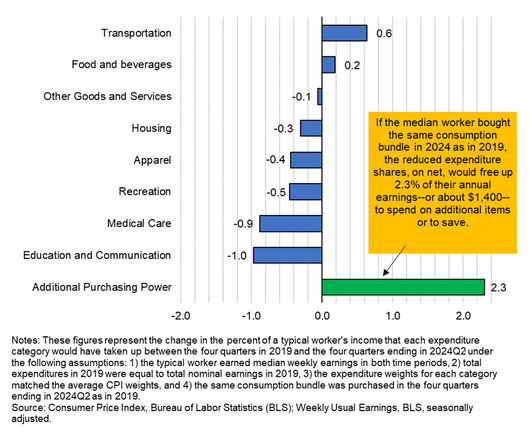

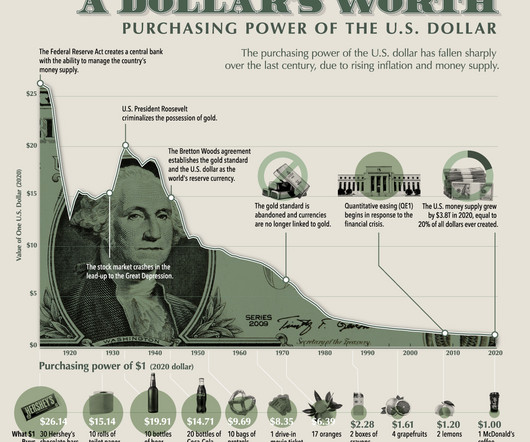

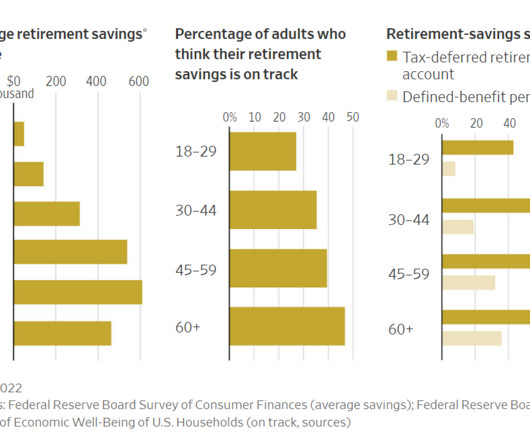

Household net worth is at all-time highs. Housing prices are at all-time highs. The stock market is near all-time highs. But not everyone is feeling great about their finances. Here’s a look at average retirement balances by age along with the share of each cohort who feels like they’re on the right track for retirement: The good news is confidence tends to increase as you age.

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

Nerd's Eye View

AUGUST 27, 2024

Welcome everyone! Welcome to the 400th episode of the Financial Advisor Success Podcast ! My guest on today's podcast is Mark Tibergien. Mark is the former CEO of Pershing Advisor Solutions, a former Principal with Moss Adams Consulting, and is a longtime practice management consultant and thought leader in the financial advisory industry. What's unique about Mark, though, is how, over the course of a 50-year career in financial services, he has seen firsthand the evolution of the financial advi

Wealth Management

AUGUST 26, 2024

And why it's so hard to create one.

Abnormal Returns

AUGUST 26, 2024

Podcasts Jill Schlesinger talks with Blair duQuesnay of RWM about her path as a financial adviser. (youtube.com) Michael Kitces talks with Kelli Kiemle, Managing Director of Growth and Client Experience of Halbert Hargrove, about maintaining culture across a remote firm. (kitces.com) Matt Zeigler talks with Eben Burr of Toews Asset Management about his unique path through the industry.

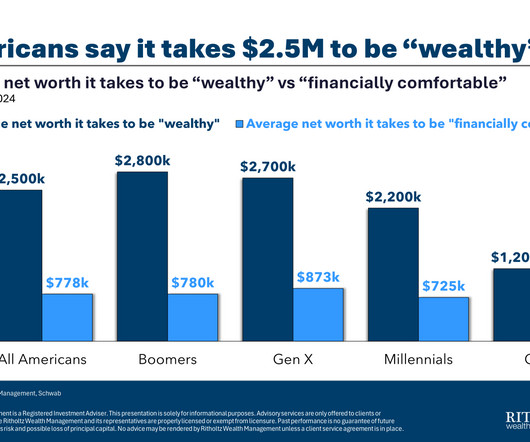

A Wealth of Common Sense

AUGUST 30, 2024

Finance definitions are tough to pin down because money is often in the eye of the beholder. The goalposts are always moving as you age and mature, and tastes change. Your perception of wealth can be impacted by: How you were raised. The wealth and material possessions of your peers. Your lifestyle. Your contentment with what you have. How your circumstances change over time.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Advisor Perspectives

AUGUST 26, 2024

As tough as financial advisors claim to be, we still get nervous about “firing” clients, too. When we say “graduate,” that is our delicate way of handling an uncomfortable situation. It’s a cheap, but effective way to massage the misgivings that we have about terminating client relationships.

Wealth Management

AUGUST 27, 2024

What can make or break a successful transition?

Abnormal Returns

AUGUST 27, 2024

Commodities Farmers are facing a bumper crop for soybeans and corn. (wsj.com) Gasoline prices are at six-month lows. (advisorperspectives.com) Strategy You're not a billionaire. Stop trying to invest like one. (axios.com) What tennis can teach us about success in investing. (carsongroup.com) Companies Snowflake ($SNOW) issues employees A LOT of stock.

A Wealth of Common Sense

AUGUST 29, 2024

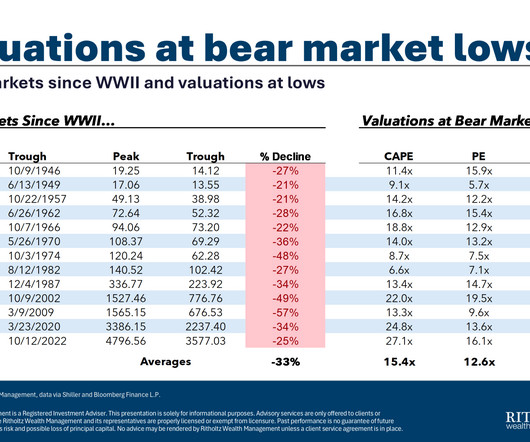

A reader asks: My asset allocation has been pretty conservative since the market run-up in 2020. My basic thesis is that the market is overvalued, and the only way I can keep myself in equities at all is to have a 60/40 stock/bond allocation. One thing I like about having the 60/40 split is that it gives me the option of changing to a more aggressive allocation if stock valuations fall.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Let's personalize your content