Private Credit Giants Are Butting Heads Over a Hot New Asset Class

Wealth Management

NOVEMBER 6, 2023

PE-style “whitelists” hamper efforts to expand the secondary market for fund stakes, as regulators raise liquidity concerns about private capital.

Wealth Management

NOVEMBER 6, 2023

PE-style “whitelists” hamper efforts to expand the secondary market for fund stakes, as regulators raise liquidity concerns about private capital.

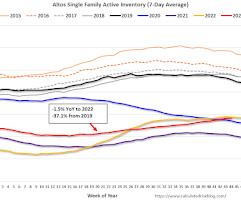

Calculated Risk

NOVEMBER 6, 2023

Altos reports that active single-family inventory was up 0.8% week-over-week. This is the latest in the year that inventory was still increasing! Click on graph for larger image. This inventory graph is courtesy of Altos Research. As of November 3rd, inventory was at 567 thousand (7-day average), compared to 563 thousand the prior week. Year-to-date, inventory is up 15.5%.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

The Big Picture

NOVEMBER 6, 2023

Source: Chartr We talked about this 2 weeks ago , but the nation missed a fantastic opportunity to refinance all of the outstanding US debt at much lower levels. Every corporate debt issuer and homeowner in America refinanced at lower rates — except for Uncle Sam. If you were in Congress from 2015-2021, you are the reason why HALF of the projected federal debt will soon be interest payments.

Abnormal Returns

NOVEMBER 5, 2023

Top clicks this week Six lessons from William Bernstein's "The Four Pillars of Investing." (humbledollar.com) Be wary shifting too much of your money into bonds. (humbledollar.com) There's nothing magic about asset allocation. (obliviousinvestor.com) Money market returns look good.almost too good. (wsj.com) Traders are buying the dip in the iShares 20+ Year Treasury Bond ETF ($TLT).

Advertisement

The office of the CFO is rapidly evolving, with more and more demands being placed upon the finance and accounting team each year. Join us in this webinar, where we share 8 things to NOT do when it comes to helping the CFO office advance in supporting the business. Learning Objectives: This course objective is to understand how best to support an organization's finance leadership.

Wealth Management

NOVEMBER 9, 2023

New York-based Arch, which aims to solve for the workflow and data problems behind alternative investments, has received funding from Focus Financial Partners, the founders of Vanilla and Altruist, and others.

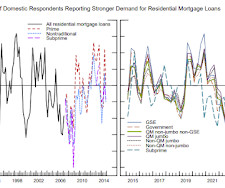

Calculated Risk

NOVEMBER 6, 2023

From the Federal Reserve: The October 2023 Senior Loan Officer Opinion Survey on Bank Lending Practices The October 2023 Senior Loan Officer Opinion Survey on Bank Lending Practices (SLOOS) addressed changes in the standards and terms on, and demand for, bank loans to businesses and households over the past three months, which generally correspond to the third quarter of 2023.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Abnormal Returns

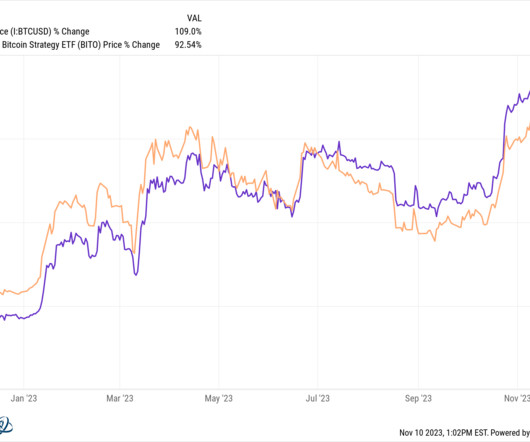

NOVEMBER 10, 2023

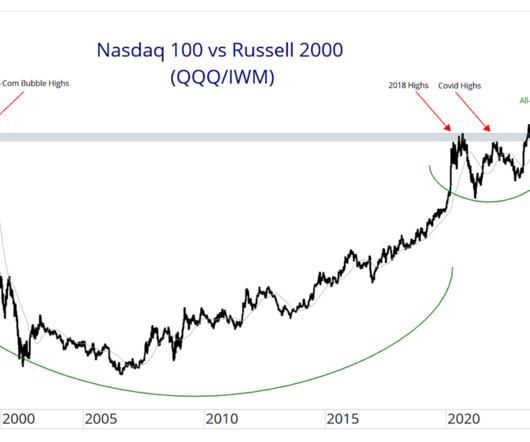

Strategy The 40 of the 60/40 portfolio is finally earning people something. (awealthofcommonsense.com) There's still no sign of a turn in the trend favoring U.S. vs. international equities. (allstarcharts.com) The case for bonds. (blogs.cfainstitute.org) Energy Solar panel manufacturing is finally on the rise in the U.S. (nytimes.com) Why the cancellation of the NuScale, small modular reactor, project is such a bummer.

Wealth Management

NOVEMBER 8, 2023

For the second straight month, sponsors launched dozens of new ETFs. That included eight bond ETFs, one commodoties ETF, 45 equities-based ETFs, 12 target date/multi-asset ETFs and four others.

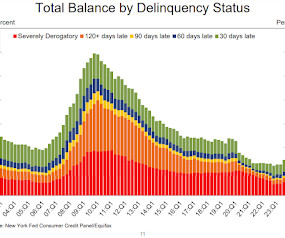

Calculated Risk

NOVEMBER 7, 2023

From the NY Fed: Household Debt Rises to $17.29 Trillion Led by Mortgage, Credit Card, and Student Loan Balances The Federal Reserve Bank of New York's Center for Microeconomic Data today issued its Quarterly Report on Household Debt and Credit. The Report shows total household debt increased by $228 billion (1.3%) in the third quarter of 2023, to $17.29 trillion.

Nerd's Eye View

NOVEMBER 7, 2023

Welcome back to the 358th episode of the Financial Advisor Success Podcast ! My guest on today's podcast is Veronica Karas. Veronica is a Senior Financial Advisor at CAPTRUST and works from the RIA's Lake Success, New York, office, where she oversees $360 million in assets under management for about 200 client households. What's unique about Veronica, though, is the unique 3-question approach she uses to generate referrals not only from clients, but also from centers of influence as well, and ev

Speaker: Dylan Secrest, Founder of Alamo Innovation and Construction Digital Transformation Consultant

Construction payment workflows are notoriously complex when you consider juggling multiple stakeholders, compliance requirements, and evolving project scopes. Delays in approvals or misaligned data between budgets, lien waivers, and pay applications can grind progress to a halt. The good news? It doesn't have to be this way! Join expert Dylan Secrest to discover how leading contractors are turning payment chaos into clarity using digital workflows, integrated systems, and automation strategies.

Abnormal Returns

NOVEMBER 8, 2023

Markets The stock market usually goes up. (tker.co) Like it or not, technology stocks are leading. (allstarcharts.com) Technology How does the technology industry not get bigger? (notboring.co) OpenAI is laying out a path forward for a sustainable business. (stratechery.com) Meta ($META) has a path forward for WhatsApp profitability. (nytimes.com) Amazon ($AMZN) is going wide with offers for One Medical membership.

Wealth Management

NOVEMBER 6, 2023

The CEO of Banrion Capital Management discusses the importance of alternative investments in portfolio planning.

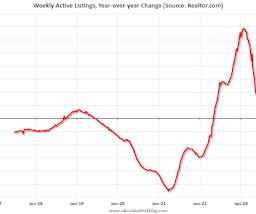

Calculated Risk

NOVEMBER 9, 2023

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report: Weekly Housing Trends View — Data Week Ending Nov 4, 2023 • Active inventory declined slightly, with for-sale homes lagging behind year ago levels by 0.2%. For 20 straight weeks, the number of homes available for sale has registered below that of the previous year, though by just a small margin this week. • N ew listings–a measure of sellers putting homes up for sale–were up this week, by 0.6% from

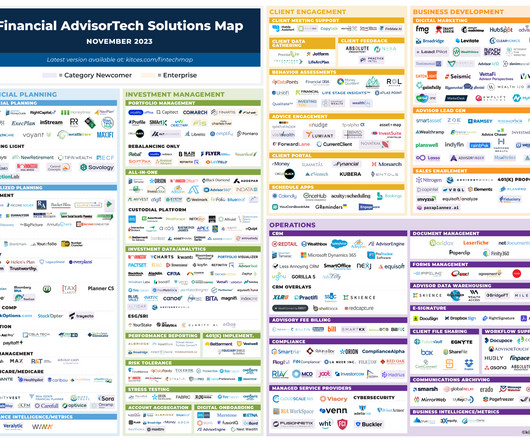

Nerd's Eye View

NOVEMBER 6, 2023

Welcome to the November 2023 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors! This month's edition kicks off with the news that Practice Intel has launched a new "growth platform" centered around quantifying the quality of an advisor's client relationships with an all-in "Relationship Quality Index" (RQI) – which while

Speaker: Victor C. Barnes, CPA, MBA

In the climb from contributor to leader, the rules quietly change. If you’re aiming for the summit, the air gets thinner—and what got you here won’t be enough to get you to the top (a concept first popularized by Marshall Goldsmith in his book What Got You Here Won’t Get You There ). What made you successful early in your finance career—technical accuracy, sharp analysis, flawless execution—won’t be what carries you to the next level.

Abnormal Returns

NOVEMBER 6, 2023

Markets A five-step framework for reading market news. (tker.co) By these measures, small cap stocks are cheap. (morningstar.com) What happens historically after a Zweig Breadth Thrust? (quantifiableedges.com) Strategy Failure is inevitable when it comes to investing. (mrzepczynski.blogspot.com) Five benefits of higher rates on cash, including no drag on holding an emergency fund.

Wealth Management

NOVEMBER 10, 2023

What if a client burdened with substantial debts or liabilities from their business unexpectedly passes away?

Calculated Risk

NOVEMBER 9, 2023

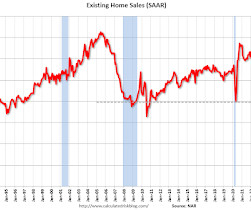

Today, in the Calculated Risk Real Estate Newsletter: Part 1: Current State of the Housing Market; Overview for mid-November A brief excerpt: The NAR reported sales were at a “seasonally adjusted annual rate of 3.96 million in September. Year-over-year, sales dropped 15.4% (down from 4.68 million in September 2022).” This was in line with the local markets I tracked for September.

The Reformed Broker

NOVEMBER 10, 2023

OK, we’re trying something new next week for registered financial advisors only. It’s a brand new show we’ve created and you can be there virtually to watch the pilot episode live. As an advisor, you’re going to spend time, money and energy implementing new technology and asset management solutions into your practice. You may as well get good at it.

Speaker: Kim Beynon, CPA, CGMA, PMP

The most overlooked, yet most critical, element of transformation is preparing people for change. Automation and AI aren't just technical upgrades, they’re cultural shifts which can challenge identities. That’s why change management isn’t a side project—it’s the foundation. In finance, where precision and process rule, navigating change can feel especially disruptive.

Abnormal Returns

NOVEMBER 5, 2023

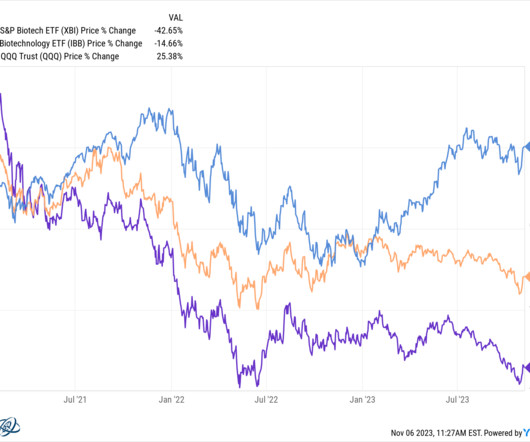

Markets Small and mid-cap stocks have badly lagged large caps. (awealthofcommonsense.com) This week was a good example why you should never be positioned for extremes. (theirrelevantinvestor.com) Why you should avoid big investment shifts. (humbledollar.com) Trading Brett Steenbarger, "The best traders evolve." (traderfeed.blogspot.com) Why cycles of speculation keep happening.

Wealth Management

NOVEMBER 7, 2023

FMG Suite, Bento Engine, Asset-Map, Holistiplan and FP Alpha were among the companies highlighting new developments during the virtual conference.

Calculated Risk

NOVEMBER 8, 2023

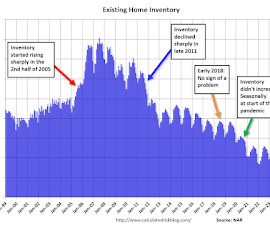

Today, in the Calculated Risk Real Estate Newsletter: Inventory will Tell the Tale A brief excerpt: Two years ago, in November 2021, I wrote Inventory will Tell the Tale and recounted how changes in housing inventory had helped me forecast the housing market at several key points. Here is an update to that post with a few additional comments. Starting in January 2005, I was very bearish on housing , but I wasn’t sure when the market would turn.

The Reformed Broker

NOVEMBER 8, 2023

On this special episode of TCAF Tuesday, Michael Batnick, Barry Ritholtz, and Downtown Josh Brown are joined by Campbell Harvey to discuss: the state of the economy, the yield curve indicator, the next recession, and much more! You can listen to the whole thing below, or find it wherever you like to listen to your favorite pods! Listen here: Apple podcasts Spotify podcasts Google podcasts Everywhere else!

Advertisement

You wouldn’t keep using a 2009 flip phone - so why settle for outdated close processes? It’s time for an upgrade. SkyStem's Guide to Month-End Close Software walks you through what today’s best tools can do (and what your team shouldn’t have to deal with anymore). Get smart, fast, and a whole lot less stressed when it’s time to close the books.

Abnormal Returns

NOVEMBER 6, 2023

Podcasts Brendan Frazier on how your clients change will inevitably over time. (wiredplanning.com) Michael Kitces talks with Jon Henderson who is the Founder and CIO for Echo45 Advisors about building a tech stack for a breakaway advisory firm. (kitces.com) Dan Haylett talks with Phil Pearlman about the relationship between health and wealth. (humansvsretirement.com) Custodians Charles Schwab ($SCHW) is laying off staff post-TDA closing.

Wealth Management

NOVEMBER 9, 2023

Industry sources say Focus Financial Partners' new private equity owner plans to merge the sprawling ecosystem of firms into a small number of its existing entities.

Calculated Risk

NOVEMBER 10, 2023

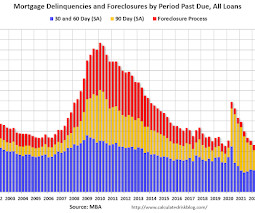

From the MBA: Mortgage Delinquencies Increase in the Third Quarter of 2023 The delinquency rate for mortgage loans on one-to-four-unit residential properties increased to a seasonally adjusted rate of 3.62 percent of all loans outstanding at the end of the third quarter of 2023 , according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey.

The Reformed Broker

NOVEMBER 10, 2023

On episode 117 of The Compound and Friends, Michael Batnick and Downtown Josh Brown are joined by Callie Cox and Malcolm Ethridge to discuss: market sentiment, Robinhood earnings, Warren Buffett and his cash, interest rates, the yield curve, recession calls, weight loss drugs, and much more! You can listen to the whole thing below, or find it wherever you like to listen to your favorite pods!

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Abnormal Returns

NOVEMBER 8, 2023

Podcasts Christine Benz and Jeff Ptak talk with JL Collins author of "Pathfinders: Extraordinary Stories of People Like You on the Quest for Financial Independence." (morningstar.com) Peter Lazaroff talks with William Bernstein author of "The Four Pillars of Investing." (peterlazaroff.com) Robin Powell talks with Moira O'Neill about teach children about money.

Wealth Management

NOVEMBER 7, 2023

They see a $10 trillion opportunity in the next decade, but obstacles remain to widespread use of private investments.

Calculated Risk

NOVEMBER 7, 2023

From Manheim Consulting today: Wholesale Used-Vehicle Prices Decrease in October Wholesale used-vehicle prices (on a mix, mileage, and seasonally adjusted basis) decreased 2.3% in October from September. The Manheim Used Vehicle Value Index (MUVVI) dropped to 209.4, down 4.0% from a year ago. “October revealed some not-so-spooky price moves, namely a reversal of the gains that were seen during the prior two months,” said Chris Frey, senior manager of Economic and Industry Insights for Cox Automo

The Reformed Broker

NOVEMBER 5, 2023

And if you haven’t subscribed yet, don’t wait. Check it out below or wherever fine podcasts are played. These are the most read posts on the site this week, in case you missed it: . The post This Week on TRB appeared first on The Reformed Broker.

Speaker: Cheryl J. Muldrew-McMurtry

Remote finance teams are rewriting how the back-office runs—and attackers are taking notes. Disconnected workflows, process blind spots, and rising cyber threats have become more than just “growing pains”. They’re now liabilities. The challenge isn’t just team distribution, but building resilient systems that protect accuracy, control, and speed across every transaction and touchpoint.

Let's personalize your content