The Importance of Delegating Financial Decisions to a Professional

Yardley Wealth Management

SEPTEMBER 24, 2024

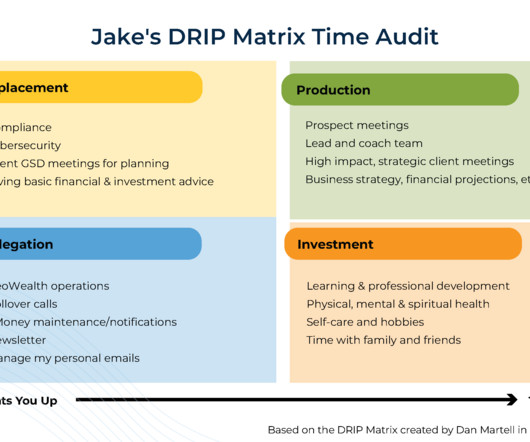

The post The Importance of Delegating Financial Decisions to a Professional appeared first on Yardley Wealth Management, LLC. The Importance of Delegating Financial Decisions to a Professional Introduction: Managing your finances effectively is essential for achieving your long-term goals and securing your financial future. However, as life gets busier and financial matters become increasingly complex, it can be challenging to stay on top of everything.

Let's personalize your content