What’s The Catalyst?

The Irrelevant Investor

APRIL 30, 2020

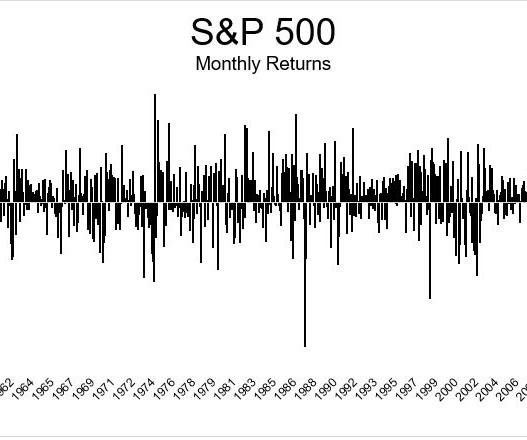

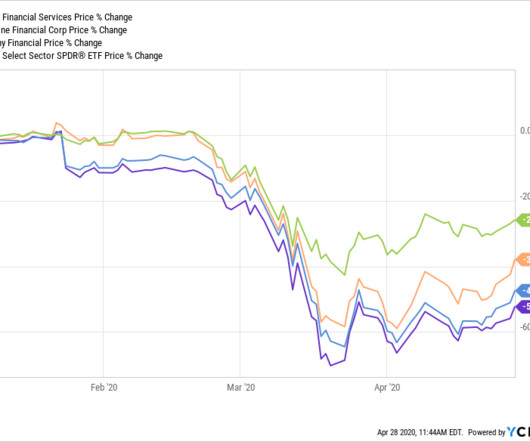

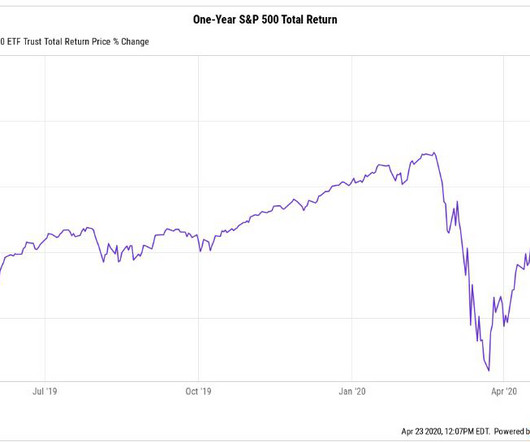

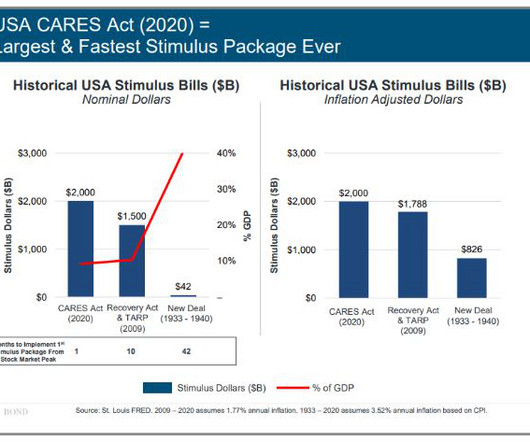

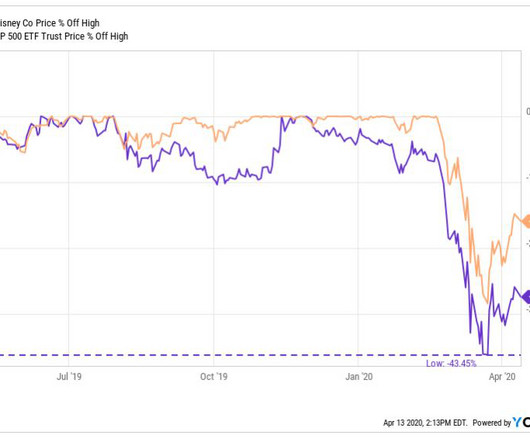

The stock market is wrapping up its best month in over 30 years. What was the catalyst? In the five weeks from February 20th through March 19th, there were 1.1 million jobless claims, and the stock market fell 29%. In the five weeks since there were 26.5 million jobless claims and the market rallied 28%. What's amazing about this is not just that the market rallied, it's how it rallied.

Let's personalize your content