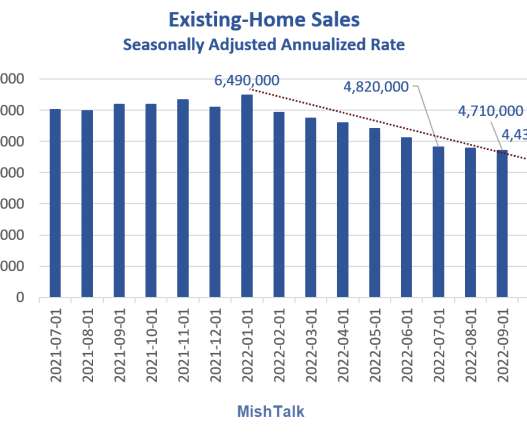

Housing December 19th Weekly Update: Inventory Decreased 2.5% Week-over-week

Calculated Risk

DECEMBER 19, 2022

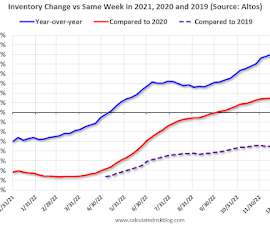

Active inventory decreased last week. Here are the same week inventory changes for the last four years ( usually inventory declines seasonally through the Winter ): 2022: -13.5K 2021: -13.1K 2020: -14.4K 2019: -18.1K Altos reports inventory is down 2.5% week-over-week and down 9.6% from the peak on October 28th. Click on graph for larger image. This inventory graph is courtesy of Altos Research.

Let's personalize your content