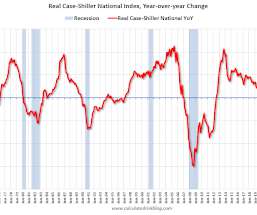

CoreLogic: House Prices up 13.5% YoY in August; Declined 0.7% MoM in August

Calculated Risk

OCTOBER 4, 2022

Notes: This CoreLogic House Price Index report is for August. The recent Case-Shiller index release was for July. The CoreLogic HPI is a three-month weighted average and is not seasonally adjusted (NSA). From CoreLogic: Annual US Home Price Gains Lose Steam Again in August, CoreLogic Reports CoreLogic®. today released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for August 2022.

Let's personalize your content