The IRS' Proposed Regulations on Digital Asset Taxation Explained

Wealth Management

AUGUST 29, 2023

The proposals aim to align tax reporting on digital assets with that of other financial assets.

Wealth Management

AUGUST 29, 2023

The proposals aim to align tax reporting on digital assets with that of other financial assets.

Abnormal Returns

AUGUST 29, 2023

Strategy How (and where) to hold cash in your portfolio. (morningstar.com) For alternatives, Is illiquidity a feature or a bug? (savantwealth.com) Don't underestimate how weird the world can be. (mr-stingy.com) Crypto Grayscale won a victory against the SEC raising the prospects of a spot Bitcoin ETF. (blockworks.co) The entire crypto space jumped on the news.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

AUGUST 29, 2023

A look at seven of the most notable private equity deals in the RIA space.

Nerd's Eye View

AUGUST 29, 2023

Welcome back to the 348th episode of the Financial Advisor Success Podcast ! My guest on today's podcast is Jeff Jones. Jeff is the Owner and Founder of Cypress Financial Planning, an independent RIA based in Haddon Heights, New Jersey, that oversees $275 million in assets under management for 380 client households. What's unique about Jeff, though, is how he built his own financial planning spreadsheets in Excel, and has developed coding and integrations that automatically populate into a Power

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Wealth Management

AUGUST 29, 2023

The Majority Partner.

Abnormal Returns

AUGUST 29, 2023

Research 15 lessons learned from the quantitative investment research business. (blog.thinknewfound.com) Should market valuations revert over time? Not necessarily. (thediff.co) Is illiquidity a feature or a bug? (savantwealth.com) How the 52-week high affects stock prices. (papers.ssrn.com) Historical returns are not set in stone. There are likely errors.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Calculated Risk

AUGUST 29, 2023

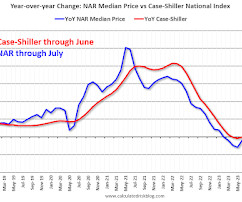

Today, in the Calculated Risk Real Estate Newsletter: Case-Shiller: National House Price Index Unchanged year-over-year in June Excerpt: The recent increase in mortgage rates to over 7% will not impact the Case-Shiller index until reports are released in the Fall. Here is a comparison of year-over-year change in median house prices from the NAR and the year-over-year change in the Case-Shiller index.

Wealth Management

AUGUST 29, 2023

More Opportunities Than Capital.

Calculated Risk

AUGUST 29, 2023

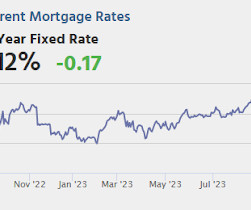

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios. Wednesday: • At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index. • At 8:15 AM, The ADP Employment Report for August. This report is for private payrolls only (no government). • At 8:30 AM, Gross Domestic Product, 2nd quarter 2023 (second estimate).

Wealth Management

AUGUST 29, 2023

The Active Operators.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Calculated Risk

AUGUST 29, 2023

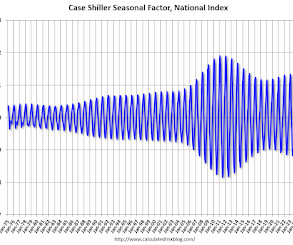

Two key points: 1) There is a clear seasonal pattern for house prices. 2) The surge in distressed sales during the housing bust distorted the seasonal pattern. This was because distressed sales (at lower price points) happened at a steady rate all year, while regular sales followed the normal seasonal pattern. This made for larger swings in the seasonal factor during the housing bust.

Wealth Management

AUGUST 29, 2023

The structured dealmaker.

The Reformed Broker

AUGUST 29, 2023

U.S. appeals court rules in favor of Grayscale over bitcoin ETF dispute with the SEC from CNBC. The post Clips From Today’s Halftime Report appeared first on The Reformed Broker.

Wealth Management

AUGUST 29, 2023

The Domain Experts.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Calculated Risk

AUGUST 29, 2023

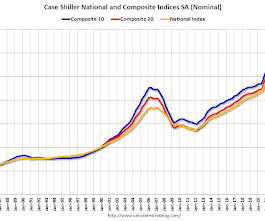

S&P/Case-Shiller released the monthly Home Price Indices for June ("June" is a 3-month average of April, May and June closing prices). This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index. From S&P S&P CoreLogic Case-Shiller Index Positive Momentum Continues in June The S&P CoreLogic Case-Shiller U.S.

Calculated Risk

AUGUST 29, 2023

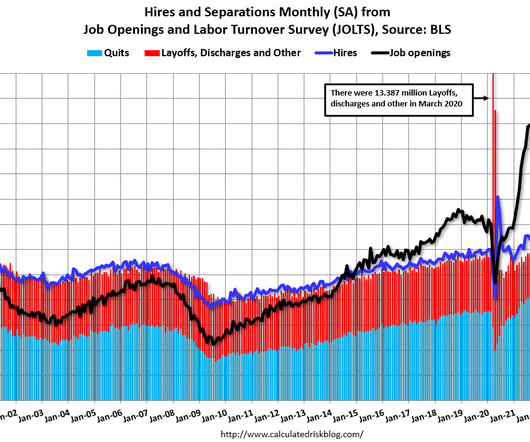

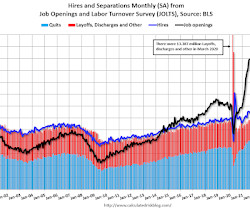

From the BLS: Job Openings and Labor Turnover Summary The number of job openings edged down to 8.8 million on the last business day of July , the U.S. Bureau of Labor Statistics reported today. Over the month, the number of hires and total separations changed little at 5.8 million and 5.5 million, respectively. Within separations, quits (3.5 million) decreased, while layoffs and discharges (1.6 million) changed little. emphasis added The following graph shows job openings (black line), hires (da

Wealth Management

AUGUST 29, 2023

How to address some of the frictional forces found in a typical retirement investment portfolio.

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

The Reformed Broker

AUGUST 29, 2023

Join Downtown Josh Brown and Michael Batnick for another round of What Are Your Thoughts? On this week’s episode, Josh and Michael discuss the biggest topics in investing and finance, including: ►Goldman/Grayscale – They found a buyer. Sounds like it took a week of discussions. ►Earnings Revisions – “Stock prices correcting as earning estimates continue to rise” ►Value Stocks – N.

Wealth Management

AUGUST 29, 2023

Newmark found that commercial real estate lending fell by 52% year-over-year in the second quarter of 2023. Private equity player KSL Capital Partners struck a deal to acquire Hersha Hospitality Trust in an all-cash deal valued at $1.4 billion, reported GlobeSt.com. These are among today’s must reads from around the commercial real estate industry.

The Big Picture

AUGUST 29, 2023

My Two-for-Tuesday morning train WFH reads: • Stock Pickers Never Had a Chance Against Hard Math of the Market : In years like this one, when just a few big companies outperform, it’s hard to assemble a winning portfolio. ( Businessweek ) but see With cash earning 5%, why risk money on the stock market? Savings rates have rocketed and UK savers can earn over 5% on deposits.

Wealth Management

AUGUST 29, 2023

The ruling marks a major legal win for the crypto industry and sent the price of Bitcoin surging by as much as 7%.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

The Irrelevant Investor

AUGUST 29, 2023

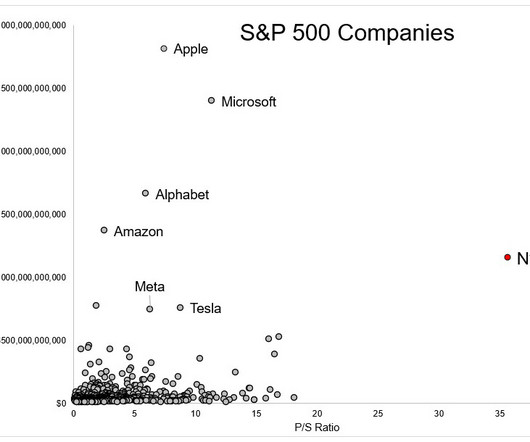

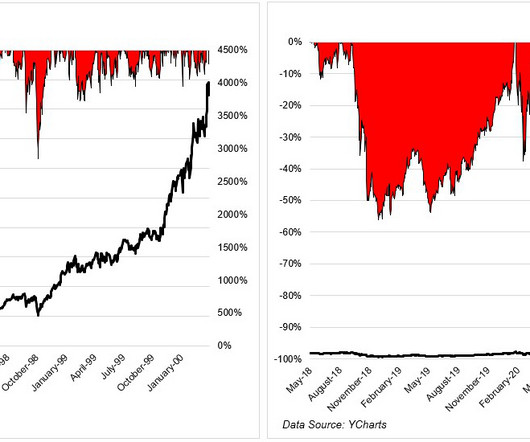

Nvidia is one of the most expensive stocks in the S&P 500. Nvidia is not the first giant tech company to trade at a rich valuation. The one that people often compare it to is Cisco, one of the darlings from the dot com era. We can’t compare things to the future, so we look to the past. Cisco sported an $8.9 billion market cap on the opening day of 1995.

Wealth Management

AUGUST 29, 2023

It's the startup’s most significant effort yet to attract a broad mix of business customers.

A Wealth of Common Sense

AUGUST 29, 2023

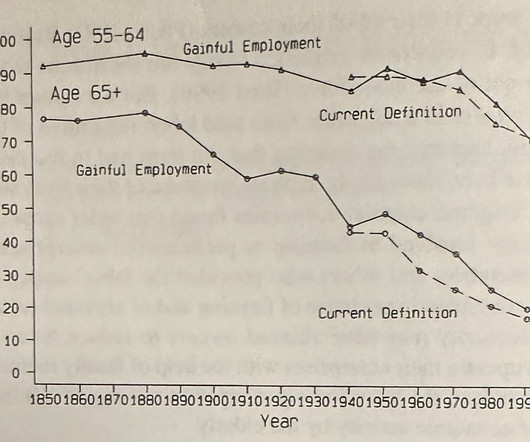

There’s a great scene in Midnight in Paris about nostalgia that I think about a lot: Some people always think the past is better than the present because of this golden age line of thinking. I always see memes like this going around Twitter: Life would be better is this was true. Unfortunately, it’s not (see here and here). Another social media trope these days is showing a picture of an old castle or church.

Wealth Management

AUGUST 29, 2023

From buying meme stocks and dumping the dollar to betting against swings in stock prices, a swath of popular trades have become losers.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Advisor Perspectives

AUGUST 29, 2023

Why is it so hard to gain the confidence with my existing clients that I have with prospects and raise their fees?

Wealth Management

AUGUST 29, 2023

Wealth Management Magazine Digital Edition -Third Quarter 2023

Advisor Perspectives

AUGUST 29, 2023

The latest job openings and labor turnover summary (JOLTS) report showed that job openings dropped to their lowest level in over two years. Vacancies fell to 8.827 million in July, lower than the expected 9.465 million vacancies.

Million Dollar Round Table (MDRT)

AUGUST 29, 2023

By Sandy Schussel The fastest way to grow your financial planning or insurance business is to get clear about what you want and how you want to get there. Here are the questions you should be asking yourself: Who do you want to serve? Telling the world that you work with everyone and do everything for them is the surest way to stunt your professional growth.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Let's personalize your content