Changing an RIA’s Name to Reflect Its New Identity

Wealth Management

JULY 12, 2024

Sometimes, what seems like the most straightforward task can end up the most difficult and meaningful.

Wealth Management

JULY 12, 2024

Sometimes, what seems like the most straightforward task can end up the most difficult and meaningful.

Calculated Risk

JULY 12, 2024

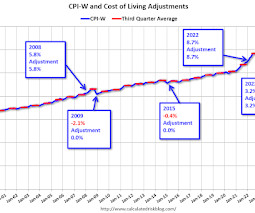

The BLS reported yesterday: The Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) increased 3.3 percent over the last 12 months to an index level of 308.163 (1982-84=100). For the month, the index increased 0.1 percent prior to seasonal adjustment. CPI-W is the index that is used to calculate the Cost-Of-Living Adjustments (COLA).

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

JULY 12, 2024

Caribou's Christine Simone details how healthcare planning can differentiate advisors.

Abnormal Returns

JULY 12, 2024

Markets How have the market's five largest stocks performed over the long run? (ft.com) When junky stocks take off, look out. (scheplick.com) Finance Home insurance rates are rising all over the country. (wsj.com) Why gate a fund that is up big? (advisorhub.com) AI LLMs are in a way still looking for product-market fit. (ben-evans.com) Doctors and insurers are dueling each other with AI.

Advertisement

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

Wealth Management

JULY 12, 2024

Effective immediately, Prime Capital Investment Advisors will become Prime Capital Financial, while Pensionmark rebrands to World Investment Advisors, a nod to its parent company.

Abnormal Returns

JULY 12, 2024

The biz How a podcast network makes money. (linkedin.com) Spotify ($SPOT) has a bundling problem. (vox.com) Global Tyler Cowen talks with Brian Winter discuss the politics and economics of nearly every country from the equator down. (conversationswithtyler.com) Russell Napier talks with Harold James, author of "Seven Crashes: The Economic Crises That Shaped Globalisation.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Nerd's Eye View

JULY 12, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that at a time when employee retention has heightened importance for advisory firms given the ongoing competition for advisor talent, recent studies indicate that factors such as firm culture and leadership, as well as providing advisors with a sense of autonomy, can play important roles in building advisor loyalty to the firm.

Wealth Management

JULY 12, 2024

Interval funds continue to raise cash from investors, and new managers are launching products at a brisk pace.

Calculated Risk

JULY 12, 2024

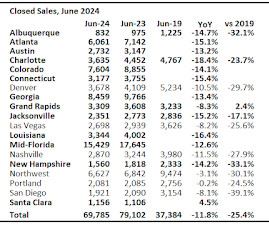

Today, in the Calculated Risk Real Estate Newsletter: 2nd Look at Local Housing Markets in June A brief excerpt: NOTE: The tables for active listings, new listings and closed sales all include a comparison to June 2019 for each local market (some 2019 data is not available). This is the second look at several early reporting local markets in May. I’m tracking over 40 local housing markets in the US.

Wealth Management

JULY 12, 2024

The team, led by father and daughter Bruce Glenn and Kristina Strickland, joins Summit Financial Networks, a super OSJ run by Marshall Leeds.

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Calculated Risk

JULY 12, 2024

From BofA: Since our last weekly publication, 2Q GDP tracking is up one-tenth to 2.0% q/q saar. The increase largely results from a lower-than-expected June CPI print. [July 12th estimate] emphasis added From Goldman: We lowered our Q2 GDP forecast to +1.8% (qoq ar). [July 8th estimate] And from the Altanta Fed: GDPNow The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2024 is 2.0 percent on July 10, up from 1.5 percent on July 3.

Wealth Management

JULY 12, 2024

The Apollo co-founder has sold or gifted 9.1 million shares of his multibillion-dollar stake since January, the most in a calendar year since the private equity firm went public more than a decade ago.

A Wealth of Common Sense

JULY 12, 2024

Charley Ellis wrote a great book about the index fund revolution back in 2016. One of my favorite parts of the book is where Ellis looks at how Wall Street has changed in the past 50 years: MBAs were uncommon. PhDs were never seen. Commissions still averaged 40 cents a share. All trading was paper based. Messengers with huge black boxes on wheels, filled with stock and bond certificates, scurried from broker to broker tr.

Wealth Management

JULY 12, 2024

Neil McLaughlin, RBC's longtime head of its personal and commercial banking division, is moving to a new role as chief of wealth management.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

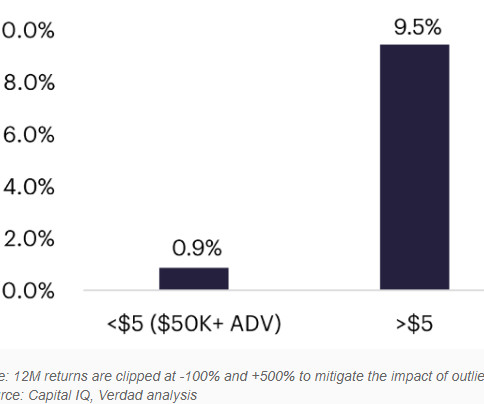

Alpha Architect

JULY 12, 2024

An efficient way to improve the expected performance of an equity strategy would be to systematically exclude penny stocks, as well with high asset growth and extreme past returns, especially if they have low profitability (and exclude funds that don’t screen out such stocks). Explaining the Performance of Low-Priced Stocks: The Penny Stock Anomaly was originally published at Alpha Architect.

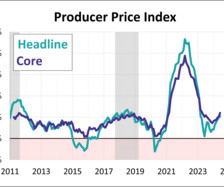

Advisor Perspectives

JULY 12, 2024

Wholesale inflation unexpectedly rose last month. The producer price index for final demand increased 0.2% month-over-month (s.a.). On an annual basis, headline PPI accelerated from 2.4% in May to 2.6% in June.

Sara Grillo

JULY 12, 2024

Question from a subscriber: “ I want to start writing articles as a guest blogger to attract new clients. How do I get started?” Guest blogging is when you write a blog on a one-time or periodic basis for a publication as a way to get known as an expert in a particular subject. You do this as a non-staff writer, or guest writer. Although you usually are not paid for guest blogging, you get exposure to the periodical’s audience – often in the tens of thousands.

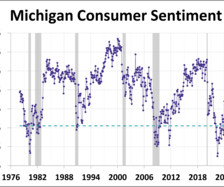

Advisor Perspectives

JULY 12, 2024

Consumer sentiment dropped to an 8-month low in July according to the preliminary report for the Michigan Consumer Sentiment Index. The index fell 2.2 points (-3.2%) from June's final reading to 66.0. The latest reading was below the forecast of 68.5.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

SEI

JULY 12, 2024

Wealth management firms can power growth by increasing productivity.

Advisor Perspectives

JULY 12, 2024

Demand for alternatives has spotlighted convertible arbitrage for portfolio diversification and risk-adjusted returns, after decades of underappreciation. Advisors must understand these strategies to effectively guide clients in the evolving market.

Sara Grillo

JULY 12, 2024

A “short” is a video, usually on social media platforms, under two minutes that is designed to “pop.” It’s kind of like a highlight reel. They are created to garner high emotional impact and lots of energy delivered in a condensed period of time. These videos are usually edited down from a longer video. So […] To access this post, you must purchase Membership Prime Portal.

SEI

JULY 12, 2024

SEI's second quarter market commentary.

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

Sara Grillo

JULY 12, 2024

Question from a subscriber: “ What is the best way to tell a prospect that they are not a good fit? “ Keep it brief. Make it about the opportunity – not the rejection. Put all the emphasis on the type of advisor who is correct and how they should find them, not why they aren’t right for you. Take these actions TODAY: When rejecting the prospect, don’t ramble.

Advisor Perspectives

JULY 12, 2024

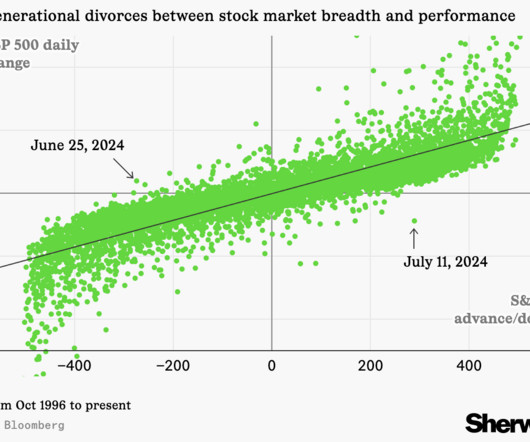

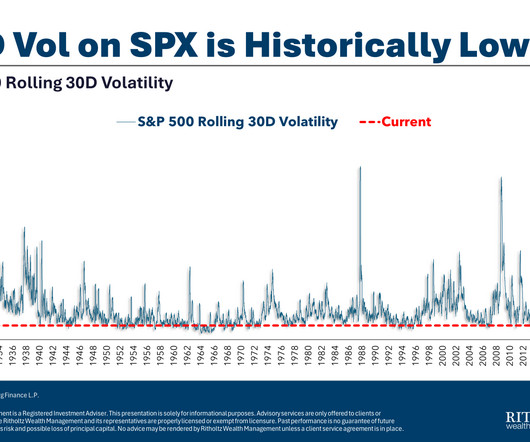

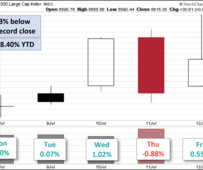

The S&P 500 posted a near perfect week with gains every day except Thursday. The index has now moved higher 8 of its last 9 trading days. The index is currently up 18.40% year to date and has recorded a new all-time high 37 times this year.

Truemind Capital

JULY 12, 2024

The tortoise won the race over the hare because it was consistent. Many people often ignore the power of consistency but those who follow, see remarkable success in life. People want to get rich quickly. The media also highlights the story of sudden riches, flamboyance & extravagant splurges. Whereas for a common person, the chances of success are much higher if only they are going through a boring everyday grind, silently climbing up the ladder, consistently saving and investing to benefit

Advisor Perspectives

JULY 12, 2024

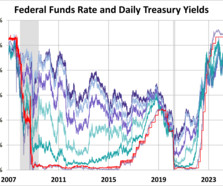

The yield on the 10-year note ended July 12, 2024 at 4.18%, the 2-year note ended at 4.45%, and the 30-year at 4.39%.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Wealth Management

JULY 12, 2024

Like Republicans before them, deep-pocketed liberal donors have discovered that their dollars aren’t likely to be a deciding factor in whether President Joe Biden decides to bow out of the race.

Advisor Perspectives

JULY 12, 2024

Human nature is such that there are always some folks who put a negative spin on obviously good news.

Advisor Perspectives

JULY 12, 2024

The economy is off to a strong start in 2024, with a strong employment picture and the Dow Jones Industrial Average crossing 40,000 for the first time. But even with those tailwinds, questions about the economy and the markets remain as we head into the second half of 2024.

Advisor Perspectives

JULY 12, 2024

Treasury yields tumbled after benign inflation data renewed confidence that the Federal Reserve will cut interest rates at least twice this year.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Let's personalize your content