IRS Stops Complying with Treasury Directive on Auditing Wealthy Taxpayers

Wealth Management

JULY 10, 2024

The IRS shifts its audit focus to a wider income range.

Wealth Management

JULY 10, 2024

The IRS shifts its audit focus to a wider income range.

Calculated Risk

JULY 10, 2024

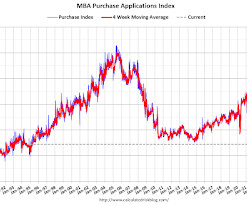

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey Mortgage applications decreased 0.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Applications Survey for the week ending July 5, 2024. Last week’s results included an adjustment for the July 4th holiday. The Market Composite Index, a measure of mortgage loan application volume, decreased 0.2 percent on a seasonally adjusted basis from one week earlier.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

JULY 10, 2024

It can be a “financial helping hand” and a great way to test-drive how well the adult kids will handle their inheritance when the time comes.

Calculated Risk

JULY 10, 2024

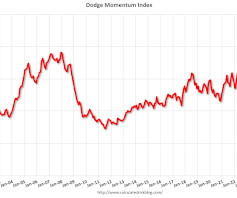

From Dodge Data Analytics: Dodge Momentum Index Gained 10% in June The Dodge Momentum Index (DMI), issued by Dodge Construction Network, increased 10.4% in June to 198.6 (2000=100) from the revised May reading of 179.9. Over the month, commercial planning increased 14.5% and institutional planning ticked up 0.2%. “Data centers continued to dominate planning projects in June – fueling another strong month for commercial planning,” stated Sarah Martin, associate director of forecasting at Dodge Co

Advertisement

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

Wealth Management

JULY 10, 2024

Open, honest and candid discussion about the job market, private equity in DC plans, Fi360's annuity tool and more.

Abnormal Returns

JULY 10, 2024

Podcasts Barry Ritholtz talks with William Bernstein about changing your behavior for the better. (ritholtz.com) Sam Parr talks with Scott Galloway author of "The Algebra of Wealth: A Simple Formula for Financial Security." (podcasts.apple.com) Dan Haylett talks with David Blanchett about swapping 'financial independence' for retirement. (humansvsretirement.com) Thomas Kopelman and Jacob Turner talk retirement planning with Taylor Schulte.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Calculated Risk

JULY 10, 2024

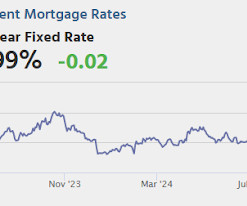

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios. Thursday: • At 8:30 AM: The Consumer Price Index for June from the BLS. The consensus is for a 0.1% increase in CPI, and a 0.2% increase in core CPI. The consensus is for CPI to be up 3.1% year-over-year and core CPI to be up 3.4% YoY. 8:30 AM: The initial weekly unemployment claims report will be released.

Wealth Management

JULY 10, 2024

Francis Financial's Stacy Francis details her journey toward becoming a financial advisor and her firm's growth strategy.

Nerd's Eye View

JULY 10, 2024

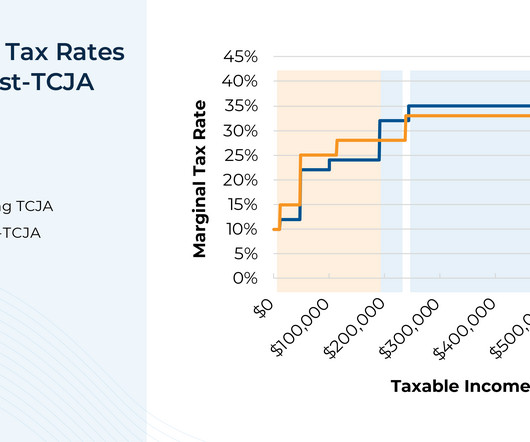

The Tax Cuts and Jobs Act (TCJA), passed in 2017, was one of the most extensive pieces of tax legislation to be passed in the last 30 years, touching many aspects of individual, corporate, and estate tax. However, most of TCJA's provisions are set to 'sunset' at the end of 2025 – an event that would have at least as much impact as TCJA's initial passage.

Wealth Management

JULY 10, 2024

Rev. Proc. 2024-22 relates to organizational requirements and exempt purposes.

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Calculated Risk

JULY 10, 2024

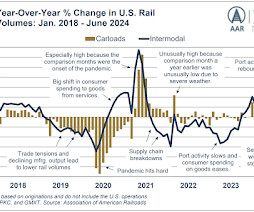

From the Association of American Railroads (AAR) Rail Time Indicators. Graphs and excerpts reprinted with permission. In terms of total carloads, we’re in a period when the changes are not positive. Total originated carloads on U.S. railroads in the second quarter of 2024 were down 4.8%, or 140,915 carloads, from the second quarter of 2023. That was the biggest year-over-year quarterly percentage decline for total carloads since Q4 2020.

Wealth Management

JULY 10, 2024

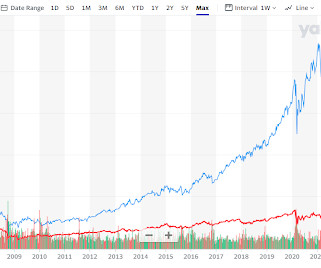

Vance Howard’s HCM Tactical Growth Fund has beaten 96% of its peers over the last five years with an annualized gain of 20%.

The Big Picture

JULY 10, 2024

Investing Is Hard with Brian Portnoy (July 10, 2024) Why is investing so hard? It’s because our brains have been trained, over thousands of years, to trust our fear instincts. In this episode, I speak with Brian Portnoy sits down with Barry Ritholtz to explain why humans aren’t built to be good investors. Portnoy has held senior investment roles throughout the hedge fund and mutual fund industries.

Wealth Management

JULY 10, 2024

Global regulators are scrutinizing the opaque business of offshore pension management.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

A Wealth of Common Sense

JULY 10, 2024

Today’s Animal Spirits is brought to you by NEOS Investments and Fabric: See here for more information on NEOS income-focused funds Go to meetfabric.com/spirits for more information on life insurance from Fabric by Gerber Life On today’s show, we discuss: Where Have All the Good Stocks Gone? Why Your Fund Manager Can’t Beat Today’s Stock Market How many US passports are in circulation?

Wealth Management

JULY 10, 2024

Wednesday, July 24, 2024 | 2:00 PM Eastern Daylight Time

Advisor Perspectives

JULY 10, 2024

Tracking down those in the technology industry cautious about artificial intelligence is much like looking for Republicans in San Francisco: There’s plenty of them out there, if you’d care to ask. And lately, they seem to be growing in number.

Wealth Management

JULY 10, 2024

Almost a third of the world’s millionaires will be in emerging markets by 2028, according to the Global Wealth Report 2024, as the millionaire population increases in nearly every country.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Advisor Perspectives

JULY 10, 2024

While the temperatures were rising, the U.S. stock market continued its climb higher as well. The S&P 500 returned 3.5% and Emerging Market stocks delivered an impressive 3.9%. Bonds also returned positively in June.

Wealth Management

JULY 10, 2024

Transcript of Episode 113 of 401(k) Real Talk.

Advisor Perspectives

JULY 10, 2024

Trust is a precious commodity and the importance of authenticity cannot be overstated. Whether in healthcare, education, or business, being genuine and transparent is essential for building strong, lasting relationships. However, nowhere is this truer than in the financial advisory industry.

SEI

JULY 10, 2024

A thoughtful investment approach should include tactics and processes designed with all types of market conditions in mind.

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

Advisor Perspectives

JULY 10, 2024

Piper Sandler & Co. is eliminating its price target for the S&P 500 Index. Its Wall Street counterparts should follow suit.

NAIFA Advisor Today

JULY 10, 2024

Panos Leledakis , a dynamic financial advisor and tech enthusiast, has revolutionized client engagement with cutting-edge digital strategies. With an impressive 25-year career spanning multiple countries, he has become a thought leader in utilizing AI and other technologies in the financial services industry. As a NAIFA member and a keynote speaker, Panos is committed to helping advisors implement technology into their practices to enhance productivity and service.

Advisor Perspectives

JULY 10, 2024

AI and automation will revolutionize the financial advisory industry. These technologies enhance efficiency, improve client communication, and enable data-driven decision-making. By 2035, AI will be integral to most advisory firms.

Trade Brains

JULY 10, 2024

The stock market plays a crucial role in economic growth, wealth creation, and investment opportunities. It enables investors to grow wealth through dividends and capital gains. The stock exchange ensures efficient capital allocation and economic expansion. Mandatory financial disclosure for listed companies encourages transparency, benefiting informed investment decisions.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Random Roger's Retirement Planning

JULY 10, 2024

We've had quite a few conversations lately about the importance of uncorrelated return streams. The concept is not new to the blog but the phrasing is. Portfoliovisualizer's correlation tool is very handy to grab the numbers but I think there needs to be some measure of why return streams are uncorrelated. Doing this between many different return streams (alt strategies) may not be plausible but a few should be.

Advisor Perspectives

JULY 10, 2024

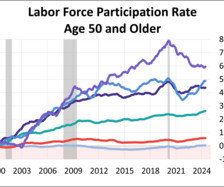

Today, one in three of the 65-69 cohort, one in five of the 70-74 cohort, and nearly one in ten of the 75+ cohort are in the labor force.

Indigo Marketing Agency

JULY 10, 2024

Financial advisors often approach marketing timidly or sporadically, never knowing how to create publish-worthy content. And even when they strike gold with content that resonates, they often don’t know what to do with it. Post it once, get a few likes, and let it fade away into obscurity forever? There are better ways. Here are 5 ways to maximize the mileage you get out of each post, blog, video, report, and email you create so you can get more exposure, start more conversations, and do more

Advisor Perspectives

JULY 10, 2024

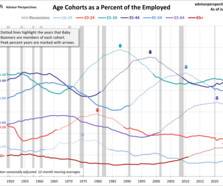

The 20th century Baby Boom was one of the most powerful demographic events in the history of the United States. We've created a series of charts to show seven age cohorts of the employed population from 1948 to the present.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Let's personalize your content