Cerulli: Advisor Headcount Stagnates

Wealth Management

JANUARY 16, 2025

Despite efforts to develop next-gen talent, the total number of advisors in the wealth management industry has remained stagnant over the last decade.

Wealth Management

JANUARY 16, 2025

Despite efforts to develop next-gen talent, the total number of advisors in the wealth management industry has remained stagnant over the last decade.

Calculated Risk

JANUARY 16, 2025

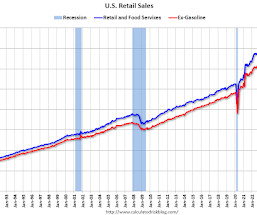

On a monthly basis, retail sales increased 0.4% from November to December (seasonally adjusted), and sales were up 3.9 percent from December 2023. From the Census Bureau report : Advance estimates of U.S. retail and food services sales for December 2024, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $729.2 billion, an increase of 0.4 percent from the previous month , and up 3.9 percent from December 2023.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

JANUARY 16, 2025

More than 100 continuation funds were raised between 2019 and 2021. Now, some are running into trouble amid a sluggish dealmaking environment and declining asset values.

Calculated Risk

JANUARY 16, 2025

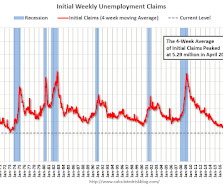

The DOL reported : In the week ending January 11, the advance figure for seasonally adjusted initial claims was 217,000 , an increase of 14,000 from the previous week's revised level. The previous week's level was revised up by 2,000 from 201,000 to 203,000. The 4-week moving average was 212,750, a decrease of 750 from the previous week's revised average.

Advertisement

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

Wealth Management

JANUARY 16, 2025

The Pensato Slyane Group is one of the most elite New York City wealth management teams, according to the director of RBCs New York complex.

NAIFA Advisor Today

JANUARY 16, 2025

Advisor Today Guest Column January of 2025 is the 50th anniversary to one of the most important pieces of legislation in the retirement planning arena ever put into law by Congress. What Im referring to is the enactment of ERISA, the Employee Retirement Income Security Act. Without question, ERISA brought about significant changes during the second half of the twentieth century.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Abnormal Returns

JANUARY 16, 2025

Strategy Stock picking is hard. So is sector picking. (awealthofcommonsense.com) How to plan for future lower market returns. (theretirementmanifesto.com) Finance Hindenberg Research is calling it quits. (wsj.com) eToro has filed for an IPO. (coindesk.com) The stocks of single-family landlords are trading at a discount to their stated NAVs. (wsj.com) Food How GLP-1 users change their food purchase patterns.

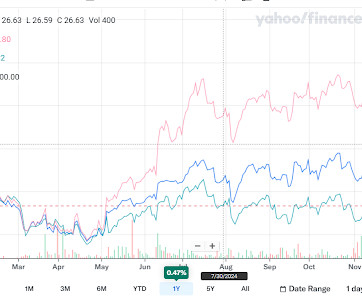

A Wealth of Common Sense

JANUARY 16, 2025

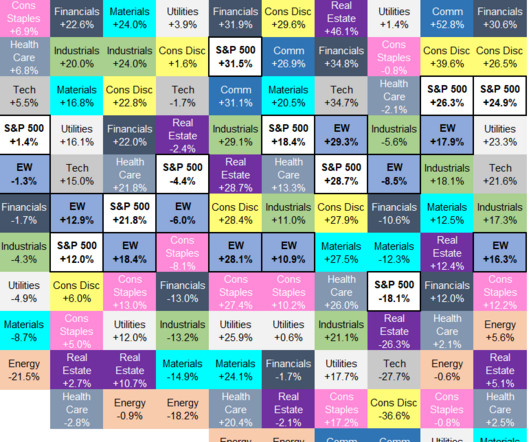

We also answered questions about 2025 retirement account limits, Coast FIRE strategies, when to take money off the table from the stock market, how to account for pension and Social Security income during retirement and how other economies impact the U.S. markets. Further Reading: Updating My Favorite Performance Chart For 2024 The post The 2024 Sector Quilt appeared first on A Wealth of Common Sense.

Wealth Management

JANUARY 16, 2025

In cases of rejection, its important to focus on what students and their parents can controlmaking the right decisions going forward.

Indigo Marketing Agency

JANUARY 16, 2025

10 Growth Marketing Strategies for Financial Planners in 2025 The new year wipes the slate clean and gives financial planners a fresh opportunity to focus on marketing strategies that attract and retain more clients in less time and with less energy. The Indigo team streamlines marketing strategies to help financial planners grow their firms. Case in point, Kevin Brown.

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Wealth Management

JANUARY 16, 2025

Hannah Moore is President of Guiding Wealth and Founder of Amplified Planning, describes her experiences and offers advice on how to train new advisors.

Calculated Risk

JANUARY 16, 2025

Here is a YouTube video of a discussion with Mike Simonsen. Enjoy.

Wealth Management

JANUARY 16, 2025

By creating the iCapital Investor Passport using Parallel Markets technology, the firm hopes to make complying with AML requirements more efficient.

Validea

JANUARY 16, 2025

In this episode of Excess Returns, we sit down with Doug Clinton of Intelligent Alpha to explore the fascinating intersection of AI and investment strategy. We discussed how Doug is using large language models (LLMs) like ChatGPT, Claude, and Gemini to build portfolios that aim to beat the market over time. Doug shares insights from his experience launching managing AI-powered investment strategies.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Wealth Management

JANUARY 16, 2025

Tony Smith of Stonegate Investment Group discusses transitioning from UBS after 14 years and $4.4 billion in AUM to independence and building the business to $6 billion, including the motivations to make a change at this stage of his career and how they achieved such growth in a short time.

Random Roger's Retirement Planning

JANUARY 16, 2025

First a new, to me, suite of single stock covered call ETF from a provider named Kurv. They have funds for Apple, Amazon, Microsoft. Tesla and couple of others as well as one for the Nasdaq 100. Their Amazon fund symbol AMZP shows a 27% yield, the Apple version shows 78% but I'm not sure that's right. On price basis they seem to land in between the common stock and the YieldMax equivalent.

Wealth Management

JANUARY 16, 2025

Graham, who joined Cambridge in 2017, stepped down from his role on Dec. 31. The IBD is currently searching for a replacement.

FMG

JANUARY 16, 2025

Annual reviews are the backbone of client relationships, but coordinating them shouldn’t eat up your valuable time. Financial advisors are discovering that compliant texting platforms like MyRepChat can cut down review preparation time while improving client engagement. Here are 5 simple ways financial advisors can use texting to streamline annual reviews: 1.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Wealth Management

JANUARY 16, 2025

Merrill clients and advisors expanded on their continued interest in alternative investments while Morgan Stanleys net interest income slightly climbed despite expectations it would decline modestly in the fourth quarter.

Advisor Perspectives

JANUARY 16, 2025

Doug Drabik discusses fixed income market conditions and offers insight for bond investors.

Wealth Management

JANUARY 16, 2025

The deal will allow Altos users to invest in early-stage, high-growth companies through their IRA accounts.

Validea

JANUARY 16, 2025

Fundamental momentum represents a company’s improvement in operational performance and financial health over time, as measured through changes in key metrics like return on equity (ROE), operating margins, and other fundamental indicators. Unlike price momentum, which looks at historical stock price movements, fundamental momentum focuses on the underlying business performance trends.

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

Wealth Management

JANUARY 16, 2025

Sagard Holdings will target Canadian accredited investors with at least C$1 million ($695,000) in financial assets or more than C$200,000 in annual income

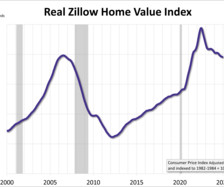

Advisor Perspectives

JANUARY 16, 2025

In December, nominal home values increased for a 21st straight months to a new all-time high. However, once we adjust for inflation, "real" home values declined for an 8th consecutive month to their lowest level since June 2021.

Carson Wealth

JANUARY 16, 2025

The good news is that American households have a totalnet worth of $85.2 trillion.The bad news is that mostfamilies are still behind where they were financially in 2007.In a recent survey, over half of Americans said they hadless than $1,000 in their checking and savings accountscombined. Download Guide The post Back 2 Basics appeared first on Carson Wealth.

Advisor Perspectives

JANUARY 16, 2025

BlackRock Inc. attracted an annual record of $641 billion in client cash, underlining the firm’s global reach across public and, increasingly, private assets as it integrates multibillion-dollar acquisitions and reshapes its leadership.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Norman Marks

JANUARY 16, 2025

People talk about organizational culture (sometimes just risk culture), but too few are examining the culture of their own team. As the leader of internal audit practitioners, I was very conscious of how my team behaved and the culture I had built that led to that behavior.

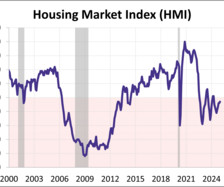

Advisor Perspectives

JANUARY 16, 2025

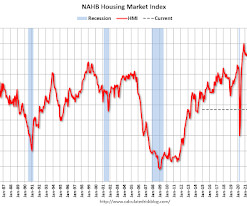

Builder confidence inched up in January to its highest level in 9 months on hopes for economic growth and an improved regulatory environment. The National Association of Home Builders (NAHB) Housing Market Index (HMI) rose to 47 this month, up one point from December. The latest reading came was above the forecast of 45.

Calculated Risk

JANUARY 16, 2025

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 47, up from 46 last month. Any number below 50 indicates that more builders view sales conditions as poor than good. From the NAHB: Builder Confidence Edges Up Even as Market Risk Concerns Rise Builder sentiment edged higher to begin the year on hopes for an improved economic growth and regulatory environment.

Advisor Perspectives

JANUARY 16, 2025

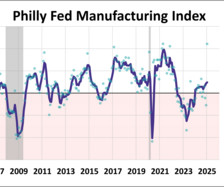

The latest Philadelphia Fed manufacturing index jumped to its highest level since April 2021 as manufacturing activity increased overall. In January, the index rose to 44.3 from -10.9 in December, the largest monthly increase since June 2020. The latest reading was much higher than the forecast of -5.0.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Let's personalize your content