Putting Highly Appreciated Assets to Work for Good Causes

Wealth Management

MAY 14, 2025

Advisors can better serve wealthy clients through strategic charitable giving of appreciated assets, from real estate to business interests.

Wealth Management

MAY 14, 2025

Advisors can better serve wealthy clients through strategic charitable giving of appreciated assets, from real estate to business interests.

Calculated Risk

MAY 14, 2025

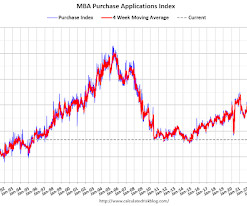

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey Mortgage applications increased 1.1 percent from one week earlier, according to data from the Mortgage Bankers Associations (MBA) Weekly Mortgage Applications Survey for the week ending May 9, 2025. The Market Composite Index, a measure of mortgage loan application volume, increased 1.1 percent on a seasonally adjusted basis from one week earlier.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

MAY 14, 2025

Betterment has acquired Rowboat Advisors, a portfolio optimization software provider with a focus on tax efficiency and direct indexing.

Calculated Risk

MAY 14, 2025

Today, in the Calculated Risk Real Estate Newsletter: Part 2: Current State of the Housing Market; Overview for mid-May 2025 A brief excerpt: Last Friday, in Part 1: Current State of the Housing Market; Overview for mid-May 2025 I reviewed home inventory, housing starts and sales. I noted that the key story right now for existing homes is that inventory is increasing sharply, and sales are essentially flat compared to last year.

Advertisement

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

Wealth Management

MAY 14, 2025

Liam Payne's son, Bear, stands to inherit his fortune in the absence of a will.

The Big Picture

MAY 14, 2025

A bonus LIVE episode of Masters in Business: I speak with bestselling author and financial journalist Michael Lewis, live, from the Landmark Theater in Port Washington, NY. Our wide-ranging, 90-minute conversation covered the full arc of his career, from Liars Poker to this years Who is Government. The informative and at times hilarious conversation included his experiences turning Moneyball into a film (including on-set hijinks from Brad Pitt), how his career as a writer evolved, and what he

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Calculated Risk

MAY 14, 2025

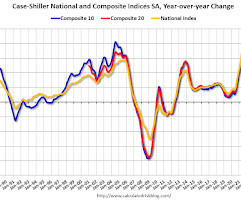

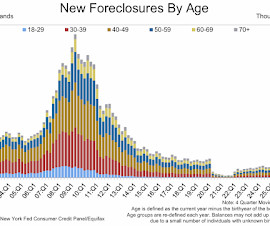

Today, in the Calculated Risk Real Estate Newsletter: Q1 NY Fed Report: Mortgage Originations by Credit Score, Delinquencies Increase, Foreclosures Increase A brief excerpt: The transition rate to serious delinquent is generally increasing and foreclosures are close to pre-pandemic levels. The Q1 increase is likely due to the end of the VA foreclosure moratorium.

Wealth Management

MAY 14, 2025

Advanced life insurance case designs address the what-ifs to protect clients.

Calculated Risk

MAY 14, 2025

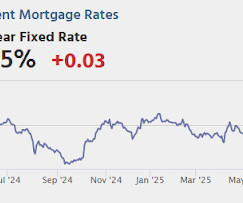

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios. Thursday: At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for initial claims of 230 thousand, up from 228 thousand last week. Also at 8:30 AM, Retail sales for April are scheduled to be released. The consensus is for 0.1% increase in retail sales.

Wealth Management

MAY 14, 2025

Morningstar's annual fund fee study found average fees dropped only 2 basis points in 2024.

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Advisor Perspectives

MAY 14, 2025

Advisors need AI solutions that are useful over the long term as the business evolves.

Wealth Management

MAY 14, 2025

Criminal courts weigh in on a dispute involving Egon Schiele's Russian War Prisoner drawing confiscated by the Nazis.

Advisor Perspectives

MAY 14, 2025

Anyone betting on the end of the private credit boom has been on the back foot of late as the upstart $1.6 trillion asset class has notched up a string of wins. But the industry’s naysayers won’t be conceding defeat just yet.

Wealth Management

MAY 14, 2025

In this episode of The Healthy Advisor Podcast, Conquest Planning's Stacie Calder opens up about how merging the personal with the professional helped her build deeper connections and navigate her own struggles.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Advisor Perspectives

MAY 14, 2025

Retail investors have won again. When trade tensions flared in early April and about $6.6 trillion in market value vanished from US stocks in just two business days – the fifth-worst two-day drop since the S&P 500’s creation in 1957 – they didn’t panic.

Wealth Management

MAY 14, 2025

The latest episode of 401(k) Real Talk, featuring stories on advisor use of AI, forfeiture lawsuits, lies told to plan sponsors and more.

Random Roger's Retirement Planning

MAY 14, 2025

We have a couple of different articles about private assets being available or otherwise worked into 401k plans. First is 401k provider Empower starting to rollout private equity, credit and real estate into plans they offer, ranging from 5-20% allocations. This quote made my eyes bug out. " Wall Street firms have been pushing to get private investments into the hands of individual investors , and they see the $12.4 trillion market for 401(k)-type retirement plans as crucial to this growth. " I'

Validea

MAY 14, 2025

Strong free cash flow yield stands out as a key metric for identifying financially healthy companies in today’s volatile market. This indicator highlights firms that effectively generate cash from operations compared to their market value. Companies with excellent cash generation enjoy financial independence, allowing them to grow, strengthen finances, and reward shareholders without depending on external funding.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Advisor Perspectives

MAY 14, 2025

The chain-smoking protagonist of Landman , the American television drama series about the Texas oil industry, puts it better than anyone else: “You want oil to live above 60, but below 90,” says the fictional Tommy Norris. “Seventy-eight dollars a barrel, that’s about perfect.

Validea

MAY 14, 2025

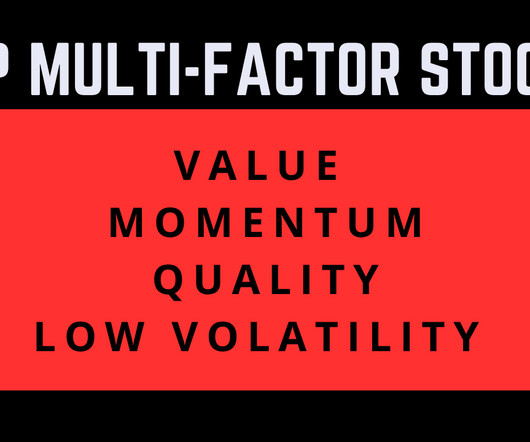

Investing is hard. Every stock has a story, and each investor has their own framework for deciding what matters most-whether it’s valuation, momentum, quality, or risk. At Validea, we aim to simplify this complexity by combining the most powerful investing factors into one cohesive framework. The result? Our list of Top Multi-Factor Stocks-names that stand out not because of just one strength, but because they score highly across the board.

Advisor Perspectives

MAY 14, 2025

To help exemplify the importance of UX, I’m breaking down a few of the most common UX myths, along with the top recommendations to avoid the pitfalls associated with them.

FMG

MAY 14, 2025

An excellent financial advisor website makes all the difference in connecting with a potential client. Thats why were proud to partner with Osaic to help keep their sites up-to-date and modern, with clear value propositions, easy navigation, engaging content, and more. Here are 10 standout Osaic advisor websites that highlight what makes a financial advisor site standout while bringing traffic to their site. 1.

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

Advisor Perspectives

MAY 14, 2025

It can be tempting to react when someone at work criticizes you at work, but take some time to consider the issue before you do.

Leading Advisor

MAY 14, 2025

After three decades of walking alongside financial advisors and agency founders, Ive noticed something the industry rarely talks about: burnout isnt always obvious. It doesnt… The post Beyond Burnout Reclaiming Time, Energy, and Meaning in Financial Leadership appeared first on Leading Advisor - Simon Reilly.

Advisor Perspectives

MAY 14, 2025

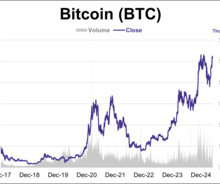

Bitcoin's closing price broke above $100,000 this week, hitting its highest level in over three months. BTC is up ~10% year to date and is ~2% below its record high from January 2025.

Norman Marks

MAY 14, 2025

As many have pointed out, May is Internal Audit Awareness Month. It is also Mental Health Awareness Month, Asian American and Pacific Islander Heritage Month, ALS Awareness Month, Skin Cancer Awareness Month, National Barbecue Month, National Photography Month, Jewish American Heritage Month, National Pet Month, and much more (see here).

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Advisor Perspectives

MAY 14, 2025

Flows of gold into Asian ETFs exploded in April, driving global ETF gold holdings higher for the fifth straight month.

Harness Wealth

MAY 14, 2025

Filing taxes can often feel like navigating a complex maze, especially when it comes to understanding the specific forms required by your state. South Dakota, known for its unique tax structure, has its own set of tax forms and filing requirements that residents and non-residents alike must be familiar with. This guide aims to clarify the essentials of South Dakota tax forms, helping you approach your tax filing with confidence and clarity.

Advisor Perspectives

MAY 14, 2025

Here is a look at real (inflation-adjusted) charts of the S&P 500, Dow 30, and Nasdaq composite since their 2000 highs. We've updated this through the April 2025 close.

Harness Wealth

MAY 14, 2025

Filing taxes in Hawaii requires a clear understanding of the specific forms and procedures unique to the state. Unlike federal tax forms, Hawaii tax forms are tailored to meet the state’s tax laws and regulations, ensuring residents and non-residents alike comply with local requirements. Navigating these forms can seem daunting at first, but with the right information, the process becomes much more manageable.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Let's personalize your content