Seeing an Opportunity, CRE Debt Funds Raise Massive War Chests

Wealth Management

FEBRUARY 5, 2023

With many traditional lenders becoming more conservative in a high-interest rate environment, debt funds see a chance to grab market share.

Wealth Management

FEBRUARY 5, 2023

With many traditional lenders becoming more conservative in a high-interest rate environment, debt funds see a chance to grab market share.

Abnormal Returns

FEBRUARY 5, 2023

Top clicks this week 11 things that zero interest rates enabled including the rise of Cathie Wood. (youngmoney.co) 20 lessons Seth Klarman learned from the GFC including 'Do not accept principal risk while investing short-term cash.' (investmenttalk.substack.com) What can you assume about stock, bond and cash returns over the long run. (awealthofcommonsense.com) Why side hustles aren't worth the hassle.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

A Wealth of Common Sense

FEBRUARY 5, 2023

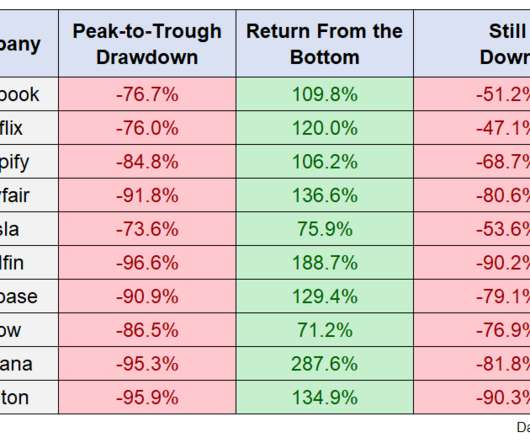

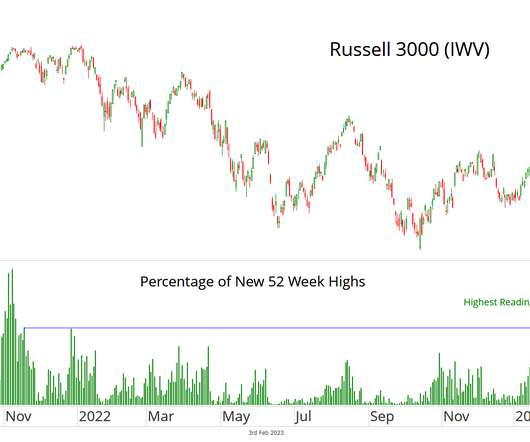

Facebook was one of the worst-performing stocks in the S&P 500 in 2022, falling 64% on the year. Who knew pouring billions into the metaverse during a time of Fed tightening and 9% inflation would be a bad idea? Well last year’s loser has turned into their year’s darling. Facebook shares are up more than 55% in the first month and change of 2023, including a one-day jump of more than 20% this week after th.

Calculated Risk

FEBRUARY 5, 2023

Weekend: • Schedule for Week of February 5, 2023 Monday: • No major economic releases scheduled. From CNBC: Pre-Market Data and Bloomberg futures S&P 500 futures are down 13 and DOW futures are down 81 (fair value). Oil prices were down over the last week with WTI futures at $73.39 per barrel and Brent at $79.94 per barrel. A year ago, WTI was at $92, and Brent was at $97 - so WTI oil prices are DOWN 20% year-over-year.

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Million Dollar Round Table (MDRT)

FEBRUARY 5, 2023

By Sandy Schussel At the end of a two-hour fact-finding meeting, financial advisor Marianne told her seemingly enthusiastic prospects that she would research a few things and then create a plan for them. After that, she would schedule a follow-up appointment with them. They were a professional couple with young children. Their plan would specifically include some crucial life insurance that needed to be priced.

Calculated Risk

FEBRUARY 5, 2023

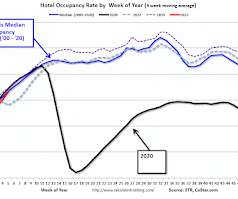

From CoStar: Hotels: Occupancy Rate Down 6.2% Compared to Same Week in 2019 U.S. hotel performance increased from the previous week, according to STR‘s latest data through Jan. 28. Jan. 22-28, 2023 (percentage change from comparable week in 2019*): • Occupancy: 56.3% (-0.3%) • Average daily rate (ADR): $142.66 (+13.4%) • Revenue per available room (RevPAR): $80.32 (+13.0%) *Due to the pandemic impact, STR is measuring recovery against comparable time periods from 2019.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

The Irrelevant Investor

FEBRUARY 5, 2023

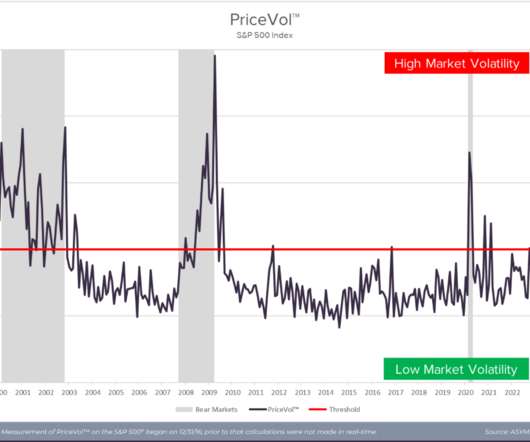

Today’s show is brought to you by ASYMmetric ETFs: We had Darren Schuringa, Founder and CEO of ASYMmetric ETFs on the show to discuss Asymetric’s latest Smart Income and Smart Alpha ETFs. On today’s show, we discuss: Darren’s background prior to ASYMmetric ETFs How ASYMmetric structures their strategies Looking at market volatility Rules-based strategies v emotions What makes Smart ETFs smart How ASYMmet.

James Hendries

FEBRUARY 5, 2023

As the call continues to come for following through on support of minority-owned businesses, [1] many are wondering how they may lend their support to black businesses. Whether through direct investment or community support, there are many ways to help black businesses grow and thrive. Interested in learning more about how to get started? Consider some of the tips listed below.

Advisor Perspectives

FEBRUARY 5, 2023

For RIAs, self-knowledge – which includes an understanding of the firm’s ideal client persona – is the first and most necessary step on the road to success and scalability.

Ron A. Rhodes

FEBRUARY 5, 2023

On December 29, 2022, President Biden signed into law the SECURE 2.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Abnormal Returns

FEBRUARY 5, 2023

Strategy You can't catch every bull (or bear) market. (awealthofcommonsense.com) Why you can safely ignore market forecasts. (marknewfield.substack.com) Horrific investment mistakes are often a function of leverage. (rationalwalk.com) The 60/40 portfolio reset in 2022. (caia.org) Finance How AI is going to change professional trading. (finance.yahoo.com) Why we don't need continuous stock trading.

The Big Picture

FEBRUARY 5, 2023

Avert your eyes! My Sunday morning look at incompetency, corruption and policy failures: • Getting less for the same price? Explore how the CPI measures “shrinkflation” and its impact on inflation. ( BLS ) • How a Drug Company Made $114 Billion by Gaming the U.S. Patent System : AbbVie for years delayed competition for its blockbuster drug Humira, at the expense of patients and taxpayers.

Let's personalize your content