Four High Frequency Indicators for the Economy

Calculated Risk

SEPTEMBER 5, 2022

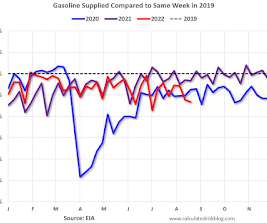

These indicators are mostly for travel and entertainment. It is interesting to watch these sectors recover as the pandemic subsides. Notes: I've added back gasoline supplied to see if there is an impact from higher gasoline prices. -- Airlines: Transportation Security Administration -- The TSA is providing daily travel numbers. This data is as of September 4th.

Let's personalize your content