Firms Not Offering Tax, Retirement Planning Are Getting it Wrong

Wealth Management

OCTOBER 4, 2023

Advisors are overdelivering services such as health care, estate and business planning, while falling short in the areas their clients most desire.

Wealth Management

OCTOBER 4, 2023

Advisors are overdelivering services such as health care, estate and business planning, while falling short in the areas their clients most desire.

Calculated Risk

OCTOBER 4, 2023

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey Mortgage applications decreased 6.0 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending September 29, 2023. The Market Composite Index, a measure of mortgage loan application volume, decreased 6.0 percent on a seasonally adjusted basis from one week earlier.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

OCTOBER 4, 2023

Orion Advisor Solutions’ chief behavioral officer explains why advisors should employ “human-first” thinking in their practices at annual Nitrogen conference.

The Big Picture

OCTOBER 4, 2023

Source: Visual Capitalist Batnick also takes a swing at this: What’s the Stock Market Worth? The post $109 Trillion Global Stock Market appeared first on The Big Picture.

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Wealth Management

OCTOBER 4, 2023

Luis Rosa, founder of Build a Better Financial Future discusses the importance of authenticity in your approach and your business model.

Abnormal Returns

OCTOBER 4, 2023

Podcasts Sam Dogen talks fear with Farnoosh Torabi author of "A Healthy State of Panic: Follow Your Fears to Build Wealth, Crush Your Career, and Win at Life." (sites.libsyn.com) Dan Haylett talks with Hal Hershfield author of "Your Future Self: How to Make Tomorrow Better Today." (humansvsretirement.com) Jon Luskin talks with Steve Chen about DIY retirement planning tools.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

The Big Picture

OCTOBER 4, 2023

My mid-week morning train reads: • The insider: how Michael Lewis got a backstage pass for the fall of Sam Bankman-Fried : As author of The Big Short and Moneyball, Michael Lewis is perhaps the most celebrated journalist of his generation. Now he delivers an astonishing portrait of the fallen crypto billionaire. But did he get too close? ( The Guardian ) but see In Michael Lewis, Sam Bankman-Fried found his last and most willing victim.

Wealth Management

OCTOBER 4, 2023

"If you’re completely adverse to change, you may want to retire real soon.

Abnormal Returns

OCTOBER 4, 2023

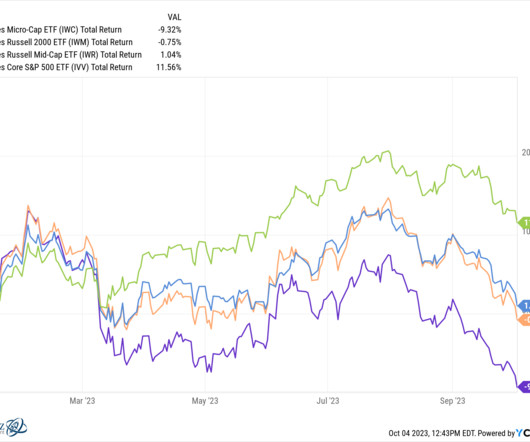

Markets The stock market is coming to terms with higher interest rates (for longer). (awealthofcommonsense.com) Japan's stock market has some catalysts working in its favor. (wsj.com) Why Treasury securities are different. (ft.com) ETFs State Street Global ($STT) is expanding the number of ETFs that engage in securities lending. (etf.com) The number of fixed income ETFs is on the rise.

Wealth Management

OCTOBER 4, 2023

Help clients protect clients themselves before the onset of challenges or the occurrence of abuse.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Nerd's Eye View

OCTOBER 4, 2023

People often talk about "the economy" as a single entity whose parts move in unison, with a small number of key indicators (such as GDP, the unemployment rate, and inflation) moving reliably in relation to each other. In reality, though, the economy is a complex web of interdependent factors where events often make sense only in hindsight – and sometimes, not at all.

Wealth Management

OCTOBER 4, 2023

The average amount donated by affluent individuals to charity in 2022 was up 19% from pre-pandemic levels, according to a recent Bank of America study.

Calculated Risk

OCTOBER 4, 2023

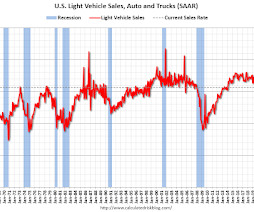

The BEA released their estimate of vehicle sales for September today. This graph shows heavy truck sales since 1967 using data from the BEA. The dashed line is the September 2023 seasonally adjusted annual sales rate (SAAR). Heavy truck sales really collapsed during the great recession, falling to a low of 180 thousand SAAR in May 2009. Then heavy truck sales increased to a new record high of 570 thousand SAAR in April 2019.

Wealth Management

OCTOBER 4, 2023

After a year and a half of high-level upheaval and no reported asset growth, Sanctuary has brought in a 30-year Morgan Stanley vet to lead East Coast expansion.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Calculated Risk

OCTOBER 4, 2023

From ADP: ADP National Employment Report: Private Sector Employment Increased by 89,000 Jobs in September; Annual Pay was Up 5.9% Private sector employment increased by 89,000 jobs in September and annual pay was up 5.9 percent year-over-year, according to the September ADP® National Employment ReportTM produced by the ADP Research Institute® in collaboration with the Stanford Digital Economy Lab (“Stanford Lab”).

Wealth Management

OCTOBER 4, 2023

The serial entrepreneur discussed a range of topics Tuesday with Nitrogen CEO Aaron Klein during Nitrogen's annual conference.

Calculated Risk

OCTOBER 4, 2023

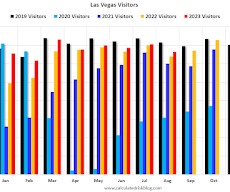

From the Las Vegas Visitor Authority: August 2023 Las Vegas Visitor Statistics August was a solid month with more than 3.3M visitors as weekend occupancy was largely on par with last year while midweek saw notable gains supported in part by a strengthening convention segment that included recurring shows such as ASD Market Week as well the Summer 2023 Las Vegas Market show at World Market Center which fell in August this year vs.

Wealth Management

OCTOBER 4, 2023

Clients join in to interview competing companies.

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

Calculated Risk

OCTOBER 4, 2023

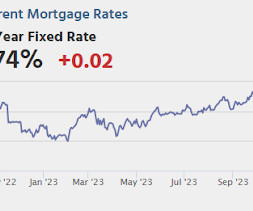

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios. Thursday: • At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 208 thousand initial claims, up from 204 thousand last week. • Also at 8:30 AM, Trade Balance report for August from the Census Bureau. The consensus is for the deficit to be $65.1 billion in August, from $65.0 billion in July.

Wealth Management

OCTOBER 4, 2023

The founder of Palantir, Addepar and Opto Investments discusses working with the government, his new alts investment platform and the complexities of RIAs.

Calculated Risk

OCTOBER 4, 2023

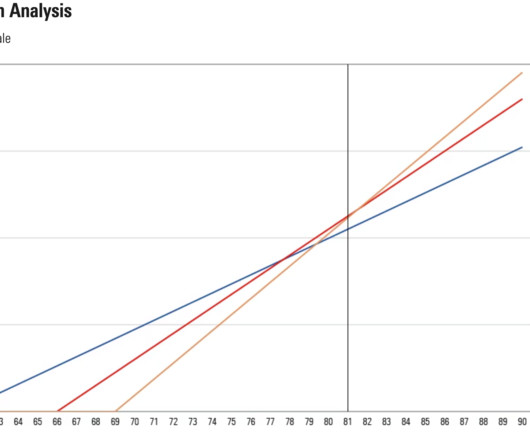

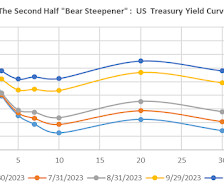

Today, in the Calculated Risk Real Estate Newsletter: Lawler: The Second Half “Bear Steepener”: Higher for Longer, a Higher R*, and A Rising Term Premium A brief excerpt: NOTE: This is technical and related to these earlier notes (and mortgage rates): August 18th: Lawler: Is The “Natural” Rate of Interest Back to Pre-Financial Crisis Levels? August 15th: The "New Normal" Mortgage Rate Range From housing economist Tom Lawler: Below is a chart showing the Treasury yield curve from 1 to 30 years ye

Wealth Management

OCTOBER 4, 2023

Advisors look toward holistic client-focused strategies with converging retirement planning and wealth management.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Calculated Risk

OCTOBER 4, 2023

Workers on strike during the reference week are not counted as employed in the BLS employment report. Every month, on the Friday before the release of the employment report, the BLS releases the CES Strike Report showing the number of workers on strike during the reference period. Click on chart for larger image. In September, 17,700 workers were on strike, mostly the now settled writers' strike.

Wealth Management

OCTOBER 4, 2023

Open, honest and candid discussions about the latest news in the RPA industry.

Calculated Risk

OCTOBER 4, 2023

(Posted with permission). The ISM® Services index was at 53.6%, down from 54.5% last month. The employment index decreased to 53.4%, from 54.7%. Note: Above 50 indicates expansion, below 50 in contraction. From the Institute for Supply Management: Services PMI® at 53.6%; September 2023 Services ISM® Report On Business® Economic activity in the services sector expanded in September for the ninth consecutive month as the Services PMI® registered 53.6 percent, say the nation's purchasing and supply

Wealth Management

OCTOBER 4, 2023

What selling life insurance taught me about becoming a comprehensive wealth advisor and facilitator.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

A Wealth of Common Sense

OCTOBER 4, 2023

Today’s Animal Spirits is brought to you by Nuveen and Kaplan Schweser: See here for more information on investing with Nuveen See here to save 10% on Schweser CFA exam prep materials On today’s show, we discuss: The worlds priciest stock market Why a US recession is still likely – and coming soon Only richest 20% of Americans still have excess pandemic savings Americans are still spending like th.

Wealth Management

OCTOBER 4, 2023

A family practice leaves Raymond James to launch an independent RIA, Edelman Financial Engines picks up a $225M firm in its first deal of the year and six other announcements this week.

Advisor Perspectives

OCTOBER 4, 2023

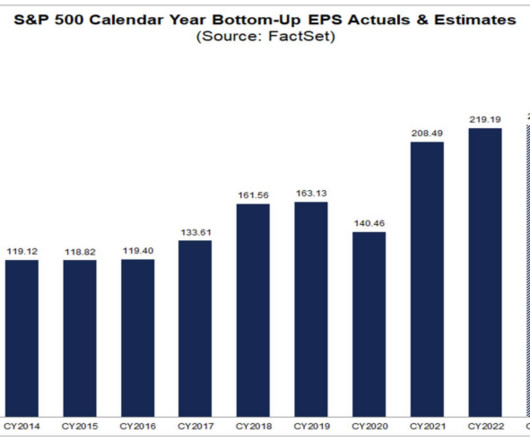

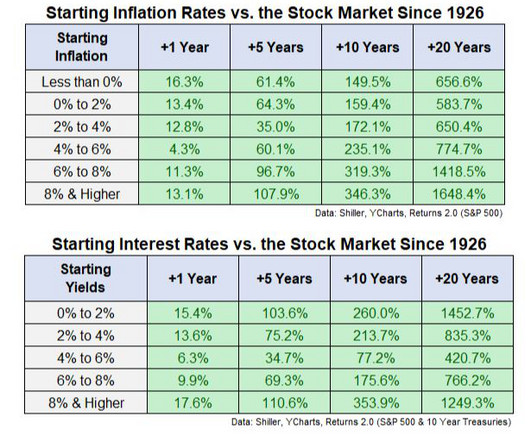

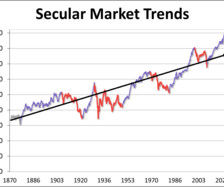

The S&P 500 real monthly averages of daily closes peaked in November of 2021 and 2022 was a bear market. Let's examine the past to broaden our understanding of the range of historical trends in market performance.

Trade Brains

OCTOBER 4, 2023

Top Stocks Held by Quant Small-Cap Fund : Quant Mutual Fund-Quant Small Cap mutual fund product is the Quant Small Cap Fund Direct Plan-Growth. This fund was established on January 1, 2013. As of June 30, 2023, Quant Small Cap Fund Direct Plan-Growth had 8,075 Crores in assets under management (AUM), making it a medium-sized fund in its category. Quant mutual fund Quant small cap fund publicly owns 29 stocks with a net worth of over Rs. 3,601.0 Cr, according to corporate shareholdings declared f

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Let's personalize your content