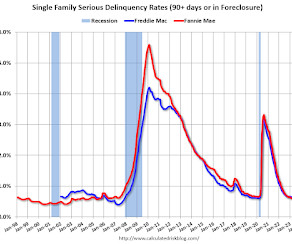

Fannie Mae: Mortgage Serious Delinquency Rate Decreased in March

Calculated Risk

APRIL 28, 2023

Fannie Mae reported that the Single-Family Serious Delinquency decreased to 0.59% in March from 0.62% in February. The serious delinquency rate is down from 1.01% in March 2022. This is below the pre-pandemic levels. These are mortgage loans that are "three monthly payments or more past due or in foreclosure". The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59% following the housing bubble and peaked at 3.32% in August 2020 during the pandemic.

Let's personalize your content