Will This Be Another Disastrous Year for the FAFSA?

Wealth Management

OCTOBER 18, 2024

The Department of Education already announced that the rollout will be delayed for a second year in a row.

Wealth Management

OCTOBER 18, 2024

The Department of Education already announced that the rollout will be delayed for a second year in a row.

Calculated Risk

OCTOBER 18, 2024

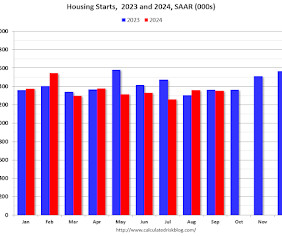

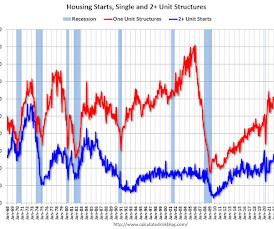

Today, in the Calculated Risk Real Estate Newsletter: Housing Starts Decreased to 1.354 million Annual Rate in September A brief excerpt: Total housing starts in September were slightly above expectations and starts in July and August were revised up. A solid report. The third graph shows the month-to-month comparison for total starts between 2023 (blue) and 2024 (red).

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

OCTOBER 18, 2024

Separate lawsuits have LPL Financial and Ameriprise Financial battling over advisors leaving, claiming breach of contract and misuse of confidential client information.

Abnormal Returns

OCTOBER 18, 2024

Companies Marc Rubenstein, "PayPal Holdings Inc is not a bank and doesn’t enjoy any of the protections that are afforded to banks." (netinterest.co) Why CVS ($CVS) and Walgreen's ($WBA) are struggling. (msnbc.com) There's Netflix ($NFLX) and everyone else. (sherwood.news) Spirit Airlines kinda sucks, but you will miss it when it is gone. (slate.com) AI OpenAI's current cash isn't going to last long.

Advertisement

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

Wealth Management

OCTOBER 18, 2024

Sanctuary announced several new capabilities at its Oasis conference in Hollywood, Fla., as it continues to integrate the tru Independence acquisition.

Nerd's Eye View

OCTOBER 18, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that Charles Schwab has revealed changes to its technology offerings in the wake of its merger with TD Ameritrade, bringing over several popular TD tools, including portfolio rebalancing tool iRebal, its Model Market Center model management service, and its trading platform thinkpipes, likely in an effort to keep former TD users (many of whom were accustomed to this software) o

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Calculated Risk

OCTOBER 18, 2024

From the Census Bureau: Permits, Starts and Completions Housing Starts: Privately-owned housing starts in September were at a seasonally adjusted annual rate of 1,354,000. This is 0.5 percent below the revised August estimate of 1,361,000 and is 0.7 percent below the September 2023 rate of 1,363,000. Single-family housing starts in September were at a rate of 1,027,000; this is 2.7 percent above the revised August figure of 1,000,000.

Wealth Management

OCTOBER 18, 2024

Tidal has filed for eight new so-called pair trades — which go long and short on two opposing stocks — in the ETF wrapper and under a trademarked “Battleshares” tag.

Calculated Risk

OCTOBER 18, 2024

From BofA: Since our last weekly publication, our 3Q GDP tracking estimate increased by four-tenths to 3.0% q/q saar. [Oct 18th estimate] emphasis added From Goldman: On net, we lowered our Q3 GDP tracking estimate by 0.1pp to +3.1% (quarter-over-quarter annualized). [Oct 17th estimate] And from the Atlanta Fed: GDPNow The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2024 is 3.4 percent on October 18, unchanged from October 17 after rounding

Wealth Management

OCTOBER 18, 2024

Tuesday, November 19, 2024 | 2:00 PM ET

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

The Big Picture

OCTOBER 18, 2024

This week, we speak with Brian Higgins , co-founder, managing partner and co-portfolio manager of King Street. Higgins focuses on handling distressed securities, real estate investments and credit. He is chair of the Management Committee, Global Investment Committee, Real Estate Investment Committee, and is a member of the Risk Committee and Operating Committee.

Wealth Management

OCTOBER 18, 2024

Fossils are fetching high prices at auction, as anonymous buyers bid millions for a piece of history and a dash of celebrity. But none of that money serves science.

Calculated Risk

OCTOBER 18, 2024

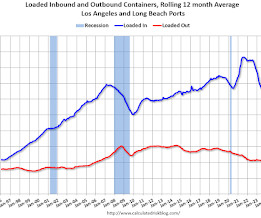

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic. The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

A Wealth of Common Sense

OCTOBER 18, 2024

It’s estimated baby boomers will pass down more than $80 trillion to their millennial and Gen X heirs over the next 20 years. This is going to be the greatest wealth transfer the world has ever seen. The timing of these transfers will be a hotly debated topic for many families. Baby boomers were born between 1946 and 1964, making them in the range of 60-78 years old.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Alpha Architect

OCTOBER 18, 2024

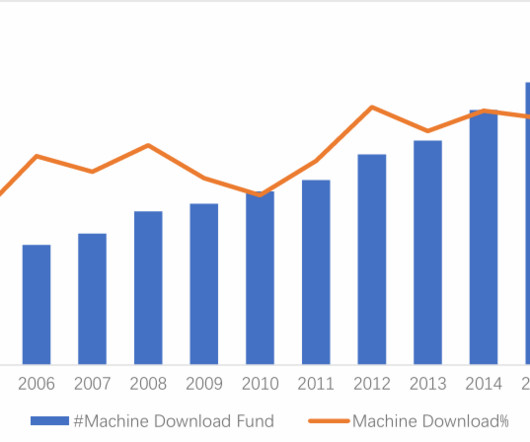

There’s no reason to think that the use of AI should lead to persistent fund outperformance, with any advantages gained likely being short lived. Artificial Intelligence, Textual Analysis and Hedge Fund Performance was originally published at Alpha Architect. Please read the Alpha Architect disclosures at your convenience.

Discipline Funds

OCTOBER 18, 2024

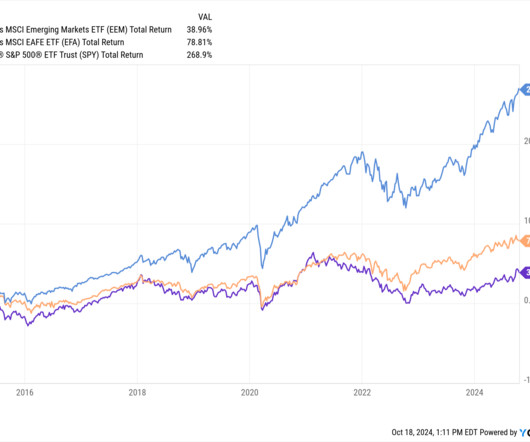

Here are some things I think I am thinking about. 1) The stock market boom/bust cycle. How should we think about the bull market in stocks in the context of its Covid era rollercoaster ride? Should we get the urge to chase the current bull market? Should we get more defensive in preparation for another bust? The simple answer is that the short-term movements of the stock market should be irrelevant to your financial plan assuming you have a well constructed temporally diversified portfolio.

Trade Brains

OCTOBER 18, 2024

Accenture’s recent financial results and business outlook have set an intriguing benchmark for the Indian IT industry. As a global leader in consulting and technology services, Accenture’s performance often signals trends that ripple through the sector. Indian IT giants like Tata Consultancy Services (TCS) and Infosys closely watch Accenture’s results to gauge market conditions and client spending patterns.

Carson Wealth

OCTOBER 18, 2024

This week on Take 5, Ryan Detrick, Chief Market Strategist at Carson Group, and Sonu Varghese, VP, Global Macro Strategist at Carson Group, discuss key factors such as rising inflation, the surge in small- and mid-cap stocks, and why investors remain calm despite higher CPI and PPI numbers. As we move into Q4, they also explore: Whether seasonal trends might help to alleviate inflation How hurricanes could impact the Fed’s future decisions How the election could sway the markets And more!

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Advisor Perspectives

OCTOBER 18, 2024

The demographic makeup of America is changing. Latinos now make up almost 20 percent of Americans, up from seven percent in 1980. But while the number of Latino Americans continues to grow, only about four percent of financial advisors identify as Latino.

Validea

OCTOBER 18, 2024

Joel Greenblatt’s Magic Formula is an investment strategy outlined in his book “The Little Book That Beats the Market.” The formula aims to identify high-quality companies trading at attractive valuations. It focuses on two key metrics: return on capital and earnings yield. The idea is to find companies that are both profitable (high return on capital) and undervalued (high earnings yield) relative to other companies in the market.

Advisor Perspectives

OCTOBER 18, 2024

Around 110 million years ago, a dinosaur went hunting. Stalking through ferns along a riverbank, he twitched his nose to the wind and caught scent of a plant-eater ahead. His head darted upward. His eyes locked on the target. The dinosaur drew his sickle claws upward, ready to make a lethal strike. But something wasn’t right.

Validea

OCTOBER 18, 2024

Warren Buffett and Peter Lynch are two of the most renowned investors of all time, each with their own distinct approaches to finding great companies. While their strategies differ in many ways, there are currently five stocks that manage to satisfy the criteria of both investing legends, according to Validea’s guru-based models. Let’s examine why these companies have caught the attention of both the Oracle of Omaha and the mutual fund maestro.

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

Advisor Perspectives

OCTOBER 18, 2024

Sales of Apple Inc.’s newest iPhones in China are up 20% in their first three weeks compared with 2023’s model, a positive sign for a device that struggled this year to gain traction in the world’s largest smartphone market.

Carson Wealth

OCTOBER 18, 2024

Carson Wealth’s Russ Nieland CFP®, AIF®Managing Director, Partner and Wealth Advisor and Josh Volgarino , CFP Ⓡ , ChFC Ⓡ , WMCP Ⓡ , CExP Ⓡ Wealth Advisor discuss strategies of Exit Planning. The post Exit Planning appeared first on Carson Wealth.

Advisor Perspectives

OCTOBER 18, 2024

We’ve had several weeks of strong data since the Federal Reserve cut policy rates by a half percentage point. It started with a surprisingly robust jobs report, followed by a janky and above-expectations inflation report.

Trade Brains

OCTOBER 18, 2024

The Indian investment banking landscape is undergoing significant changes. From its historical roots to recent developments, the sector is evolving rapidly. Moreover, the introduction of AI and other technological advancements is reshaping the industry’s future. A Brief History and Current State Investment banking in India traces its origins to the 19th century.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Advisor Perspectives

OCTOBER 18, 2024

Navigating space is hard. It’s expensive, complex, time-consuming and dangerous. And yet you have to hand it to Elon Musk: His SpaceX firm makes it look easy.

Trade Brains

OCTOBER 18, 2024

Bitcoin is the most well-known cryptocurrency, having come a long way since its debut on the deep web in 2009. Its price has surged drastically since then, and now we are witnessing increasing institutional involvement in the crypto ecosystem. Cryptocurrency adoption has grown, and many traditional market players are stepping in, including through the recent launch of Bitcoin ETFs, which, despite a decrease in inflows this September, remain a success.

Advisor Perspectives

OCTOBER 18, 2024

In China’s resurgent stock market, there’s a lesson for investors about the perils of market timing.

Truemind Capital

OCTOBER 18, 2024

Think of navigating a river—sometimes the water is calm and steady, other times it’s turbulent, but at the end, there’s a rewarding view. That’s exactly what we’ve seen in India’s financial markets in the quarter ending September 2024. It’s been a mix of strength and growth, even as global uncertainty ripples through. Here is what’s happening currently- Stock markets are rising Bond Prices are increasing / Bond Yields are falling Gold is trending upwards Real Estate Prices are inching upwards AL

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Let's personalize your content