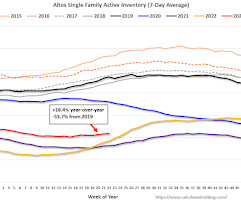

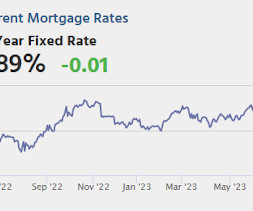

Housing June 5th Weekly Update: Inventory Increased 0.7% Week-over-week

Calculated Risk

JUNE 5, 2023

Altos reports that active single-family inventory was up 0.7% week-over-week. Click on graph for larger image. This inventory graph is courtesy of Altos Research. As of June 2nd, inventory was at 436 thousand (7-day average), compared to 433 thousand the prior week. Year-to-date, inventory is down 11.1%. And inventory is up 7.6% from the seasonal bottom seven weeks ago.

Let's personalize your content