Top clicks this week on Abnormal Returns

Abnormal Returns

OCTOBER 8, 2023

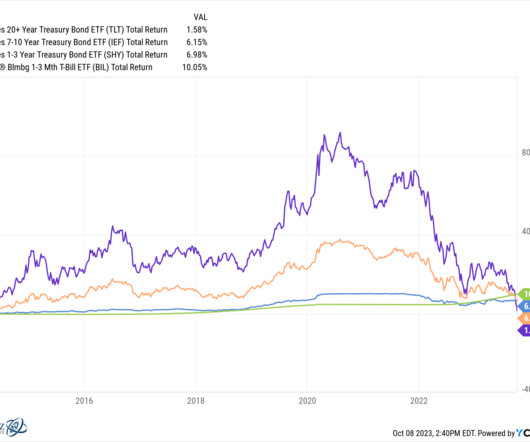

Top clicks this week The stock market is coming to terms with higher interest rates (for longer). (awealthofcommonsense.com) Why simplicity in investing can help reduce errors. (mrzepczynski.blogspot.com) Why some people like to research and hold individual stocks instead of funds. (investmenttalk.co) How major asset classes performed in September 2023.

Let's personalize your content