Rethinking Wealth Preservation in a Declining Dollar Era

Wealth Management

JUNE 4, 2025

Growing US fiscal pressures prompt advisors to consider Swiss-based investments as a hedge against dollar devaluation and to preserve multigenerational wealth.

Wealth Management

JUNE 4, 2025

Growing US fiscal pressures prompt advisors to consider Swiss-based investments as a hedge against dollar devaluation and to preserve multigenerational wealth.

Nerd's Eye View

JUNE 4, 2025

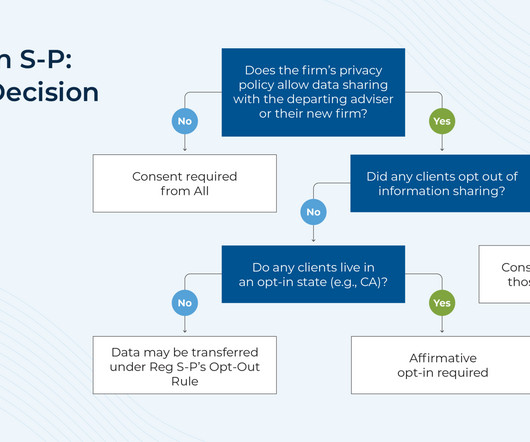

When a financial advisor transitions from one firm to another, they're often offered incentives by the new firm based on how much client revenue they bring with them. The challenge, however, is that advisors generally don't have the legal authority to simply transfer clients to a new firm. Because client relationships are technically "owned" by the firm – not the individual advisor – any transition requires clients to take action to shift from one firm to the other.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

JUNE 4, 2025

Billionaire David Geffen files for divorce from David Armstrong after less than two years, revealing how estate planning can safeguard wealth.

Calculated Risk

JUNE 4, 2025

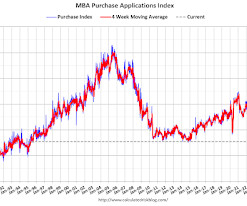

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey Mortgage applications decreased 3.9 percent from one week earlier, according to data from the Mortgage Bankers Associations (MBA) Weekly Mortgage Applications Survey for the week ending May 30, 2025. This weeks results included an adjustment for the Memorial Day holiday. The Market Composite Index, a measure of mortgage loan application volume, decreased 3.9 percent on a seasonally adjusted basis from one week earlier.

Advertisement

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

Wealth Management

JUNE 4, 2025

A Morningstar analyst discusses whether financial advisors will reap benefits from investing in vehicles that combine public and private assets.

Calculated Risk

JUNE 4, 2025

From ADP: ADP National Employment Report: Private Sector Employment Increased by 37,000 Jobs in May; Annual Pay was Up 4.5% After a strong start to the year, hiring is losing momentum , said Dr. Nela Richardson, chief economist, ADP. Pay growth, however, was little changed in May, holding at robust levels for both job-stayers and job-changers. emphasis added This was well below the consensus forecast of 120,000.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Calculated Risk

JUNE 4, 2025

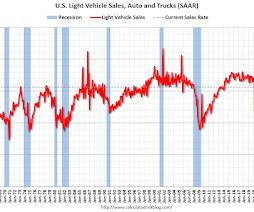

This graph shows heavy truck sales since 1967 using data from the BEA. The dashed line is the May 2025 seasonally adjusted annual sales rate (SAAR) of 446 thousand. Heavy truck sales really collapsed during the great recession, falling to a low of 180 thousand SAAR in May 2009. Then heavy truck sales increased to a new record high of 570 thousand SAAR in April 2019.

Wealth Management

JUNE 4, 2025

Key steps for executors handling art and tangible property in estates, from initial inventory to valuation and disposition strategies.

Advisor Perspectives

JUNE 4, 2025

The “sell and stay” approach in wealth management mergers and acquisitions (M&A) is a transformative trend reshaping how advisors approach their succession planning and business transitions.

Wealth Management

JUNE 4, 2025

Merchant Investment Management seeks to expand its network of service providers with the addition of Rich Policastro, formerly of Hightower, as managing director.

Speaker: Victor C. Barnes, CPA, MBA

In the climb from contributor to leader, the rules quietly change. If you’re aiming for the summit, the air gets thinner—and what got you here won’t be enough to get you to the top (a concept first popularized by Marshall Goldsmith in his book What Got You Here Won’t Get You There ). What made you successful early in your finance career—technical accuracy, sharp analysis, flawless execution—won’t be what carries you to the next level.

Fortune Financial

JUNE 4, 2025

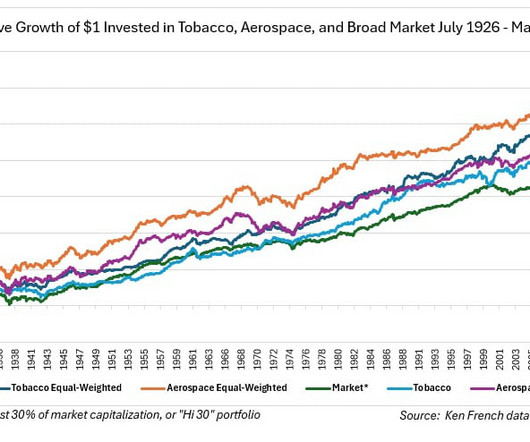

As an investor, imagine if you could invest in an industry that enjoys the pricing power and regulatory barriers enjoyed by tobacco incumbents as well as the growth prospects of high tech? That would be a kind of investment Nirvana, wouldn’t it? Well, it just so happens that such an industry exists, and it is the multilayered aerospace industry.

Wealth Management

JUNE 4, 2025

A survey from the Financial Planning Association and the Journal of Financial Planning shows a spike in advisors using alternative investments.

WiserAdvisor

JUNE 4, 2025

Apart from new laws and changes in regulations, it is also important to pay attention to emerging investment trendsevery year. The financial planning industry is constantly undergoing change. However, the shift in recent years has been particularly noteworthy and is likely to evolve even more in the future, given the moment in history we are experiencing.

Wealth Management

JUNE 4, 2025

Also at this years BNY Pershing INSITE conference, KKR, which has partnered on a private/public fund with Capital Group, predicts that wealth management will eventually drive 30% to 50% of the firms overall revenue.

Speaker: Kim Beynon, CPA, CGMA, PMP

The most overlooked, yet most critical, element of transformation is preparing people for change. Automation and AI aren't just technical upgrades, they’re cultural shifts which can challenge identities. That’s why change management isn’t a side project—it’s the foundation. In finance, where precision and process rule, navigating change can feel especially disruptive.

Calculated Risk

JUNE 4, 2025

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios. Thursday: At 8:30 AM ET, Trade Balance report for April from the Census Bureau. The consensus is the trade deficit to be $117.3 billion. The U.S. trade deficit was at $140.5 Billion in March. Also at 8:30 AM, The initial weekly unemployment claims report will be released.

Wealth Management

JUNE 4, 2025

Analyze how the proposed Big Beautiful Bill affects ETFs in healthcare, clean energy and defense sectors, with potential market implications for investors.

Calculated Risk

JUNE 4, 2025

Fed's Beige Book Reports across the twelve Federal Reserve Districts indicate that economic activity has declined slightly since the previous report. Half of the Districts reported slight to moderate declines in activity, three Districts reported no change, and three Districts reported slight growth. All Districts reported elevated levels of economic and policy uncertainty, which have led to hesitancy and a cautious approach to business and household decisions.

Wealth Management

JUNE 4, 2025

The highest court denied the Utah-based brokers petition to reconsider the federal court decision allowing FINRAs enforcement proceedings against the firm to continue.

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Calculated Risk

JUNE 4, 2025

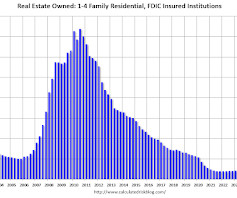

Today, in the Calculated Risk Real Estate Newsletter: Q1 Update: Delinquencies, Foreclosures and REO A brief excerpt: This entire housing cycle Ive argued that we would NOT see a surge in foreclosures that would significantly impact house prices (as happened following the housing bubble) for two key reasons: 1) mortgage lending has been solid, and 2) most homeowners have substantial equity in their homes.

Wealth Management

JUNE 4, 2025

Ryan Nauman and Envestnet PMC's Brooks Friederich discuss the blurring lines between active versus passive investment management, the importance of both approaches in a diversified investment portfolio, and the impact of innovative financial tools such as active ETFs.

Advisor Perspectives

JUNE 4, 2025

US job openings unexpectedly rose in April in a fairly broad advance and hiring picked up, indicating demand for workers remains healthy despite heightened economic uncertainty.

Wealth Management

JUNE 4, 2025

As the RIA M&A market evolves, market pricing is getting harder to set as valuations become more nuanced, according to a panel at this years BNY Pershing INSITE conference.

Speaker: Cheryl J. Muldrew-McMurtry

Distributed finance teams are rewriting how the back-office runs, and attackers are taking notes. Disconnected workflows, process blind spots, and rising cyber threats are more than just growing pains—they’re liabilities. The challenge isn’t just going remote. It’s building resilient systems that protect accuracy, control, and speed across every transaction and touchpoint.

Advisor Perspectives

JUNE 4, 2025

America’s holiday from history is over: Debt matters again. It is not just that the national debt is so big it cannot be ignored.

Fintoo

JUNE 4, 2025

Market Commentary Global markets – US indices closed mixed on Wednesday over weak economic data. Dow Jones closed negative by 0.2 pct. While Nasdaq rose by 0.3 pct. Global Indices % Change Last Close 1 day YTD Dow Jones 42,427 -0.2 -0.3 Nasdaq 19,460 0.3 0.8 Hang Seng 23,879 1.0 19.0 Nikkei 37,658 […] The post Market Morning Notes For 5th June 2025 appeared first on Fintoo Blog.

Advisor Perspectives

JUNE 4, 2025

The U.S. Dollar Index is at a critical inflection point, and how it behaves from here will have a major impact on the direction of gold, silver, and commodities.

Tobias Financial

JUNE 4, 2025

Were excited to share that our CEO, Marianela Collado, CPA/PFS, CFP, CDS will be serving as a panelist at the National Association of Women Business Owners (NAWBO) Womens Business Conference, taking place June 58, 2025, in Washington, D.C. This year marks a historic milestone, NAWBOs 50th anniversary, and the celebration will return to where it all began in 1975.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Advisor Perspectives

JUNE 4, 2025

After more than a half-decade cleaning up Wells Fargo & Co.’s scandals, the chief executive officer has cleared away the firm’s biggest impediment to growth: the Federal Reserve’s seven-year-old cap on assets.

NAIFA Advisor Today

JUNE 4, 2025

Juli McNeely, CFP, CLU, LUTCF, is a seasoned financial services professional with over 25 years of experience. Through her consulting work and speaking engagements, she continues to empower financial professionals to define success on their own terms and excel in their careers. In 2014, Juli made history as the first female president of NAIFA. She is also the accomplished author of No Necktie Needed: A Womans Guide to Success in Financial Services , which offers insights into achieving a balance

Advisor Perspectives

JUNE 4, 2025

Mortgage rates last week climbed to their highest levels since the beginning of the year on elevated economic risks. With markets still hopeful of at least one interest rate cut in the second half, the real estate sector stands poised to bounce back in a lower rate environment.

Carson Wealth

JUNE 4, 2025

The Peanut Butter Manifesto written by a Yahoo executive in 2006 gave us the term Peanut Butter Approach. Its a business term that describes spreading anythingmoney, energy, timetoo far and too thin to be effective or useful. Dropping change in bellringers buckets, rounding up your purchase to benefit a local sheltercharitable giving can become diffuse quickly.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Let's personalize your content