Tips From the Pros: Estate Planning for Middle Rich Clients

Wealth Management

NOVEMBER 28, 2023

Stick to the basics.

Wealth Management

NOVEMBER 28, 2023

Stick to the basics.

Calculated Risk

NOVEMBER 28, 2023

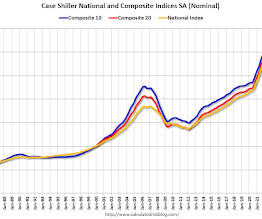

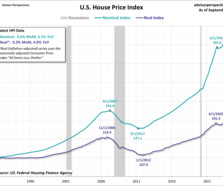

S&P/Case-Shiller released the monthly Home Price Indices for September ("September" is a 3-month average of July, August and September closing prices). This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index. From S&P S&P CoreLogic Case-Shiller Index Continued to Trend Upward in September The S&P CoreLogic Case-Shiller U.S.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

NOVEMBER 28, 2023

The acquisition of Daniels + Tansey adds advisory, investment and tax expertise to Creative Planning.

Abnormal Returns

NOVEMBER 28, 2023

Market timing The research shows how hard it is to find a reliable market timing system. (papers.ssrn.com) Luck plays a big role in successful market calls. (ritholtz.com) Options Beware look ahead bias in option strategy tests. (papers.ssrn.com) Investors are attracted to covered call strategies for the wrong reason. (alphaarchitect.com) Alternatives How to distinguish among alternative risk premia.

Advertisement

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

Wealth Management

NOVEMBER 28, 2023

With a niche focus on Taft-Hartley retirement plan sponsors, Mammini Company left Lincoln Investments to support an ambitious growth plan.

Nerd's Eye View

NOVEMBER 28, 2023

Welcome back to the 361st episode of the Financial Advisor Success Podcast ! My guest on today's podcast is Peter Tiboris. Peter is a Partner of Park Avenue Capital, an advisory firm affiliated with Northwestern Mutual based in New York City, that oversees $2.4 billion in assets under management for 1,377 client households. What's unique about Peter, though, is how he and his business partner have built up their firm through a combination of organic growth, and a series of mergers and acquisitio

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Calculated Risk

NOVEMBER 28, 2023

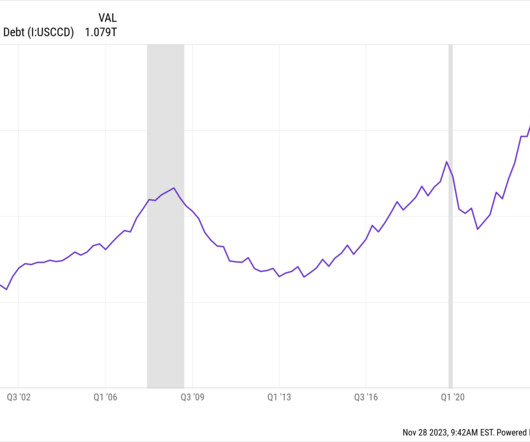

High-Cost Areas increase to $1,149,825. Here is the official announcement from the FHFA: FHFA Announces Conforming Loan Limit Values for 2024 The Federal Housing Finance Agency (FHFA) today announced the conforming loan limit values (CLLs) for mortgages Fannie Mae and Freddie Mac (the Enterprises) will acquire in 2024. In most of the United States, the 2024 CLL value for one-unit properties will be $766,550 , an increase of $40,350 from 2023.

Wealth Management

NOVEMBER 28, 2023

Steven Schwarzman indicated Blackstone will be looking at real estate buying opportunities for data centers, warehouses and student housing across Europe, reported Bloomberg. CoStar warned that investors shouldn’t expect commercial real estate prices to bottom out in the near future.

Calculated Risk

NOVEMBER 28, 2023

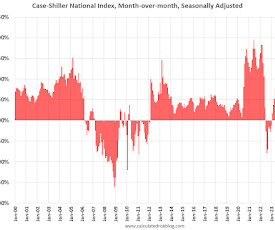

Today, in the Calculated Risk Real Estate Newsletter: Case-Shiller: National House Price Index Up 3.9% year-over-year in September; New all-time High Excerpt: S&P/Case-Shiller released the monthly Home Price Indices for September ("September" is a 3-month average of July, August and September closing prices). September closing prices include some contracts signed in May, so there is a significant lag to this data.

Wealth Management

NOVEMBER 28, 2023

Sassi Mizrahi was sentenced to more than seven years in prison after being found guilty of five counts of wire fraud related to helping his brother defraud at least 40 investors, according to the Justice Department.

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Calculated Risk

NOVEMBER 28, 2023

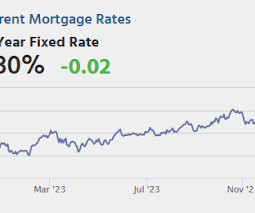

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios. Wednesday: • At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index. • At 8:30 AM, Gross Domestic Product (Second Estimate) and Corporate Profits (Preliminary), 3rd Quarter 2023. The consensus is that real GDP increased 5.0% annualized in Q3, up from the advance estimate of 4.9% in Q3. • At 2:00 PM, the Federal Reserve Beige Book , an informal r

Wealth Management

NOVEMBER 28, 2023

Legal Editor Dawn S. Markowitz discusses this month's cover art.

The Reformed Broker

NOVEMBER 28, 2023

Join Downtown Josh Brown and Michael Batnick for another round of What Are Your Thoughts? On this week’s episode, Josh and Michael discuss the biggest topics in investing and finance, including: ►Year End Rally – Choose your weapon – tech almost always leads bull markets. ►Calm Breaks Out – One man’s calm is another man’s euphoria?

Wealth Management

NOVEMBER 28, 2023

The acquisition of Sevenich, Butler, Gerlach & Brazil is the first in an M&A strategy focused on accounting firms and relationship managers.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

The Reformed Broker

NOVEMBER 28, 2023

The new online home of Ritholtz Wealth Management has (finally) arrived! It’s ironic that we’re a firm with ten content creators and all these big blogs but we’ve never really paid much attention to what our corporate site looks like or how it works. It was just always an afterthought. Until today. Our old site was fine. It just didn’t do anything for anyone.

Wealth Management

NOVEMBER 28, 2023

Envestnet's Brooks Friederich is leading the firm's model-portfolio division with 2,000 customized products from some 150 asset managers.

A Wealth of Common Sense

NOVEMBER 28, 2023

Some questions I’m pondering about the economy at the moment: 1. Why do people keep spending money if the economy is so terrible? We’re breaking records for holiday travel: And spending money on Black Friday like crazy: Granted, this is holiday travel and spending. It’s not the normal course of action. But just look at the inflation-adjusted spending for consumers on goods and services: Lots of people.

Wealth Management

NOVEMBER 28, 2023

Getting it right; fixing up the other guy’s mistakes.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Alpha Architect

NOVEMBER 28, 2023

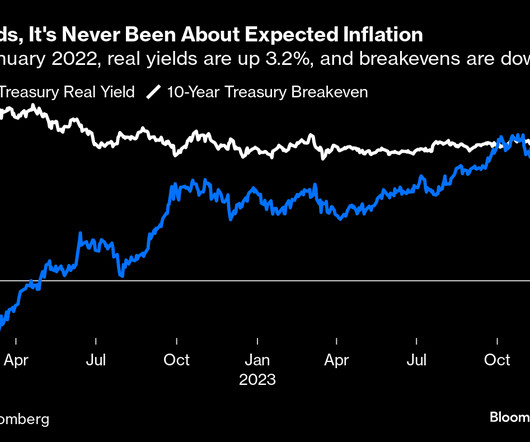

As pundits wrestle over the cause, implications, and sustainability of the recent massive moves in interest rates, I’ll instead delve into the two terms most often blamed for these shifts in rates: R-star and the Term Structure Premium. Unfortunately, what most want—a measure of them—is unknowable. But we can benefit from understanding the theories and models behind these terms.

Dear Mr. Market

NOVEMBER 28, 2023

Dear Mr. Market: In the world of finance and investing, the passing of a visionary figure leaves an indelible mark on the landscape they helped shape. Today, we bid farewell to an icon, a man whose wisdom and wit transcended the realms of business and life itself. Charlie Munger, the renowned investor, philanthropist, right hand man of Warren Buffett and Vice Chairman of Berkshire Hathaway, passed away today, but his legacy endures through the profound insights he shared with the world.

Wealth Management

NOVEMBER 28, 2023

Careful drafting can prevent lawsuits.

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

Walkner Condon Financial Advisors

NOVEMBER 28, 2023

What are I Bonds? I Bonds are a type of government savings bond issued by the United States Department of the Treasury. They are a low-risk investment vehicle designed to help individuals save money over the long term and protect from inflation. They are backed by the U.S. government, making them one of the safest investments available. How is the interest rate on I Bonds calculated?

Wealth Management

NOVEMBER 28, 2023

In the world of philanthropy, there are “bargains” as well, but they may be lost without proper documentation.

Million Dollar Round Table (MDRT)

NOVEMBER 28, 2023

By Jenny Brown, CFP, FChFP Marketing and branding are about your public identity, or what others think of you and your business. Even your lack of an online presence speaks volumes about your branding. Perception matters in business. When you have a brand you’re proud of that authentically represents you, you attract lifelong clients who advocate for your business.

Wealth Management

NOVEMBER 28, 2023

An argument as to why fiduciaries can’t ignore this analysis.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Integrity Financial Planning

NOVEMBER 28, 2023

Working with a financial advisor is a big deal. In the same way a good doctor may know key aspects of your personal health, a good financial advisor will know the crucial aspects of your financial situation–all to help you improve your financial health and retirement longevity. That’s why it’s important to know what to expect when working with a financial advisor and understand where and how your advisor can improve your finances.

Wealth Management

NOVEMBER 28, 2023

Focus on preventing an inadvertent end to S corp status.

Advisor Perspectives

NOVEMBER 28, 2023

The Federal Housing Finance Agency (FHFA) house price index (HPI) continued to increase in September, coming in at 414.8. U.S. house prices increased by 0.6% from the previous month and by 6.1% from one year ago. After adjusting for inflation, the real index is up 0.4% month-over-month and up 4.0% year-over-year.

Wealth Management

NOVEMBER 28, 2023

Use it or lose it.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Let's personalize your content