Assessing the State of Commercial Real Estate Debt

Wealth Management

OCTOBER 1, 2023

MSCI Real Assets’ new report looks at the capital availability trends in the commercial real estate sector.

Wealth Management

OCTOBER 1, 2023

MSCI Real Assets’ new report looks at the capital availability trends in the commercial real estate sector.

Abnormal Returns

OCTOBER 1, 2023

Markets The S&P 500 was down 4.77% in September 2023. (on.spdji.com) There's no shortage of stuff to be worried about at the moment. (tker.co) Rates The yield curve is finally steepening. (awealthofcommonsense.com) Higher interest rates mean higher taxes. (marketwatch.com) Closed-end muni funds are trading at big discounts to NAV. (marketwatch.com) Finance Do you really want a private investment targeted to individual investors?

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Calculated Risk

OCTOBER 1, 2023

Weekend: • Schedule for Week of October 1, 2023 Monday: • At 10:00 AM ET, ISM Manufacturing Index for September. The consensus is for a reading of 47.8, up from 47.6 in August. • Also at 10:00 AM Construction Spending for August. The consensus is for a 0.5% increase. From CNBC: Pre-Market Data and Bloomberg futures S&P 500 futures are up 16 and DOW futures are up 110 (fair value).

Abnormal Returns

OCTOBER 1, 2023

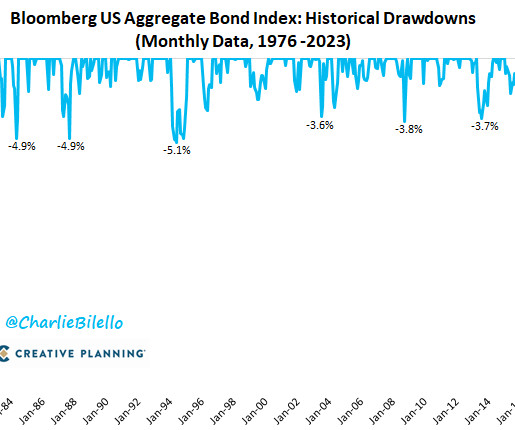

Also on the site Netflix's DVD-by-mail business is winding up. (abnormalreturns.com) Top clicks this week Individual investors win by not competing with professionals. (awealthofcommonsense.com) Why it is so hard to be a truly long term investor. (behaviouralinvestment.com) How long is too long when it comes to your bond allocation? (humbledollar.com) 5%+ T-bill yields are a welcome relief, but don't overdo it.

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Calculated Risk

OCTOBER 1, 2023

Today, in the Calculated Risk Real Estate Newsletter: Freddie Mac House Price Index Increased in August to New High; Up 4.0% Year-over-year A brief excerpt: On a year-over-year basis, the National FMHPI was up 4.0% in August , from up 3.0% YoY in July. The YoY increase peaked at 19.1% in July 2021, and for this cycle, bottomed at up 0.9% in May 2023.

A Wealth of Common Sense

OCTOBER 1, 2023

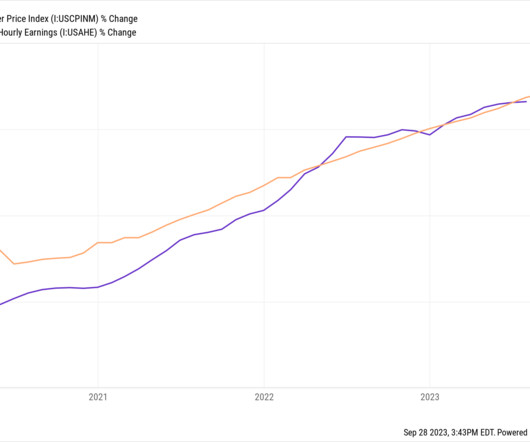

Brandolini’s law states: The amount of energy needed to refute b t is an order of magnitude bigger than the amount needed to produce it. Carlson’s law of finance is similar: The amount of energy needed to refute bad news is an order of magnitude bigger than the amount needed to produce it. It’s much easier to take bad news at face value than good news.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Million Dollar Round Table (MDRT)

OCTOBER 1, 2023

By Mike Beirne, MDRT Round the Table editor As there are many types of clients in a range of demographics, there also are a variety of ways to communicate with them. Try these three ideas from MDRT members around the world for inspiration. Allocating retirement planning I introduce asset allocation with clients by dividing retirement life into two parts: basic life and high-quality life.

The Irrelevant Investor

OCTOBER 1, 2023

Today’s Talk Your Book is brought to you by Standpoint Asset Management: On today’s show, we spoke with Eric Crittenden, CIO of Standpoint Asset Management to discuss trend following and all-weather portfolios. See here for the Content Library and here for Standpoints monthly update. On today’s show, we discuss: An introduction to trend following Market-risk dynamics over time What managed futures are Giving i.

Advisor Perspectives

OCTOBER 1, 2023

The Chinese yuan has lost nearly 6% of its value against the U.S. dollar this year, while Shanghai-listed stocks are off about 8% from their 2023 high, set back in May.

The Irrelevant Investor

OCTOBER 1, 2023

Articles What are all these GPUs being used for? Who is the customer’s customer? (By David Cahn) The company’s global parks attendance is not much higher than it was a decade ago; the primary driver of improved financial results in Disney’s Parks business has been a more than 100% increase in per capita guest spending. (By Alex Morris, paid) Life is about change (By Michael Antonelli) Some things I believe about inv.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Advisor Perspectives

OCTOBER 1, 2023

The Oakland Hills Public Use Microdata Area, or PUMA (a Census Bureau designation that I’ll explain in a moment), in Oakland, California, contains some of the most appealing urban neighborhoods in the US.

oXYGen Financial

OCTOBER 1, 2023

Advisor Perspectives

OCTOBER 1, 2023

Wall Street economists are growing more upbeat about US economic growth while acknowledging that it may require interest rates to stay higher for longer, in line with recent projections by the Federal Reserve.

The Big Picture

OCTOBER 1, 2023

Avert your eyes! My Sunday morning look at incompetency, corruption and policy failures: • Inside Sam Bankman-Fried’s Family Bubble : At Stanford Law School, Joseph Bankman and Barbara Fried specialized in ethics and social fairness. Now that their son stands accused of one of the largest financial frauds in U.S. history, they’re scrambling for legal escape routes. ( New Yorker ) • The Nasdaq 100 Is Wildly Popular.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Advisor Perspectives

OCTOBER 1, 2023

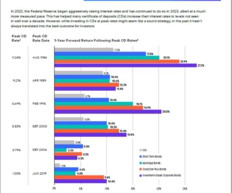

In 2022, the Federal Reserve began aggressively raising interest rates and has continued to do so in 2023, albeit at a much more measured pace. This has helped many certificate of deposits (CDs) increase their interest rates to levels not seen in well over a decade. However, while investing in CDs at peak rates might seem like a sound strategy, in the past it hasn’t always translated into the best outcome for investors.

Random Roger's Retirement Planning

OCTOBER 1, 2023

The Permanent Portfolio was devised decades ago by Harry Browne as diversified approach that favored defense and tried to ensure that no matter how bad things got, at least one holding was working. It equal weights stocks, long term bonds, gold and cash. Any back testing you might do or find will probably look pretty good because of the fantastic 40 year run that long bonds had up until the end of 2021.

Advisor Perspectives

OCTOBER 1, 2023

Change is inevitable. When those changes involve tax law, it is extremely important for clients to meet with their financial professional, tax advisor, and legal advisor to discuss any adjustments that may need to be made to their financial, retirement, or estate plan. One change that is looming is the expiration of provisions that were passed under the Tax Cuts and Jobs Act of 2017 (TCJA).

Advisor Perspectives

OCTOBER 1, 2023

As September comes to a close, Bitcoin is poised to end the quarter on a down note in its first quarterly decline this year.

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

Advisor Perspectives

OCTOBER 1, 2023

U.S. stocks typically post their best returns in the final quarter of the year. Our review of S&P 500 performance since the index’s inception in 1957 found an average Q4 uptick of 4%. (Q1 was next best at an average of 2%.

Advisor Perspectives

OCTOBER 1, 2023

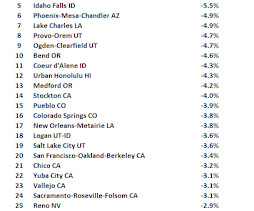

Avocado toast, hard seltzers, and Instagrammable vacations are not the reasons millennials and our Gen Z compatriots have failed to scrimp, save and budget our way into home ownership.

Advisor Perspectives

OCTOBER 1, 2023

The level of concern among retail executives over the resumption of student loan payments run the gamut from brushing it off as a non-event to bracing for a big pullback in spending.

Advisor Perspectives

OCTOBER 1, 2023

Rising real interest rates invariably trigger recessions. The residual impact of pandemic related behaviors delayed the impact in this cycle.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Advisor Perspectives

OCTOBER 1, 2023

It was the week that bond markets finally seemed to grasp what central bankers have been warning all year: higher interest rates are here to stay.

Advisor Perspectives

OCTOBER 1, 2023

We believe a mild U.S. recession is more likely than not in 2024, although a soft-landing scenario cannot be ruled out. A recession is also likely in the UK and eurozone, but appears less likely in Australia.

Advisor Perspectives

OCTOBER 1, 2023

The prevailing narrative about the U.S. economy is that it’s ‘resilient’: despite rapid rate hikes, economic growth has held up and may even be accelerating.

Advisor Perspectives

OCTOBER 1, 2023

Certain asset classes thrive or lag as economies move through one cycle to the next. Franklin Templeton Institute’s Tony Davidow shares how to analyze different economic indicators and how asset classes perform through economic regime changes.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Advisor Perspectives

OCTOBER 1, 2023

Big tech is often cited as the primary catalyst in 2023’s stock market rally. Yet at some point, the laws of market gravity will set in, and what comes up must eventually come down. As 2023 winds down, some market experts foresee pressure ahead for big tech.

Advisor Perspectives

OCTOBER 1, 2023

Active management in ETFs are gaining market share in 2023, as leading managers bring their best ideas into the ETF industry.

Let's personalize your content