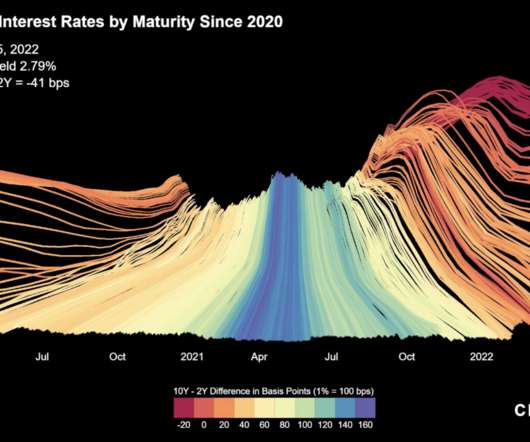

Visualizing Interest Rates Since 2020

The Big Picture

SEPTEMBER 24, 2022

? ?. Visual Capitalist : “The sharp rise in interest rates has sent shockwaves through markets. The S&P 500 Index has steadily declined ~20% year-to-date, and the NASDAQ Composite Index has fallen ~30%. Bond markets are also showing signs of uncertainty, with the 10-year minus 2-year Treasury yield curve acting as a prime example. This yield curve subtracts the return on short-term government bonds from long-term government bonds.” The post Visualizing Interest Rates Since 2020 a

Let's personalize your content