WealthStack Roundup: GeoWealth, Halo Investing Partnership Offers Structured Note Portfolios In UMAs

Wealth Management

AUGUST 10, 2023

Also, Two Sigma’s Venn launches Report Lab with help from NewEdge Wealth and ForwardLane rolls out Emerge.

Wealth Management

AUGUST 10, 2023

Also, Two Sigma’s Venn launches Report Lab with help from NewEdge Wealth and ForwardLane rolls out Emerge.

Calculated Risk

AUGUST 10, 2023

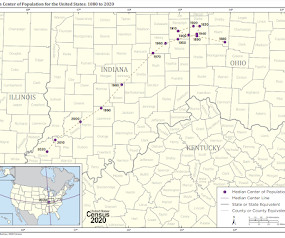

Today, in the Calculated Risk Real Estate Newsletter: The Long-Term Housing and Population Shift A brief excerpt: Something different … Here is a look at the last 50 to 60 years, and some predictions about the next 50+ years. First, here is a graph from the Census Bureau showing the Median Center of Population for the United States: 1880 to 2020 A key driver of the westward movement was the availability of water , and this boosted population growth in California, and in several other states like

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

AUGUST 10, 2023

Four ways to help clients navigate uncertainty.

Calculated Risk

AUGUST 10, 2023

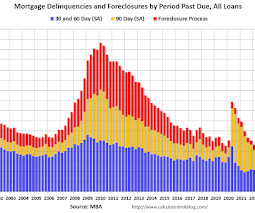

From the MBA: Mortgage Delinquencies Decrease in the Second Quarter of 2023 The delinquency rate for mortgage loans on one-to-four-unit residential properties decreased to a seasonally adjusted rate of 3.37 percent of all loans outstanding at the end of the second quarter of 2023 , according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey.

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Wealth Management

AUGUST 10, 2023

Brookfield Asset Management is aiming to raise $150 billion this year to take advantage of the buying opportunities it sees, reports The Wall Street Journal. Industry experts react to WeWork’s “going concern” warning and what it might mean for the already beleaguered office market. These are among the must reads from around the real estate investment world to end the week.

Abnormal Returns

AUGUST 10, 2023

Business Will the AI boom bail out San Francisco as a destination? (marketwatch.com) How Larry Fink, CEO of Blackrock ($BLK), became so demonized. (economist.com) Being an Airbnb ($ABNB) host is no longer easy money. (bloomberg.com) Cities When it comes to housing, supply and demand work. (nymag.com) How to make cities safe. (unchartedterritories.tomaspueyo.com) Environment Just how much have we already overfished the oceans?

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Abnormal Returns

AUGUST 10, 2023

Markets The equity risk premium in the U.S. keeps falling. (economist.com) Blame Big Tech for the surfeit of tech IPOs. (klementoninvesting.substack.com) Charlie Bilello, "Calm markets don’t make great investors." (creativeplanning.com) Meme stocks How Hertz ($HTZ) became a blueprint for future meme stocks. (youngmoney.co) Reddit doesn't seem to be driving this round of meme stocks.

Wealth Management

AUGUST 10, 2023

Institutional investors remain committed to the best-performing sectors, although there is some interest in newer subsectors, according to exclusive WMRE research.

The Big Picture

AUGUST 10, 2023

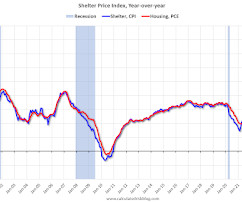

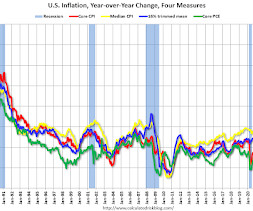

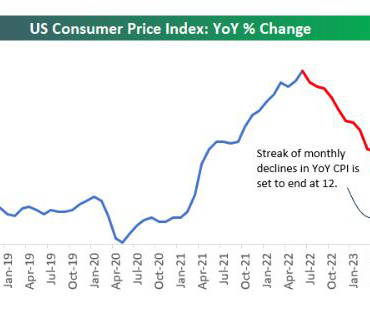

A quick note on today’s BLS report on the Consumer Price Index (CPI), which rose 0.2% in July on a seasonally adjusted basis, Over the last 12 months, the CPI has increased 3.2%. Once again, the biggest part of the gains was for shelter. As I have noted before, the entity primarily responsible for rising home prices higher is the Fed. There are numerous ways to measure price increases, and I wanted to highlight a specific approach the BLS occasionally references: “The 16% trimmed-mea

Wealth Management

AUGUST 10, 2023

The U.S. wealth business is still the sweet spot for CI Financial, growing earnings by nearly half as the firm continues integrating its acquired RIAs under the new Corient brand.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Nerd's Eye View

AUGUST 10, 2023

Financial advisors who have established and successfully built up their advisory firms over several years can often go through many stages of firm development, requiring them to hire staff and additional advisors to manage their growing clientele. When a firm becomes large enough, though, the firm owner may be compelled to consider stepping away from their long-standing work as a client-facing financial advisor into a more pronounced business leadership role to manage the growing business.

Wealth Management

AUGUST 10, 2023

Marc Horner discusses how his leap to independence allowed him to think and act more creatively, connect with clients and prospects on a new level, and ultimately grow his business in ways he could not in the wirehouse world.

Calculated Risk

AUGUST 10, 2023

Here are a few measures of inflation: The first graph is the one Fed Chair Powell had mentioned when services less rent of shelter was up 7.6% year-over-year. This has fallen sharply and is now up 3.3% YoY. Click on graph for larger image. This graph shows the YoY price change for Services and Services less rent of shelter through July 2023. Services were up 5.7% YoY as of July 2023, from 5.7% YoY in June.

Wealth Management

AUGUST 10, 2023

The financial professionals joining Cetera in the aftermath of the deal represent about $50 billion in client assets, with one Cetera exec saying the deal marked the “beginning of a new phase” for the company.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

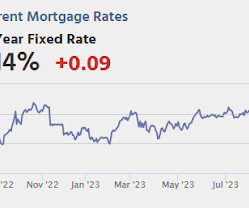

Calculated Risk

AUGUST 10, 2023

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios. Friday: • At 8:30 AM ET, The Producer Price Index for July from the BLS. The consensus is for a 0.2% increase in PPI, and a 0.2% increase in core PPI.

Wealth Management

AUGUST 10, 2023

A new analysis has calculated the potential reduction in payouts if politicians are unable to address the looming budget shortfall.

Calculated Risk

AUGUST 10, 2023

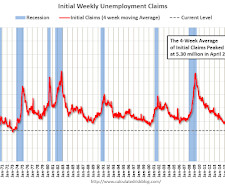

The DOL reported : In the week ending August 5, the advance figure for seasonally adjusted initial claims was 248,000 , an increase of 21,000 from the previous week's unrevised level of 227,000. The 4-week moving average was 231,000, an increase of 2,750 from the previous week's unrevised average of 228,250. emphasis added The following graph shows the 4-week moving average of weekly claims since 1971.

Wealth Management

AUGUST 10, 2023

James Gorman, 65, is running Wall Street’s most closely watched horse race, vowing to have his successor at Morgan Stanley n place in less than a year.

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

Calculated Risk

AUGUST 10, 2023

The Cleveland Fed released the median CPI and the trimmed-mean CPI. According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% in July. The 16% trimmed-mean Consumer Price Index also increased 0.2% in July. "The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report".

Wealth Management

AUGUST 10, 2023

Monday, September 11, 2023 | 4:15 PM ET

Calculated Risk

AUGUST 10, 2023

From the BLS : The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.2 percent in July on a seasonally adjusted basis, the same increase as in June, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 3.2 percent before seasonal adjustment. The index for shelter was by far the largest contributor to the monthly all items increase, accounting for over 90 percent of the increase , with the index for motor vehicle insurance also contr

Clever Girl Finance

AUGUST 10, 2023

Budgeting is one of the most important financial habits to develop. There are so many budgeting methods out there to choose from, but it’s not just creating a budget that will set you up for financial success. Instead, it’s important to learn how to budget well by using a monthly expenses list so you don’t forget about any costs. Table of contents Monthly expenses list: 29 Commonly overlooked items Expert tip: Check your bank statements for accuracy often Budgeting tips to stay on top of

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

A Wealth of Common Sense

AUGUST 10, 2023

A reader asks: I’m 38 years old and for most of my adult life I didn’t make much money. I made just enough to survive with nothing left to invest. Everything changed a few years ago. I went from making $35k per year to around $140k in about 4 years. At first I spent everything, but in the last two years I’ve started doing the opposite.

Alpha Architect

AUGUST 10, 2023

In this episode host Belle Osvath, CFP® talks with Dr. Wesley Gray the founder of ETF Architect and Alpha Architect, about how advisors can create their own ETFs which can be used to help manage client funds and taxes. They discuss the creation process, the cost, and what type of advisory practice would benefit the most from their own ETF. Wes Talks with Belle about Creating Your Own ETF was originally published at Alpha Architect.

Advisor Perspectives

AUGUST 10, 2023

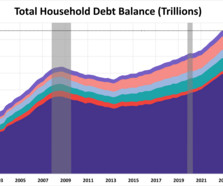

Household debt increased by $16 billion (0.1%) to $17.06 trillion in Q2 2023. Credit card balances rose by $45 billion to a series high of $1.03 trillion. Meanwhile, student loan balances fell to $1.57 trillion while mortgage balances were largely unchanged at $12.01 trillion.

Clever Girl Finance

AUGUST 10, 2023

Choosing to work in healthcare is a truly noble way to spend your working years. But over eight years of medical school and residency is a lot, leaving you to wonder if maybe you should find a profession that is less expensive (in both time and money) to get your foot in the door. Well, let’s delve into 20 high paying medical jobs without a degree!

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Advisor Perspectives

AUGUST 10, 2023

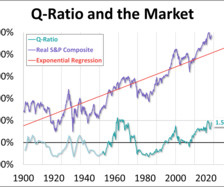

The Q Ratio is the total price of the market divided by the replacement cost of all its companies. The latest Q-ratio is at 1.56, up from June.

The Irrelevant Investor

AUGUST 10, 2023

Today’s Compound and Friends is brought to you by DWS: See here for more information on Xtrackers by DWS On today’s show, we discuss: Bridgewater culture The latest CPI reading Silver linings from inflation 1970s vs 2020s inflation Buying crypto hedge fund fueds Listen here: Charts: Recommendations: Jones Beach Amphitheater Animal Spirits Destination NBA This American Life Bob Elliot: The post The Compound and Friends: Unlimited Alpha appeared first on The Irrelevant Investor.

Ron A. Rhodes

AUGUST 10, 2023

Which of Your Varied Activities Do You Enjoy Most?

SEI

AUGUST 10, 2023

New markets. Different investors. Game-changing platforms. Read the full paper below or download the PDF for later.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Let's personalize your content