Diving into Real Estate Debt Stats with Walker & Dunlop's Willy Walker

Wealth Management

AUGUST 3, 2023

We spoke with Walker & Dunlop CEO to get his take on what's happening in the real estate lending market.

Wealth Management

AUGUST 3, 2023

We spoke with Walker & Dunlop CEO to get his take on what's happening in the real estate lending market.

The Big Picture

AUGUST 3, 2023

Source: Madison Trust The post Who Are the World’s Largest Land Owners? appeared first on The Big Picture.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

AUGUST 3, 2023

We spoke with Walker & Dunlop CEO to get his take on what's happening in the real estate lending market.

Abnormal Returns

AUGUST 3, 2023

Markets Share buybacks are down some 15% YTD. (advisorperspectives.com) Managed futures are struggling to keep up YTD. (rcmalternatives.com) The Big Seven It's not surprising that a handful of stocks are driving the market. (etf.com) Portfolio managers won't outperform if they get it wrong about the biggest seven stocks. (capitalallocators.com) Strategy Market regimes change, whether you like it or not.

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Wealth Management

AUGUST 3, 2023

Massachusetts Secretary of the Commonwealth William Galvin sent inquiry letters to Morgan Stanley, JP Morgan Chase and E*Trade, among others, asking about their supervisory policies and procedures for artificial intelligence.

Abnormal Returns

AUGUST 3, 2023

Books A Q&A with Ashlee Vance author of "When the Heavens Went on Sale: The Misfits and Geniuses Racing to Put Space Within Reach. (fasterplease.substack.com) How "The Body Keeps Score" by Bessel van der Kolk has changed how we talk about trauma. (nymag.com) Technology The inside story of how Meta ($META) built Threads. (wapo.st) Starlink dominates the satellite internet business.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Calculated Risk

AUGUST 3, 2023

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios. Friday: • At 8:30 AM ET, Employment Report for July. The consensus is for 184,000 jobs added, and for the unemployment rate to be unchanged at 3.6%.

Wealth Management

AUGUST 3, 2023

The Wall Street Journal analyzed the fundamentals in the industrial real estate sector. Several executives pushed back on the narrative about the troubles facing the commercial real estate sector. These are among the must reads from around the real estate investment world to end the week.

Calculated Risk

AUGUST 3, 2023

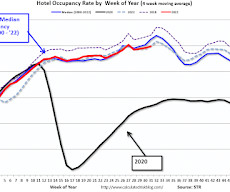

From STR: U.S. hotel results for week ending 29 July U.S. hotel performance declined slightly from the previous week but showed improved comparisons year over year, according to CoStar’s latest data through 29 July. 23-29 July 2023 (percentage change from comparable week in 2022): • Occupancy: 72.2% (+0.6%) • Average daily rate (ADR): US$161.83 (+2.3%) • Revenue per available room (RevPAR): US$116.91 (+2.9%) emphasis added The following graph shows the seasonal pattern for the hotel occupancy ra

Wealth Management

AUGUST 3, 2023

Caitlin Douglas, the head of transition services at Dynasty, details what advisors need to know about the supported independence model, tips on preparing for a move, key milestones and more.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Calculated Risk

AUGUST 3, 2023

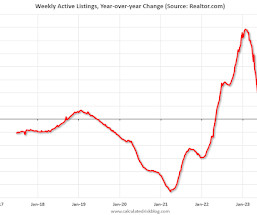

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report from Danielle Hale: Weekly Housing Trends View — Data Week Ending July 29, 2023 • Active inventory declined, with for-sale homes lagging behind year ago levels by 9%. This week marks a 6th consecutive decline in the number of homes actively for sale compared to the prior year, and the gap is growing. • New listings–a measure of sellers putting homes up for sale–were down again this week, by 17% from

Wealth Management

AUGUST 3, 2023

Rhys Williams discusses the increasing importance of holistic financial planning and how advisors are adapting to meet the unique needs of different generations.

The Reformed Broker

AUGUST 3, 2023

Apple’s earnings are going to move the market, says Ritholtz’s Josh Brown from CNBC Chart of the day: Qualcomm from CNBC Grade my trade: DIS, UNH, RIG & BROS from CNBC Final Trades: Uber, Cisco, CVS & more from CNBC

Wealth Management

AUGUST 3, 2023

Lest the noisy wheels of commerce drown out the voice in your head that tells you to focus on your clients above all else.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Calculated Risk

AUGUST 3, 2023

On Friday at 8:30 AM ET, the BLS will release the employment report for July. The consensus is for 184,000 jobs added, and for the unemployment rate to be unchanged at 3.6%. There were 209,000 jobs added in June, and the unemployment rate was at 3.6%. From BofA economists: "For the July employment report, we expect nonfarm payroll employment increased by 200k, little changed from the 209k gain in June.

Wealth Management

AUGUST 3, 2023

Also, Advisor360 announces several client portal and platform updates and Modern Life debuts its generative AI chatbot, which the company claims has passed the life insurance licensing exam.

Calculated Risk

AUGUST 3, 2023

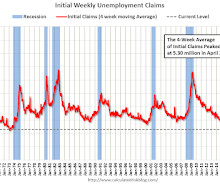

The DOL reported : In the week ending July 29, the advance figure for seasonally adjusted initial claims was 227,000 , an increase of 6,000 from the previous week's unrevised level of 221,000. The 4-week moving average was 228,250, a decrease of 5,500 from the previous week's unrevised average of 233,750. emphasis added The following graph shows the 4-week moving average of weekly claims since 1971.

Wealth Management

AUGUST 3, 2023

F2 Strategy's co-founder and CEO provides his take on the most important wealthtech news of the last month.

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

Calculated Risk

AUGUST 3, 2023

(Posted with permission). The ISM® Services index was at 52.7%, down from 53.9% last month. The employment index decreased to 50.7%, from 53.1%. Note: Above 50 indicates expansion, below 50 in contraction. From the Institute for Supply Management: Services PMI® at 52.7% July 2023 Services ISM® Report On Business® Economic activity in the services sector expanded in July for the seventh consecutive month as the Services PMI® registered 52.7 percent, say the nation's purchasing and supply executiv

Wealth Management

AUGUST 3, 2023

SSGA lowered expense ratios on 10 ETFs with $78 billion in assets this week. Over the past year, it has lowered fees on 20 funds.

A Wealth of Common Sense

AUGUST 3, 2023

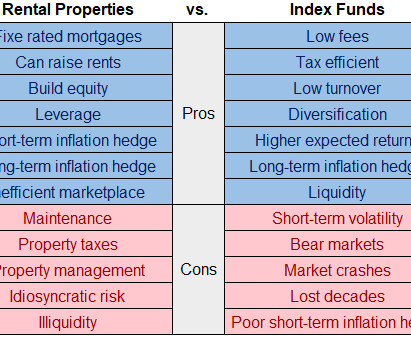

A reader asks: I’m looking to purchase a new home in the coming months as I’m in need of some additional space. I’m weighing my options with my existing home — to rent or to sell — which has a 3% interest rate and $200k in equity since I purchased it in 2016. My real estate agent along with many other pundits seem to default to renting it out as the no-brainer approach because of the 3% inter.

Wealth Management

AUGUST 3, 2023

Jerry Garcia previously helped lead JPMorgan’s private bank for Latin America.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Advisor Perspectives

AUGUST 3, 2023

The US Treasury boosted the size of its quarterly bond sales for the first time in 2 1/2 years to help finance a surge in budget deficits so alarming it prompted Fitch Ratings to cut the government’s AAA credit rating a day earlier.

Wealth Management

AUGUST 3, 2023

More than $350 million was put into 20 ETFs that track broad-based commodity indexes in July, only the second month of inflows this year.

Advisor Perspectives

AUGUST 3, 2023

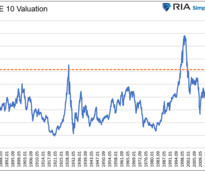

History, analytical rigor, and logic argue that long-term buy-and-hold investors should shift their allocations from stocks toward bonds.

Wealth Management

AUGUST 3, 2023

VanEck, Roundhill and Volatility Shares are among a half dozen issuers that have submitted applications for Ether-futures ETFs since Friday.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Alpha Architect

AUGUST 3, 2023

Doug Pugliese, the head of our 1042 QRP business, was recently invited on the ScuttleButt Podcast to discuss the ESOP landscape and the costs and benefits of 1042 QRP transactions. (article on the topic is here). Doug Discusses 1042 QRP and ESOP Transactions was originally published at Alpha Architect. Please read the Alpha Architect disclosures at your convenience.

Wealth Management

AUGUST 3, 2023

Schwab survey finds nearly 80% of 1,000 401(k) participants said inflation and market volatility were getting into the way of saving more this year.

MainStreet Financial Planning

AUGUST 3, 2023

“MainStreet Chalk Talk” The MainStreet Financial Planning Discussion Club When: Tuesday 8-15-23 at 7:30pm Eastern; 4:30pm Pacific ~30-45 minutes Recorded and able to retrieve for one week How : Zoom Meeting, Free to current clients; $10 for guests Register here! Renting vs. Buying a Home: Making the Right Decision for You Hosted by: Katherine Edwards , CFP® Guest commentator: Tori Young , Realtor, Exit Realty Today’s real estate market can be confusing and overwhelming.

Million Dollar Round Table (MDRT)

AUGUST 3, 2023

By Matt Pais, MDRT Content Specialist For Alphonso B. Franco, RHU, RCIS , the pursuit of a balanced life is never something fully achieved, but rather a daily effort. It’s why the 29-year MDRT member from Victoria, British Columbia, Canada, is continually finding new ways to spend time with his wife and two sons and do things that bring them happiness and a sense of purpose.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Let's personalize your content