Investing Platform Seeds Raises $10M in Series A Funding

Wealth Management

MAY 20, 2025

Fintech startup Seeds secures funding to develop technology that helps financial advisors create personalized investing experiences and streamline operations.

Wealth Management

MAY 20, 2025

Fintech startup Seeds secures funding to develop technology that helps financial advisors create personalized investing experiences and streamline operations.

Calculated Risk

MAY 20, 2025

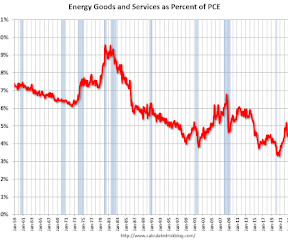

During the early stages of the pandemic, energy expenditures as a percentage of PCE hit an all-time low of 3.3% of PCE. Energy expenditures as a percentage of PCE increased to 2018 levels by the end of 2021 and increased further in 2022 due to the Russian invasion of Ukraine. Here is an update through the April 2025 PCE report. This graph shows expenditures on energy goods and services as a percent of total personal consumption expenditures.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

MAY 20, 2025

Steward Partners latest acquisition expands its presence in the Southeast and prompted it to add Fidelity as a custodian at the request of the father-and-son leadership team at Moores Wealth.

The Big Picture

MAY 20, 2025

The transcript from this weeks, MiB: John Montgomery, Bridgeway Capital Management , is below. You can stream and download our full conversation, including any podcast extras, on Apple Podcasts , Spotify , YouTube , and Bloomberg. All of our earlier podcasts on your favorite pod hosts can be found here. ~~~ Bloomberg Audio Studios, podcasts, radio News.

Advertisement

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

Million Dollar Round Table (MDRT)

MAY 20, 2025

By Antoinette Tuscano, MDRT senior content specialist Connecting with prospects, converting them to clients and then keeping them as long-term, happy clients depends on several different components, with communication topping the list. Clients want to feel heard and understood by their financial advisors, and they also need to understand how their financial advisor can help them and their families reach their goals and have the future they envision.

Random Roger's Retirement Planning

MAY 20, 2025

A reader left a link to a short post from Felix Salmon provocatively titled How AI could end the ETF boom. Ok, you've got my attention but, is this actually something new? A few years ago Schwab starting offering thematic baskets of stocks and if you search on Google you can find several similar products from other companies. It's safe to say that at least some of these products use some form of technology to assemble and then maintain these baskets.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Advisor Perspectives

MAY 20, 2025

Bitcoin was launched in 2008. It was the following year when it was initially used as an actual currency.

Tobias Financial

MAY 20, 2025

Deciding when and how to file for your Social Security retirement benefits can feel overwhelmingand with good reason. The rules can be complex, and the choices you make may have a lasting impact on your financial security in retirement. Thats why its so important to take the time to understand your options and how they align with your broader financial goals.

Advisor Perspectives

MAY 20, 2025

Tidal’s Mike Venuto discusses the latest in ETF innovation, from 351 conversions and the ETF share class structure to options-based strategies and leveraged products. VettaFi’s Kirsten Chang offers a tour around the world of fixed income ETFs, highlighting recent flows, new launches, and under-the-radar success stories.

Wealth Management

MAY 20, 2025

The RIA platform rolled out the program in November for advisors who had been independently constructing portfolios and wanted to outsource trading and investment management.

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Calculated Risk

MAY 20, 2025

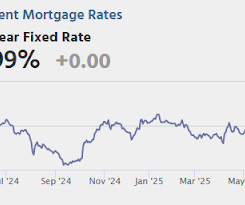

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios. Wednesday: At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index. At 10:00 AM, State Employment and Unemployment (Monthly) for April 2025 During the day, The AIA's Architecture Billings Index for April (a leading indicator for commercial real estate).

Wealth Management

MAY 20, 2025

Charles Schwabs ProDirect, launching in July, will offer independent RIAs third-party vendor deals and business consulting that goes beyond its traditional custodial offering for entrepreneurial RIAs.

Calculated Risk

MAY 20, 2025

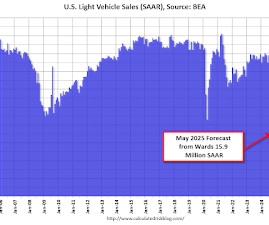

From WardsAuto: U.S. Light-Vehicle Sales Cooling Off in May; Inventory Still Falling (pay content). Brief excerpt: With inventory set to continue declining month-to-month, and the cost to automakers of the tariffs more strongly kicking in by July, sales are likely to continue sequential weakness into the summer unless automakers decide to eat most of the increased cost.

Wealth Management

MAY 20, 2025

In the Wealth Management Invest Podcast, Eaglebrook Advisors' Kristen Mirabella explains how the firm helps wealth managers navigate cryptocurrency investments through SMAs, in-kind transfers and tax-efficient strategies.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

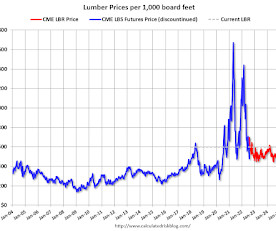

Calculated Risk

MAY 20, 2025

This is something to watch again. Here is another monthly update on lumber prices. SPECIAL NOTE: The CME group discontinued the Random Length Lumber Futures contract on May 16, 2023. I switched to a physically-delivered Lumber Futures contract that was started in August 2022. Unfortunately, this impacts long term price comparisons since the new contract was priced about 24% higher than the old random length contract for the period when both contracts were available.

Wealth Management

MAY 20, 2025

Advisors Brandon Hayes, Eric Pucciarelli, and Cristina Briboneria have launched ClariVise Private Wealth, with Bluespring's support.

Abnormal Returns

MAY 20, 2025

Finance Battery maker CATL is now public. (semafor.com) The SEC is losing staff and its willingness to enforce rules. (ft.com) Fund management Timing the market is hard: the case of the Pacer Trendpilot US Large Cap ETF ($PTLC). (morningstar.com) Private equity should be careful what it wishes for. (axios.com) Companies How Home Depot ($HD) is prepared for tariffs.

Wealth Management

MAY 20, 2025

Morristown, N.J.-based RIA Simon Quick has established a presence in Texas with three new Dallas-based advisors and a specialization in business exit planning.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Abnormal Returns

MAY 20, 2025

Round-ups Some recent academic research including 'Cross-Bond Momentum Spillovers.' (alphainacademia.substack.com) A round-up of recent research on asset allocation including 'A Century of Macro Factor Investing Diversified Multi-Asset Multi-Factor Strategies through the Cycles.' (capitalspectator.com) Economics Why it matters who is on the FOMC at any point in time.

Calculated Risk

MAY 20, 2025

Today, in the Calculated Risk Real Estate Newsletter: California Home Sales "Retreat" in April; New Listings "Surge" A brief excerpt: From the California Association of Realtors (C.A.R.): California home sales retreat for second straight month in April as median home price hits new all-time high, C.A.R. reports Aprils sales pace fell 3.4 percent from the 277,030 homes sold in March and was down 0.2 percent from a year ago , when 268,170 homes were sold on an annualized basis.

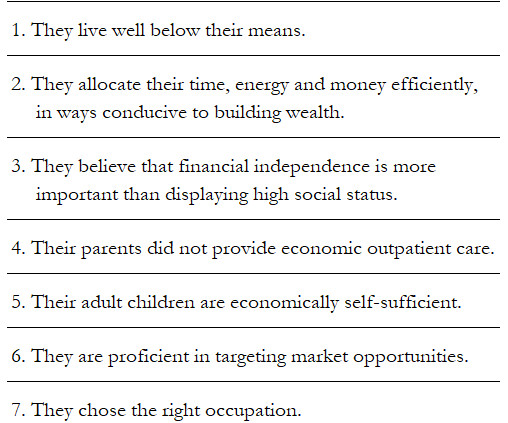

A Wealth of Common Sense

MAY 20, 2025

I first readThe Millionaire Next Doora year or so into my first job. I didn’t know a thing about what it takes to get wealthy so the book was eye-opening for me as a 20-something trying to figure out my career and finances. The general thesis of the book is that the prototypical millionaire is not what you think. They live below their means, prioritize saving over spending, don’t spend frivolously on luxur.

Nerd's Eye View

MAY 20, 2025

Welcome everyone! Welcome to the 438th episode of the Financial Advisor Success Podcast ! My guest on today's podcast is Nikki Savage. Nikki is a senior director in the Tampa, Florida, office of the RIA Sequoia Financial Group, where she manages approximately $150 million in assets under management for 100 client households. What's unique about Nikki, though, is how she has been able to boost client retention and satisfaction by asking key questions that help her reach a deeper level of understa

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

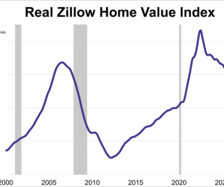

Advisor Perspectives

MAY 20, 2025

Home values fell for a second straight month in April, according to the Zillow Home Value Index. However, after adjusting for inflation, real home values declined for a 12th consecutive month, hitting their lowest level in nearly four years.

Zajac Group

MAY 20, 2025

If youre offered incentive stock options (ISOs) as part of your compensation package, you have an exciting opportunity ahead to build significant wealth. The key is to know what, exactly, youre being given, when your tax bill may be impacted, and how to incorporate your equity comp into your greater financial plan. To help, weve created this basic guide to understanding ISOs and the role they play in your portfolio.

Advisor Perspectives

MAY 20, 2025

Imagine an institutional investor that allocates a big chunk of its portfolio to illiquid private assets but then needs to sell some of those investments to raise cash. Or a fund company that makes a fortune on actively managed mutual funds for decades, but its investors move their money to low-cost index trackers.

Steve Sanduski

MAY 20, 2025

Guest: Peter Wilken , a global brand strategist. Peter is the author of Dim Sum Strategy and the former head of BBDO Asia Pacific, where he advised iconic brands like Coca-Cola, Disney, and McDonald’s. In a nutshell: Effective branding is about more than a slick logo or a memorable tag line. According to my guest today, great brands assemble intangibles into a “territory of the mind” where our feelings about a particular product or company reside.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Advisor Perspectives

MAY 20, 2025

With financial markets whipsawing on every tweet and press release, Maharrey urged listeners to step back, take a breath, and consider the big picture — particularly on the issues of debt, inflation, and de-dollarization.

Validea

MAY 20, 2025

In Q3 2024, Berkshire Hathaway initiated a position in Pool Corporation (POOL), and in its most recent 13F filing, Buffetts firm disclosed a 140%+ increase in that stake. While it’s still a relatively small position in Berkshire’s portfolio (about $460 million as of now), the investment gives POOL a meaningful endorsement from one of the worlds most successful long-term investors.

Advisor Perspectives

MAY 20, 2025

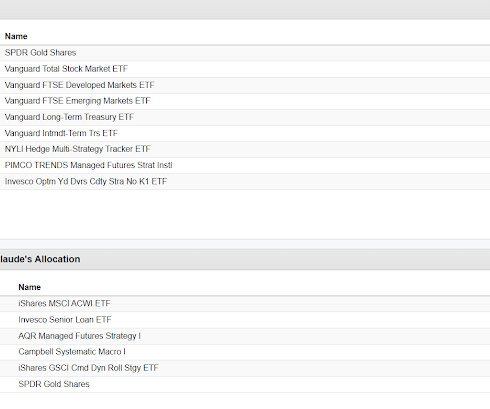

The 60/40 approach has not been what it was just a few years ago. Fortunately, there are alternatives.

Investment Writing

MAY 20, 2025

Underlining headings in your written documents used to be common. That’s no longer true, especially because underlined text now leads people to expect hyperlinks. Underlining headings dates back to the days of typewriters. As Practical Typography says, Underlining is another dreary typewriter habit. Typewriters had no bold or italic styling. So the only way to emphasize text was to back up the carriage and type underscores beneath the text.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Let's personalize your content