When Planning for Clients with Autistic Kids, Empathy Is Key

Wealth Management

APRIL 18, 2023

During Autism Awareness Month, a financial advisor and father of two kids with autism sheds light on how to help those in the "invisible" population.

Wealth Management

APRIL 18, 2023

During Autism Awareness Month, a financial advisor and father of two kids with autism sheds light on how to help those in the "invisible" population.

Calculated Risk

APRIL 18, 2023

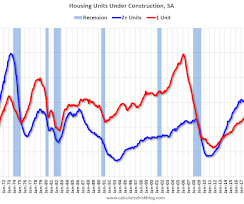

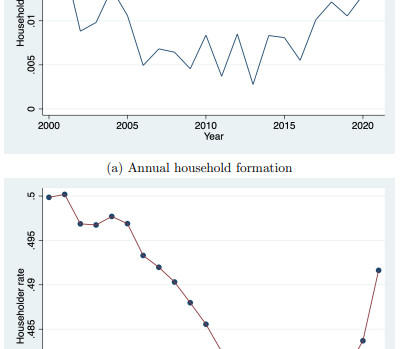

Today, in the CalculatedRisk Real Estate Newsletter: March Housing Starts: Most Multi-family Under Construction Since 1973 Excerpt: The fourth graph shows housing starts under construction, Seasonally Adjusted (SA). Red is single family units. Currently there are 716 thousand single family units (red) under construction (SA). This was down in March compared to February, and 112 thousand below the recent peak in April and May 2022.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

APRIL 18, 2023

Current inflation levels are much closer to past peaks than the official series would suggest.

Calculated Risk

APRIL 18, 2023

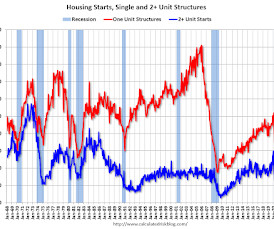

From the Census Bureau: Permits, Starts and Completions Housing Starts: Privately‐owned housing starts in March were at a seasonally adjusted annual rate of 1,420,000. This is 0.8 percent below the revised February estimate of 1,432,000 and is 17.2 percent below the March 2022 rate of 1,716,000. Single‐family housing starts in March were at a rate of 861,000; this is 2.7 percent above the revised February figure of 838,000.

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Wealth Management

APRIL 18, 2023

A new survey finds 27% of people aged 59 and older have no money set aside for their later years.

Nerd's Eye View

APRIL 18, 2023

Welcome back to the 329th episode of the Financial Advisor Success Podcast ! My guest on today's podcast is Charesse Spiller. Charesse is Founder and Principal Consultant for Level Best, an operations and process strategy consulting firm based in Houston, Texas. What's unique about Charesse though, is how she has founded a consulting firm that doesn’t just try to teach financial advisors how to systematize and automate, and instead actually works as an outsourced provider to build and impl

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Abnormal Returns

APRIL 18, 2023

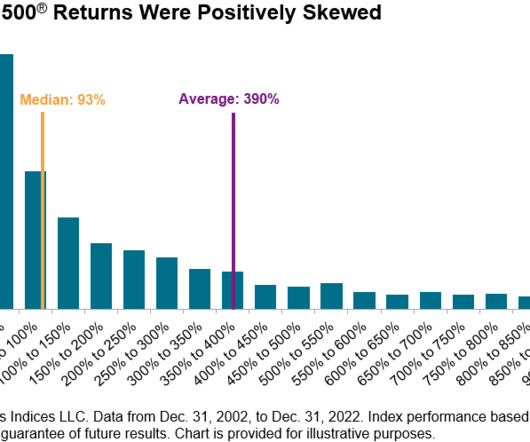

Quant stuff The difference between the Spearman and Pearson coefficients. (mrzepczynski.blogspot.com) Traders often come up with a strategy and then try to justify it. (priceactionlab.com) Factors Factors aren't forever. How exposure decay over time. (alphaarchitect.com) The case for factor timing. (institutionalinvestor.com) Equity risk premium More evidence that the vast majority of stock market returns come from a handful of stocks.

Wealth Management

APRIL 18, 2023

Julie Littlechild's practice management consultancy's recently launched "Engagement Engine" wants to drag the client survey into the digital age.

Abnormal Returns

APRIL 18, 2023

Strategy Four questions you should ask yourself before making an investment. (behaviouralinvestment.com) Due diligence hasn't changed. (theinformation.com) AI What's holding AI in getting deployed in finance? (ft.com) AI is computationally intensive. (theinformation.com) Intel ($INTC) has stopped making Bitcoin mining chips. (coindesk.com) Apple Apple ($AAPL) devices just have better resale values.

Wealth Management

APRIL 18, 2023

The robo advisor failed to tell some clients its tax-loss harvesting service only checked accounts on alternating days and not daily, as some materials claimed, according to the commission.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

The Reformed Broker

APRIL 18, 2023

Join Downtown Josh Brown and Michael Batnick for another round of What Are Your Thoughts? On this week’s episode, Josh and Michael discuss the biggest topics in investing and finance, including: ►Goldman/Netflix Earnings – Stocks edge higher. ►Too Bearish – Has bearish equity positioning gone too far? ►Small Business Stress – “Only 1 in 4 small businesses think they could stay open for.

Wealth Management

APRIL 18, 2023

More than a quarter of advisors, including a third of wirehouse advisors, believe cryptocurrencies will collapse on a more spectacular scale in 2023 than the FTX-led plunge in 2022, according to a new survey.

The Reformed Broker

APRIL 18, 2023

The ‘Investment Committee’ weigh in on the traditional 60/40 portfolio from CNBC. The post Clips From Today’s Halftime Report appeared first on The Reformed Broker.

Wealth Management

APRIL 18, 2023

Two bills put forward last week by U.S. Rep. Andy Barr would tie the SEC registration threshold to CPI and amend venture capital rules.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

The Big Picture

APRIL 18, 2023

The transcript from this week’s, MiB: Joe Barratta, Blackstone’s Global Head of Private Equity , is below. You can stream and download our full conversation, including any podcast extras, iTunes , Spotify , Stitcher , Google , Bloomberg , and Omny. All of our earlier podcasts on your favorite pod hosts can be found here. ~~~ ANNOUNCER: This is Masters in Business with Barry Ritholtz on Bloomberg Radio.

Wealth Management

APRIL 18, 2023

SVB advisors have until April 23 before the firm leaves the protocol, but that assumes the advisor looking to leave has already done some due diligence, says one RIA attorney.

Calculated Risk

APRIL 18, 2023

For fun, here is a graph of economist Arthur Okun's misery index (popularized by President Reagan). Okun added inflation and the unemployment rate together as a measure of "misery". Click on graph for larger image. Currently YoY inflation is at 5.0%, and the unemployment rate is at 3.5% for a "misery index" value of 8.5. This is down from 9.6 in February, and below the median of 9.6 over the last 50 years.

Wealth Management

APRIL 18, 2023

Thursday, May 11, 2023 | 4:00 PM ET

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

Calculated Risk

APRIL 18, 2023

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios. Wednesday: • At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index. • During the day: The AIA's Architecture Billings Index for March (a leading indicator for commercial real estate). • At 2:00 PM, the Federal Reserve Beige Book , an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

Wealth Management

APRIL 18, 2023

FiComm founder and CEO Megan Carpenter details what firms that have seen the most growth are doing correctly, and what they're doing differently.

A Wealth of Common Sense

APRIL 18, 2023

Whenever there is an extreme move in the economy or markets most people want a simple explanation. We want a single variable to explain what just happened. Interest rates rose because of X. We went into a recession because of Y. Stocks crashed because of Z. But when it comes to something as complicated as the economy or markets, it’s never just one variable.

Wealth Management

APRIL 18, 2023

Direct indexing is just one component of Vestmark's VAST, a kind of personalized unified managed account, which allows for tax optimization and transition services across the entire portfolio.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

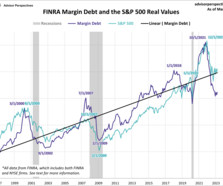

Advisor Perspectives

APRIL 18, 2023

FINRA has released new data for margin debt, now available through March. The latest debt level is at 645.43 billion, up 3.4% month-over-month (MoM) and down 19.3% year-over-year (YoY). However after adjusting for inflation, debt level is up 3.0% MoM and down 23.1% YoY.

Wealth Management

APRIL 18, 2023

Year to date, 62 exchange-traded funds have been liquidated or delisted, more than double the number seen in that same span last year.

The Irrelevant Investor

APRIL 18, 2023

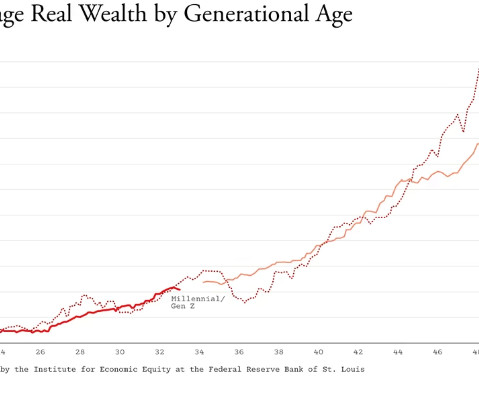

Today’s Animal Spirits is brought to you by PacerETFs: See here for more information on the Pacer Cash Cow ETF Series On today’s show, we discuss: Fed pause wouldn’t necessarily refresh the Stock Market What do Americans want in a European Vacation? Fewer Americans Want to beat the Stock Market? Avoid the cost of ‘being human’ The myth of the broke Millennial AI clones teen girls voice in $.

Wealth Management

APRIL 18, 2023

Strategists from BlackRock Investment Institute favor public and private investments as well as tactical holdings of bonds.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Million Dollar Round Table (MDRT)

APRIL 18, 2023

By John C. Moshides, CLU, ChFC There were three critical decisions I made throughout my career that helped me grow. They took me to MDRT, then Court of the Table and, ultimately, Top of the Table. (Read about qualifying for MDRT.) Those decisions were attending the MDRT Annual Meeting, joining a study group and hiring a coach. Attending the MDRT Annual Meeting Coming to this meeting is both a game changer and a life changer.

Integrity Financial Planning

APRIL 18, 2023

If you are headed toward retirement soon, or you have just retired, you may find yourself wondering, “Is my nest egg enough?” It’s a common question and one that causes a lot of people a lot of reasonable anxiety. Because retirement finances are much more about prediction than they are about facts and assurances, it can be hard to feel confident that you will have enough to carry you through your entire retirement.

Steve Sanduski

APRIL 18, 2023

Guest: Amit Dogra , President and COO of tru Independence. tru offers an open architecture platform that provides a full suite of services that advisors need to manage and grow their business effectively. In a Nutshell: In 2022, I crunched the numbers from Charles Schwab’s 2022 RIA Benchmarking Study and spotted an alarming trend: net organic revenue growth is almost non-existent in our industry.

Advisor Perspectives

APRIL 18, 2023

If you're not creating valuable blog content, regularly posting it on your website and sharing it through social media, you are missing attention from countless potential clients.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Let's personalize your content