DOL Opens Door for Crypto in 401(k)s

Wealth Management

MAY 28, 2025

The Department of Labor rescinded its 2022 guidance cautioning against cryptocurrency in 401(k) plans, reaffirming a neutral stance on digital assets in retirement accounts.

Wealth Management

MAY 28, 2025

The Department of Labor rescinded its 2022 guidance cautioning against cryptocurrency in 401(k) plans, reaffirming a neutral stance on digital assets in retirement accounts.

Calculated Risk

MAY 28, 2025

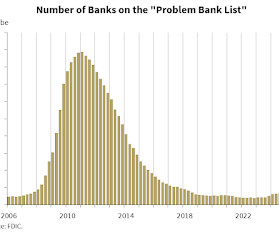

The FDIC released the Quarterly Banking Profile for Q1 2025: Net Income Increased from the Prior Quarter, Led by Higher Noninterest Income Quarterly net income for the 4,462 FDIC-insured commercial banks and savings institutions totaled $70.6 billion, up $3.8 billion (5.8 percent) from the prior quarter. The banking industry reported an aggregate return on assets of 1.16 percent in first quarter 2025, up from 1.11 percent in fourth quarter 2024 and up from 1.09 percent in the year-ago quarter.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

MAY 28, 2025

Explore historical tariff impacts on markets and learn strategies for guiding clients through current trade tensions and economic uncertainties.

Calculated Risk

MAY 28, 2025

From the Fed: Minutes of the Federal Open Market Committee, May 67, 2025. Excerpt: In considering the outlook for monetary policy, participants agreed that with economic growth and the labor market still solid and current monetary policy moderately restrictive, the Committee was well positioned to wait for more clarity on the outlooks for inflation and economic activity.

Advertisement

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

Wealth Management

MAY 28, 2025

Even as the advisor industry has embraced fee-based compensation models, nearly one-quarter of affluent investors still prefer a one-off, commission-based structure.

Calculated Risk

MAY 28, 2025

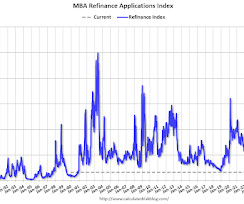

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey Mortgage applications decreased 1.2 percent from one week earlier, according to data from the Mortgage Bankers Associations (MBA) Weekly Mortgage Applications Survey for the week ending May 23, 2025. The Market Composite Index, a measure of mortgage loan application volume, decreased 1.2 percent on a seasonally adjusted basis from one week earlier.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Nerd's Eye View

MAY 28, 2025

Retirement has long been associated with leisure, relaxation, and winding down from a long career. But as more individuals confront the emotional realities of this life transition, many find that the absence of structure, socialization, and identity once provided by work can create a gap that traditional retirement planning doesn't fully address. In this guest post, Kathleen Rehl, a "ReFired" financial advisor and educator in legacy planning, shares a framework to help advisors guide clients thr

Wealth Management

MAY 28, 2025

Garrett DAlessandro leads a team of City National Rochdale alumni at a new RIA and wealth platform for ultra-high-net-worth clients.

Calculated Risk

MAY 28, 2025

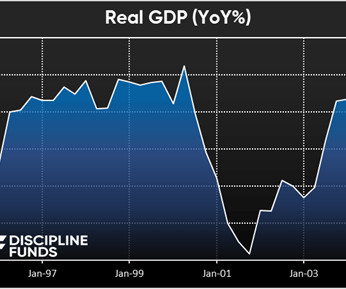

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios. Thursday: At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for initial claims of 232 thousand, up from 229 thousand last week. Also at 8:30 AM, Gross Domestic Product, 1st quarter 2025 (Second estimate). The consensus is that real GDP decreased 0.3% annualized in Q1, unchanged from the advance estimate of -0.3%.

Wealth Management

MAY 28, 2025

Commonwealth Financial Network provides discounted access to Zocks AI notetaking technology for its 2,900 independent advisors, with enterprise-level features.

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Calculated Risk

MAY 28, 2025

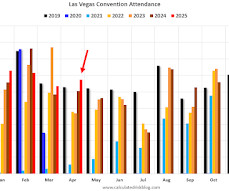

From the Las Vegas Visitor Authority: April 2025 Las Vegas Visitor Statistics With a strong convention segment and events including Wrestlemania, counterbalanced by consumer uncertainty with evolving federal policies , visitation saw a net YoY decrease of 5.1% as the destination hosted approximately 3.3 million visitors in April. Convention attendance approached 574k attendees for the month, up 13.9% YoY, benefitting from the inrotation of shows that were held elsewhere last year including Inter

Wealth Management

MAY 28, 2025

Wealth management firms court Gen Z with AI advisors, but human financial planners retain an edge through soft skills and personalized guidance.

Abnormal Returns

MAY 28, 2025

Podcasts Barry Ritholtz talks with Morgan Housel about how to spend money. (ritholtz.com) Katie Gatti Tassin talks with JL Collins, author of the revised edition of "The Simple Path to Wealth: Your Road Map to Financial Independence and a Rich, Free Life." (podcast.moneywithkatie.com) Brendan Frazier talks retirement planning with Dan Haylett. (podcasts.apple.com) Scott Barry Kaufman talks with Sahil Bloom, author of "The Five Types of Wealth: A Transformative Guide to Design Your Dream Life.

Wealth Management

MAY 28, 2025

Strategies for estate planners to effectively manage tangible personal property disposition, minimizing family conflicts and ensuring smooth administration.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Calculated Risk

MAY 28, 2025

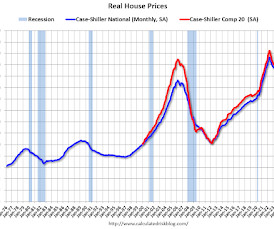

Today, in the Calculated Risk Real Estate Newsletter: Inflation Adjusted House Prices 1.0% Below 2022 Peak Excerpt: It has been almost 19 years since the housing bubble peak, ancient history for some readers! In the March Case-Shiller house price index released yesterday, the seasonally adjusted National Index (SA), was reported as being 78% above the bubble peak in 2006.

Wealth Management

MAY 28, 2025

Key estate planning tactics for expatriates in light of 2025 Section 2801 tax regulations, including pre-expatriation trusts and covered status avoidance.

Discipline Funds

MAY 28, 2025

Here are some things I think I am thinking about this week: 1) Google’s VEO 3 is Mind Blowing. So far AI has been interesting, but not earth shattering. I use ChatGPT dozens of times a day and it is basically refined search. For me personally, I’d argue it’s turned me into a sort of hyper efficient financial advisor. I am kind of a Jack of All Trades, expert in none type of financial advisor, but ChatGPT makes me an expert in almost any financial field as I know all of the righ

Wealth Management

MAY 28, 2025

Katrina Radenberg discusses Mariner's organic growth strategies, the impact of their foundation and attracting next-gen talent in wealth management.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Advisor Perspectives

MAY 28, 2025

In the race to stand out, many financial advisors have expanded their service offerings. Estate planning. Tax strategies. Insurance consulting. Succession planning. The thinking is simple: More services signal more value.

Wealth Management

MAY 28, 2025

As Republicans debate a path forward for their sweeping budget bill, its become increasingly clear the GOP is growing comfortable with targeted tax hikes on the wealthy.

Advisor Perspectives

MAY 28, 2025

Exchange-traded funds have amassed trillions of dollars by offering investors greater tax efficiency, liquidity and lower costs than mutual funds.

Wealth Management

MAY 28, 2025

Host Ryan Nauman interviews David Armstrong of WealthManagement.com about the upcoming Wealth Management EDGE conference, changes in the wealth management conference landscape and key industry trends.

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

Advisor Perspectives

MAY 28, 2025

The wealth management industry is prepared to court its newest potential clients: Gen Z. Instead of trotting out older professionals with decades of experience, companies are utilizing generative AI to develop digital assistants.

Random Roger's Retirement Planning

MAY 28, 2025

Sitting for the Alpha Exchange Podcast , Corey Hoffstein said he's very rarely seen advisors use merger arbitrage which is part of the story of why they stack merger arb on top of bonds in the RSBA ETF. FT Alphaville looked at recent trends in active share which measures the extent to which a mutual fund is or is not a closet indexer. They say that active share isn't terribly useful for market signals, it's more like noise but lately it has been very low (so a lot of closet indexing).

Advisor Perspectives

MAY 28, 2025

Cantor Fitzgerald LP agreed to buy UBS Group AG’s O’Connor unit, ending more than three decades of ownership by the Swiss bank and placing the hedge fund back in control of one of its early founders.

Validea

MAY 28, 2025

Low volatility investing focuses on companies whose stock prices tend to move less than the overall market. While traditional finance theory suggests that higher returns come with higher risk, decades of research have shown that low-volatility stocks have often delivered better risk-adjusted returns than their more volatile counterparts. These stocks appeal to investors looking for more stable performance and less dramatic losses during market downturns.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Advisor Perspectives

MAY 28, 2025

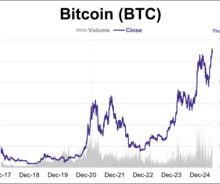

Bitcoin reached a new record closing price this week, surging over 40% since its April low. BTC is up ~15% year to date.

Leading Advisor

MAY 28, 2025

As a Fractional Chief Operating Officer, Ive seen firsthand how even the most talented team members can find themselves stuck not because they lack… The post How One Simple Communication Audit Can Transform Team Dynamics appeared first on Leading Advisor - Simon Reilly.

Advisor Perspectives

MAY 28, 2025

Proposed tax-cut extensions and higher debt costs could amplify fiscal concern.

Validea

MAY 28, 2025

The S&P 500 is home to America’s corporate giants – companies with massive scale, global reach, and market-moving influence. But while every S&P 500 member is large-cap by definition, they are not all created equal when it comes to fundamental strength. At Validea, we score every S&P 500 stock using a multi-model system rooted in the principles of legendary investors like Warren Buffett and Peter Lynch.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Let's personalize your content