Comments on December Employment Report

Calculated Risk

JANUARY 10, 2025

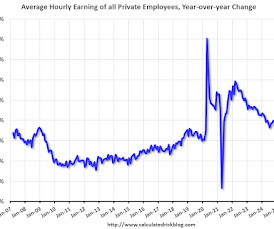

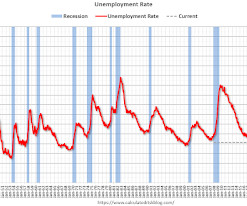

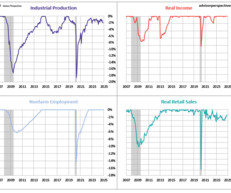

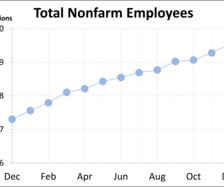

The headline jobs number in the December employment report was well above expectations, however, October and November payrolls were revised down by 8,000 combined. The participation rate was unchanged, the employment population ratio increased, and the unemployment rate decreased to 4.1%. Earlier: December Employment Report: 256 thousand Jobs, 4.1% Unemployment Rate Prime (25 to 54 Years Old) Participation Since the overall participation rate is impacted by both cyclical (recession) and demograp

Let's personalize your content