Investing strategies for bear markets

Nationwide Financial

OCTOBER 12, 2022

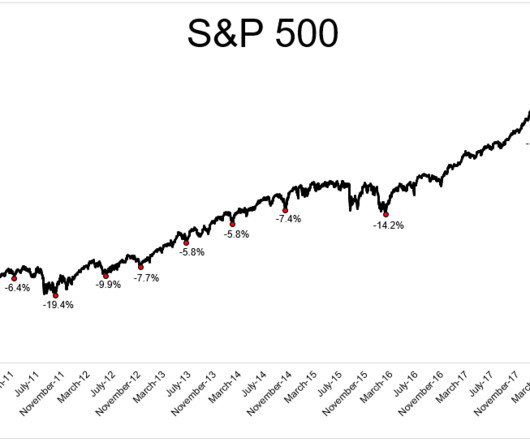

Investors now have a lot on their minds — inflation, market volatility, worries about a potential recession, etc. The possibility of a bear market for stocks adds even more stress for investors. What do “bear” and “bull” mean in the stock market? A bear market is typically defined as a 20% decline from peak to trough.

Let's personalize your content