Balancing Act | A Stroll Down Hindsight Lane

Brown Advisory

NOVEMBER 28, 2017

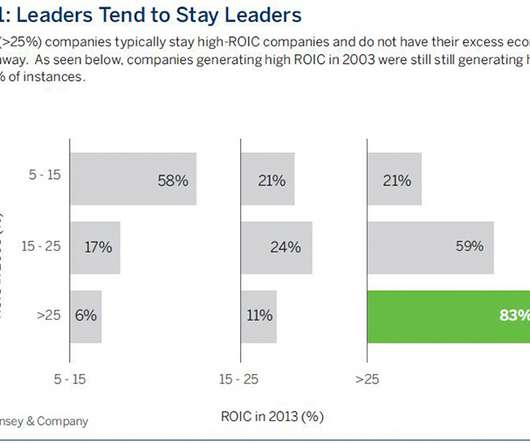

Well, we believe that broader economic fundamentals are important for long-term stock valuations. These facts suggest that if the economy and markets do turn sour and we experience a major market correction, actively managed strategies may in fact weather the storm better than indexes if they focus on robust, healthy businesses.

Let's personalize your content